Technology giant IBM (NYSE:IBM) will release its Q4 2023 earnings after the market closes on January 24. While macro headwinds are adversely impacting spending on information technology (IT), the ongoing strength in the Software and Consulting segments and its productivity initiatives could continue to support its top-and-bottom-line growth.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

While IBM’s Q4 revenue and earnings are likely to show improvement, its stock has jumped nearly 27% in the past six months, outperforming the S&P 500’s (SPX) gain of over 6%. The appreciation in its value could limit its upside potential in the near term. Let’s dig deeper.

IBM – Q4 Expectations

Wall Street expects IBM to report revenue of $17.29 billion in Q4, representing a year-over-year growth of 3.6%. The company’s Software business will likely benefit from the continued strength of the hybrid platform and solutions division. Meanwhile, its Consulting segment will gain from hybrid cloud and AI opportunities.

Improved sales, a favorable portfolio mix, and benefits from productivity initiatives will likely drive its margins and bottom line. Analysts expect IBM to report earnings of $3.79 per share in Q4, up from $3.6 in the prior-year quarter.

Analysts Weigh In

Ahead of the Q4 print, Stifel Nicolaus analyst David Grossman raised IBM’s price target to $183 from $144. The analyst reiterated the Buy rating on January 22 and sees a better operating environment in 2024.

Further, Evercore ISI analyst Amit Daryanani upgraded IBM stock to Buy on January 19. The analyst expects IBM’s Consulting and Software businesses to benefit from higher enterprise spending on IT and artificial intelligence (AI)-led demand. The analyst raised the firm’s price target to $200 from $165.

What is the Outlook for IBM Stock?

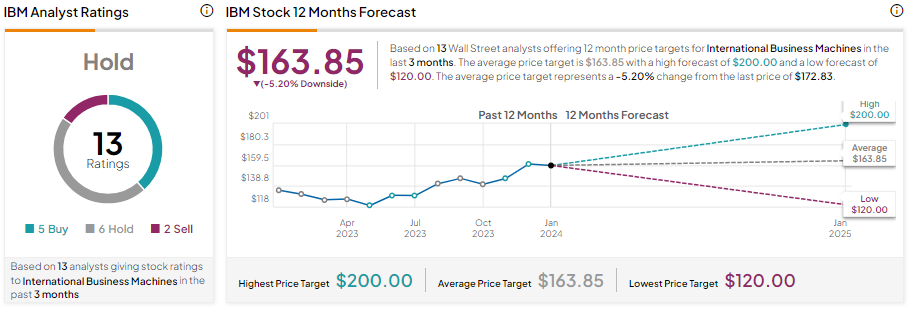

Given the recent appreciation in its value, Wall Street remains sidelined on IBM stock. It has five Buy, six Hold, and two Sell recommendations for a Hold consensus rating.

Analysts’ average price target of $163.85 implies 5.2% downside potential from current levels.

Insights from Options Trading Activity

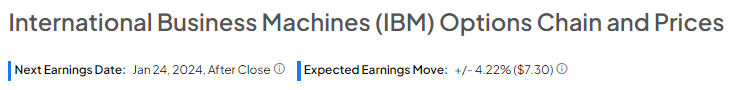

While analysts are sidelined on IBM stock, options traders are pricing in a +/- 4.22% move on earnings, smaller than the previous quarter’s earnings-related move of 4.88%.

The anticipated move is determined by computing the at-the-money straddle of the options closest to the expiration after the earnings announcement.

Learn more about TipRanks’ Options tool here.

Bottom Line

IBM is likely to benefit from the continued momentum in its Software and Consulting businesses, which account for the majority of its revenues. Moreover, its productivity initiatives and expected increase in enterprise IT spending are positives. However, the recent appreciation in its share price and macro uncertainty could limit upside potential, as reflected in analysts’ average price target.