The iShares Morningstar Growth ETF (NYSEARCA:ILCG) from BlackRock’s (NYSE:BLK) iShares doesn’t always get the attention it deserves, but this rock-solid, low-cost growth ETF has been generating good results for its investors for a long time. I’m bullish on ILCG, given its long track record of producing strong returns, its super low-cost expense ratio, and the fact that it gives investors diversified exposure to 389 top U.S. large- and mid-cap growth stocks.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The formula may not be anything groundbreaking, but you don’t always need to go against the grain or try to be revolutionary in order to build wealth in the stock market over time, as we’ll discuss below.

What Is the ILCG ETF’s Strategy?

According to ILCG’s sponsor, BlackRock, ILCG gives investors “exposure to U.S. companies whose earnings are expected to grow at an above-average rate relative to the market.” The fund invests in an index of large-cap and mid-cap U.S. stocks that “exhibit growth characteristics.”

The index defines these as companies “that typically have higher than average historical and forecasted earnings, sales, book value and cash flow growth.”

ILCG is coming up on its 20th anniversary, as it has been around since June 2004, and it has $2.1 billion in assets under management (AUM).

ILCG’s Top Holdings

ILCG offers plenty of diversification and gives investors exposure to 389 different growth stocks, and its top 10 holdings account for 55.1% of assets.

Below, you’ll find an overview of ILCG’s top 10 holdings using TipRanks’ holdings tool.

Because the fund invests in large- and mid-cap growth stocks, it’s unsurprising to find stocks like Microsoft (NASDAQ:MSFT), Apple (NASDAQ:AAPL), Nvidia (NASDAQ:NVDA), and Amazon (NASDAQ:AMZN) among its top holdings.

Among the top holdings, Tesla (NASDAQ:TSLA) is the only one that has a negative return over the past year, while other top holdings like Nvidia, Meta Platforms (NASDAQ:META) and healthcare giant Eli Lilly and Company (NYSE:LLY) have all produced spectacular triple-digit returns over the past 12 months.

While there’s nothing particularly unique about these top holdings, they are strong companies that look well-positioned for the future, and they have helped the fund generate a strong performance over a long time horizon, as we’ll delve further into in the next section.

As you can see from this chart, many of ILCG’s top holdings are tech stocks, and it’s worth pointing out that in recent years, because of their growth, these stocks have come to make up a large portion of the fund’s underlying index. The fund has a 45.7% weighting in the information technology sector. The sector with the next largest weighting is consumer discretionary, at a distant 14.3%, followed by communications at 9.4%.

A Reliable Performer Over the Years

ILCG has built up a long and reliable track record of strong performance over many years. As of February 29, the fund has generated a three-year annualized return of 9.4%.

Zooming further out, it has generated an excellent five-year annualized return of 16.5% and a nice 10-year annualized return of 14.6%.

It should be noted that ILCG has slightly underperformed the 11.9% three-year annualized return of the broader market, as represented by the Vanguard S&P 500 ETF (NYSEARCA:VOO). However, ILCG has outperformed VOO over both the past five and 10 years. VOO has returned 14.7% on an annualized basis over the past five years and 12.7% over the past 10, as of February 29 (versus ILCG’s respective five- and 10-year returns of 16.5% and 14.6%).

Furthermore, the fund has managed to produce double-digit returns on an annualized basis going all the way back to its inception in 2004.

Investing in a fund like this that consistently generates double-digit annualized returns enables investors to build significant wealth over time. Looking at it from a cumulative perspective rather than an annualized one helps illustrate this point further.

For example, an investor who allocated $10,000 into ILCG 10 years ago would have just over $40,000 today. An investor who bought the fund at its inception in June 2004 would have an investment worth nearly $75,000 today.

A Cost-Effective Option for Investors

Another appealing aspect of ILCG is that it provides this strong performance for a very low cost, with an expense ratio of just 0.04% — significantly cheaper than the average expense ratio for all ETFs, which stands at 0.57%. This means that an investor putting $10,000 into the fund will pay a mere $4 in expenses annually.

Assuming that ILCG returns 5% per year going forward and maintains its current expense ratio, an investor putting $10,000 into the fund today would pay just $51 in fees over the course of the next decade. Investing in low-cost funds like ILCG helps investors to hold on to more of the principle of their portfolios over time, so fees are always an important consideration to take into account when looking at any ETF.

Does ILCG Pay a Dividend?

While it’s certainly not the main draw here, ILCG is a dividend payer and currently yields 0.6%. ILCG has paid a dividend to its holders for 19 years in a row and has grown this payout for the past three years.

Is ILCG Stock a Buy, According to Analysts?

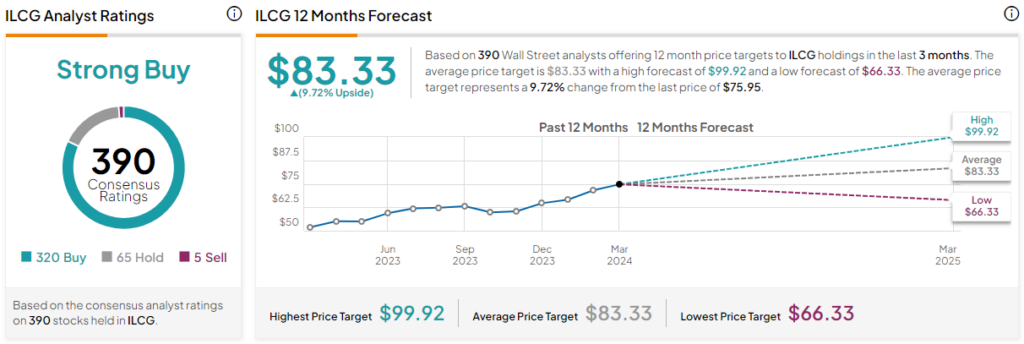

Turning to Wall Street, ILCG earns a Strong Buy consensus rating based on 320 Buys, 65 Holds, and five Sell ratings assigned in the past three months. The average ILCG stock price target of $83.33 implies 9.7% upside potential.

It’s Hard Not to Like the ILCG ETF

While there’s nothing necessarily novel about ILCG’s strategy of investing in a diversified group of large- and mid-cap U.S. growth stocks, the strategy has worked out well for its investors for a long time.

I’m bullish on ILCG, given its long and reliable track record of generating strong returns for its holders, its diversified portfolio that enables investors to tap into a large number of top large- and mid-cap U.S. growth stocks, and its ultra-low expense ratio, which helps investors preserve more of their money over time. It’s hard not to like a reliable, diversified, and low-cost long-term winner like ILCG.