Anyone with basic knowledge of standard economic principles will likely understand why shares of clothing retailer Gap (NYSE:GPS) performed so poorly this year. With multidecade highs in inflation crimping household budgets, many consumers opted to focus their spending on critical goods and services. However, nothing in the market evolves linearly, allowing speculators to secure high-risk profits on GPS stock. Nevertheless, the fundamentals can’t be denied. I am bearish on GPS.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

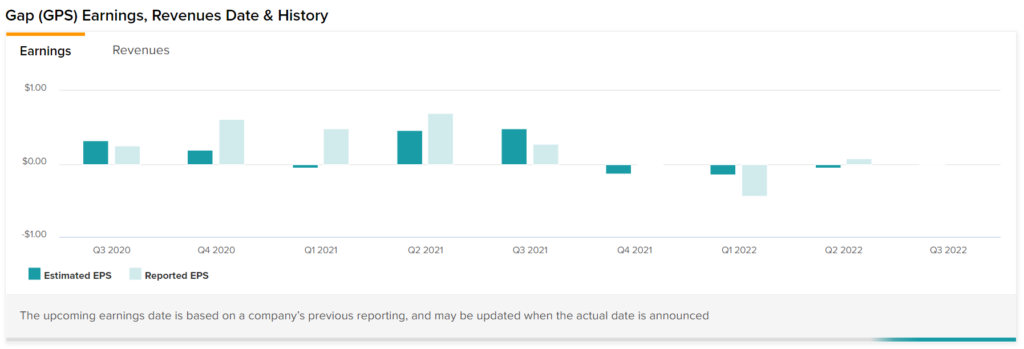

To be clear, the idea of exiting the investment “opportunity” in Gap shares runs contrary to current fundamentals. Namely, the otherwise struggling retailer posted relatively solid results for its fiscal second quarter. Adjusted for non-recurring items, Gap posted earnings of $0.08 per share, beating out Wall Street’s expectations of -$0.05 per share. However, the latest tally compares unfavorably to the year-ago earnings of $0.70 per share.

Nevertheless, Q2 represented a dramatic improvement over Q1’s report this year. Back then, the company posted a loss of $0.44 per share when the Street anticipated a loss of only $0.11 cents. Over the last eight quarters, the company has surpassed consensus EPS estimates four times.

On the revenue front, Gap generated sales of $3.86 billion for the three months that ended July 31, 2022. This figure surpassed the consensus target by 0.93%. Unfortunately, this sales haul compared unfavorably to the year-ago quarter’s tally of $4.21 billion.

While the numbers on paper were encouraging, Gap’s management team withdrew its financial outlook for the year, citing recent execution challenges and macroeconomic uncertainties. Since the quarterly disclosure, GPS stock has been struggling for traction, possibly signaling stakeholders to trim their exposure.

The Game Has Changed for GPS Stock

One of the defining characteristics of the post-COVID-19 new normal is rising inflation. Though prominent in 2021, this year has brought an avalanche of rising consumer prices, thereby negatively impacting broader sentiment. At the same time, higher prices also incentivize spending. However, the latest policy remarks by Federal Reserve chair Jerome Powell suggest that the game has changed for GPS stock.

As TipRanks Team pointed out recently, “Any hopes of the Fed’s pivot from its hawkishness were dashed on Friday when Powell reinforced the Fed’s stance. Now that July’s inflation data came below expectations, many were hoping that the Fed would ease its policy. However, Powell did not mince his words while reinstating that more aggressive interest rate hikes are on the way this year and that the central bank will not depend on a month or two of positive inflation data.”

While inflation obviously hurts consumers – particularly those in the lower-income bracket – it also encourages spending to certain degrees and for those that can reasonably afford to. It all comes down to the purchasing power (or lack thereof) of the dollar.

Last month, I wrote, “In 2021, the purchasing power of the U.S. dollar declined by 6%. However, just in the first half of this year, purchasing power dipped by 5.3%. Put another way, the rate of acceleration in currency erosion almost doubled this year.”

Translated into practical terms, under an inflationary environment, shoppers are essentially encouraged to spend today. That’s because tomorrow, the dollar will be worth less. However, the opposite is true in a deflationary (or hawkish) environment. The dollar will be worth more tomorrow, thereby incentivizing people to save money.

That’s not going to be helpful for GPS stock, where the underlying business caters to premium fashion. It’s nice to have but not critical to own.

Rising Prices Incentivize Spending

Again, as mentioned earlier, Gap’s fiscal Q2 is for the three months that ended July 31. As well, during the first half of this year, purchasing power declined by 5.3%. That means during 66.7% of Q2, Gap navigated an environment of ever-rising prices, incentivizing relatively affluent customers to open their wallets. To repeat, in an inflationary cycle, it’s better to spend now than save eroding dollars for later purchases, all other things being equal.

With the Fed committed to tackling inflation aggressively, the dollar will likely rise in relative value. Significantly, purchasing power increased to 33.8 in July from 33.7 in June. True, it’s a very small difference. Nevertheless, the Fed’s hawkish monetary policy stemmed what previously looked like runaway inflation.

As the central bank dives deeper into its strategy to kill inflation, the dollar should progressively rise in purchasing power. While that might sound positive for GPS stock, it’s important to consider the implications for behavioral dynamics. If the dollar is rising in value, it’s far better for consumers to sit on their wallets and wait for macroeconomic clarity.

After all, a deflationary environment also implies a possible economic slowdown. What should weigh on GPS stock and its ilk is accelerating technology-sector layoffs. If low-paying jobs are replacing the good jobs, that’s not an optimistic narrative for Gap, which caters to a more sophisticated consumer base.

Is GPS a Good Stock to Buy?

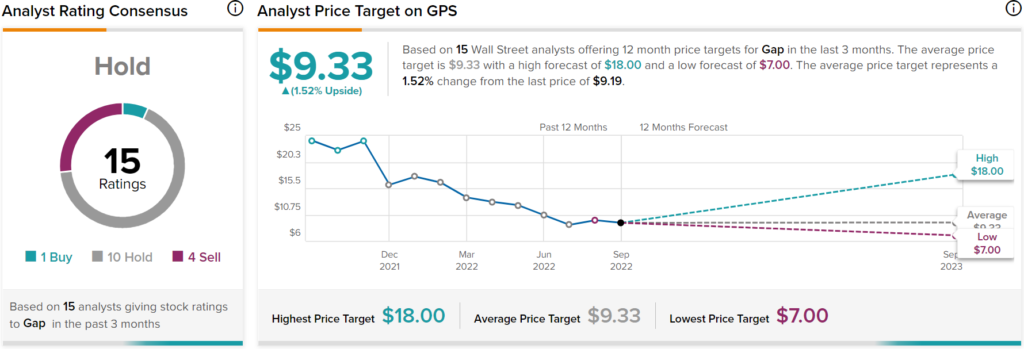

Turning to Wall Street, GPS stock has a Hold consensus rating based on one Buy, 10 Holds, and four Sells assigned in the past three months. The average GPS stock price target is $9.33, implying 1.5% upside potential.

Takeaway – GPS Stock is Unlikely to Perform Well Going Forward

While Gap has done well to mostly beat revenue targets over the last four quarters, a repeat performance over the next four may not be likely. With the Fed changing the monetary backdrop, consumers will be incentivized to save money, especially in an ambiguous macroeconomic environment. Therefore, stakeholders who profiteered off GPS stock should consider trimming their position.