With the future of mobility and transportation seemingly earmarked for electric vehicles (EVs), many investors have sought out individual EV brands. However, this is a much harder task than it appears. Therefore, if you are bullish on this sector, you should instead consider Rio Tinto (NYSE:RIO). As an infrastructural play, Rio benefits from a higher probability of sustained relevance because it mines lithium and copper — two important metals used to make EVs. Therefore, I am bullish on RIO stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Will EVs Dominate the Roads Eventually?

On paper, it’s easy to assume that EVs will dominate the next generation of transportation solutions. With climate change becoming an ever-increasing concern, replacing combustion-powered vehicles with their zero-emissions counterparts seems incredibly intuitive. However, with EVs remaining expensive, the future might not be so electrifying.

Further, even assuming that EVs take over the world’s roadways at some point, sector king Tesla (NASDAQ:TSLA) does not represent a guaranteed shoo-in for sustained upside. Anything can happen in the consumer market, particularly in the automotive realm.

As an op-ed from The Global and Mail pointed out, it was inconceivable during the 1950s that the Japanese auto industry would one day dominate both the U.S. and the rest of the world. However, a concerted focus on cost controls and reliability saw Japanese brands overtake their American rivals.

Moreover, the dramatic rise in gasoline prices during the 1970s contributed to many American consumers giving Japanese cars a chance. The rest is history. Put simply, brands that look dominant now may not be that way decades later.

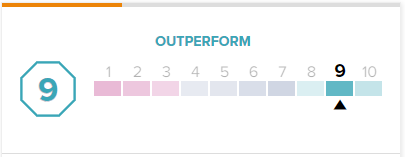

However, because Rio Tinto aligns with infrastructure, RIO stock deserves serious consideration. Supporting the bull case, on TipRanks, RIO stock has a 9 out of 10 Smart Score rating. This indicates strong potential for the stock to outperform the broader market.

RIO Stock Sells the Tickets

To really understand the forward value of RIO stock, it’s important to recognize the underlying framework. By betting on individual EV manufacturers like Tesla, you’re essentially betting that one team will beat the other. In contrast, acquiring shares of RIO stock is akin to selling tickets to the big game. You might not know which team will ultimately persevere. However, you do know that the competition will attract fans.

Again, for clarification, EVs might not even end up replacing combustion cars. Aside from their high costs relative to their combustion counterparts, EVs will require power grid upgrades. At the moment, many regional grids can’t handle air conditioners during a heatwave, let alone millions of EVs charging up.

However, if you genuinely believe that EVs will replace combustion cars, RIO stock seems the more reasonable long-term investment. Specializing in the extraction and production of various critical commodities, two really stand out within Rio Tinto’s portfolio — lithium and copper.

Obviously, the former commodity undergirds lithium-ion batteries which provide the mobility of EVs. More importantly, from a geopolitical standpoint, with China aggressively investing in its EV ecosystem, finding reliable sources of lithium will carry precedence. Just from this angle alone, RIO stock should perform well.

As for copper, manufacturers also use the metal to build electric motors and batteries. As well, they integrate copper into inverters, wiring, and charging stations. Copper benefits from durability, malleability, reliability, and superior electrical conductivity, thus bolstering the relevance of RIO stock.

Decent Financials Should Attract Astute Investors

Even better, not only does RIO stock enjoy a compelling narrative, but it also makes for an objectively intriguing opportunity. For instance, the mining firm’s Altman Z-Score (a solvency metric) is 3.37, reflecting low bankruptcy risk over the next two years. Further, fiscal stability should command a premium during these uncertain times.

Operationally, Rio delivers the goods. Its three-year revenue growth rate stands at 8.8%, outpacing the materials sector’s -1.4% three-year growth rate. Moreover, its book value per share growth rate during the same period pings at 7.4% compared to -1.6% for the sector.

Regarding profitability, Rio’s operating margin is 34.7%, beating 89.4% of rivals. Additionally, its net margin comes in at 22.3%, outranking nearly 85% of sector players. If that wasn’t convincing enough, the market prices RIO stock at a forward multiple of 8.95, better (lower) than 64.6% of the metals and mining industry.

Is RIO Stock a Buy, According to Analysts?

Turning to Wall Street, RIO stock has a Moderate Buy consensus rating based on three Buys, zero Holds, and zero Sell ratings. The average RIO stock price target is $85.99, implying 30.55% upside potential.

The Takeaway: RIO Stock Offers Superior Relevance

While individual EV brands may enjoy the highest reward potential, their probability of success may be suspect. Anything can happen over the next several years, meaning that investors should diversify their holdings. As a play on the underlying infrastructure of EVs, Rio Tinto commands significant and possibly permanent relevance. Thus, RIO stock deserves consideration.