I am neutral on International Business Machines (IBM) as its strong competitive positioning and impressive dividend yield and growth are offset by a relatively uninspiring valuation, and mediocre long-term growth potential.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

IBM is a leading global enterprise information technology firm that also invests aggressively in cloud, artificial intelligence, and other software technologies.

Its main products include software, information technology and consulting services, as well as some hardware. It has vast global scale, operating in 175 countries with about 350,000 employees.

Competitive Positioning in Global IT

IBM’s main competitive advantages lie in its massive network of business-to-business relationships built up over decades, its global scale that positions it well to win and sustain contracts from large multi-national corporations, and its vaunted portfolio of intellectual property.

For example, it boasts a massive network of 80,000 business partners, and services about 5,200 clients. It also services about 95% of the companies in the Fortune 500, making it a truly major player in the information technology industry.

On top of that, its advanced technological capabilities and the substantial switching costs affiliated with many of its products make its existing book of business very sticky. The interconnectedness of its various offerings make it a very convenient information technology services provider for large enterprises, and a very inconvenient and costly provider to replace with a competitor.

IBM further fortifies its competitive position through its vaunted intellectual property library. For example, in 2019, IBM had over 8,500 innovators on its payroll that set a record with 9,262 U.S. patents received in that year alone.

Year-after-year, IBM leads the United States in patents received, making it a leading research and development firm.

Attractive and Safe Dividend

One of the most attractive traits of IBM stock is its attractive and safe dividend. Its current yield is 4.7%, and it has the distinguished title of Dividend Aristocrat after raising its dividend for 26 consecutive years.

The payout ratio for 2022 is expected to be about 70%, making the dividend very safe and likely to continue growing for years to come.

When combining the stickiness of IBM’s revenues, its lucrative dividend yield, and strong commitment to continuing to grow its payout, IBM is one of the most attractive dividend stocks in the market today.

Unimpressive Valuation

While it certainly has a strong competitive position in its industry and also boasts an attractive and safe dividend, the current valuation for IBM stock is unimpressive.

Its EV/EBITDA ratio is 10.29, which is elevated compared to its five-year average of 9.33x.

Its price-to-normalized earnings and price-to-free cash flow ratios are also elevated at 13.4 and 10.9, respectively, compared to their respective five-year averages of 12.4 and 10.7.

Finally, while the dividend yield is attractive, it is still below its five-year average of 4.93%.

Wall Street’s Take

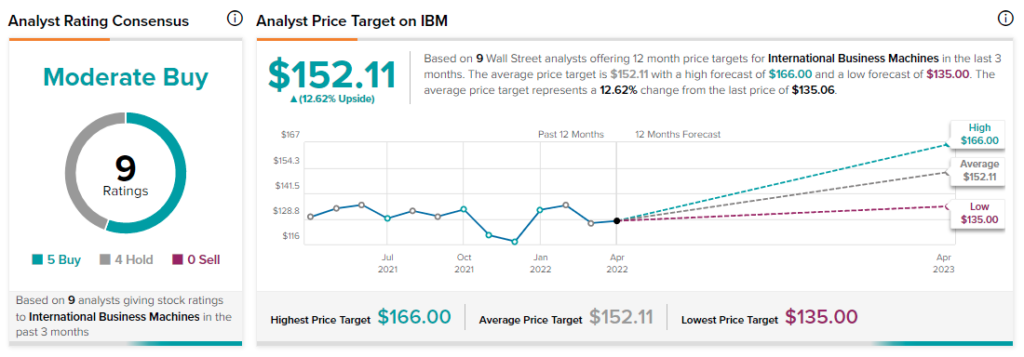

Wall Street analysts are mildly bullish on the stock, giving it a Moderate Buy consensus rating based on five Buys, four Holds, and zero Sell ratings assigned in the past three months. Additionally, the average IBM price target of $152.11 puts the upside potential at 12.6%.

Summary and Conclusions

IBM has a very sticky customer base thanks to its massive intellectual property library, economies of scale, and global presence, interconnected products, and vaunted business network that makes it an ideal partner for large multinational corporations.

Its dividend yield, coverage, and growth momentum all imply that it is one of the more attractive risk-adjusted dividend-growth stocks available today.

That said, the valuation is not particularly compelling here and, with interest rates rising, IBM stock does not look like it is likely to deliver significant outperformance moving forward. On top of that, analysts, while bullish, do not give it meaningful upside potential over the next year with the consensus price target.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure