Everyone is talking up the prospect of a recession. Well, actually, not everyone, it seems. In contrast to the widely held view that a recession is now all but inevitable, BlackRock CEO Larry Fink believes otherwise.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Fink argues that due to the huge volume of stimulus being directed at the economy from a host of bills, such as the Inflation Reduction Act, the Infrastructure Bill, and the Chips and Science Act, there’s little chance a meaningful recession will materialize.

“Those three bills are a trillion dollars of stimulus over the next few years,” explained the CEO of the biggest asset manager in the world. “Think about how many jobs infrastructure creates. Think about the demand for commodities as we build infrastructure.”

So, that will be good news for investors who are worried about the state of the economy and are on the lookout for the next stock to lean into. And here, BlackRock can also offer a guiding hand.

Using the TipRanks database, we’ve tracked down three top stocks for which BlackRock is currently one of the largest institutional holders. What’s more, all are also rated as Strong Buys by the analyst consensus. So, let’s explore what makes them appealing investment choices right now.

Valero Energy (VLO)

We’ll start off in the energy sector with a major player in the field. In fact, Valero is the biggest independent refiner in the world. Based in San Antonio, Texas, Valero oversees 15 refineries spread across the U.S., Canada, and the U.K., with a total throughput capacity of over 3 million barrels per day. Additionally, Valero is the world’s second biggest producer of renewable fuels.

Energy stocks enjoyed their moment in the sun last year and as a reflection of the outsized demand, Valero Q4’s numbers added extra sheen to what was the company’s best-ever year.

With its refineries operating at 97% – their best utilization rate since 2018 – profits more than tripled vs. 4Q21, as net income reached $3.1 billion, translating to adj. EPS of $8.45, and easily beating Wall Street’s $7.22 forecast. The refining segment’s operating profit soared by 230% from the same period a year ago to $4.1 billion, as Valero made use of the chasm between crude oil prices and those of refined products. Due to its success, Valero also managed to reduce its debt by $2.7 billion last year, and the company’s stronger balance sheet allowed it to increase shareholder returns.

And it gets even more exciting. BlackRock, one of the biggest players in the financial world, has thrown its weight behind Valero, with a whopping 36,761,291 shares, valued at approximately $4.72 billion based on the current share price. This significant investment underscores the confidence that BlackRock has in Valero’s potential for growth and success.

And they are not the only ones showing confidence in this name. Stifel analyst Ryan Todd thinks Valero’s model is one that will shield it from any negative macro developments.

“Despite economic concerns, refining margins remain robust, product trends are encouraging (particularly in gasoline/jet markets), and tight global capacity is likely to stay with us for some time,” Todd explained. “VLO remains best in class in the space, on everything from portfolio strength to operational reliability to management quality, and at only 4x PSCe EPS in 2023 (6x consensus), the stock remains significantly undervalued, in our view, and the best large-cap exposure to what looks to be an increasingly attractive 2023 driving season.”

All of the above combined with a compelling valuation prompted Todd to maintain a Buy recommendation on VLO. On top of this, the 5-star analyst gives the stock a $188 price target, suggesting ~46% upside. (To watch Todd’s track record, click here)

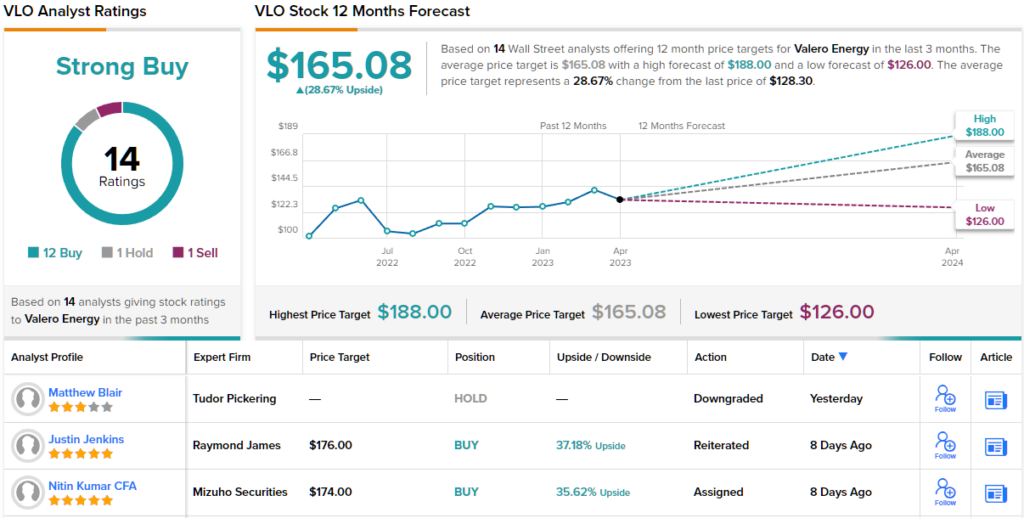

Overall, VLO has picked up 14 recent analyst reviews, with a breakdown of 12 Buys, 1 Hold, and 1 Sell supporting a Strong Buy consensus rating on the shares. The stock is selling for $128.30 and its average price target of $165.08 implies ~29% upside for the coming year. (See VLO stock forecast)

Schlumberger Limited (SLB)

From one energy giant to an even bigger one: Schlumberger claims the title of the world’s biggest offshore drilling company, making it an oilfield services heavyweight. The company provides the global oil & gas industry with oilfield equipment and services, and it operates in more than 120 countries. Among Schlumberger’s services are oil well testing, site assessment, data processing, drilling, and lifting operations, as well as management and consulting solutions.

Schlumberger will release its Q1 numbers later this week (Friday, April 21) but we can hark back to Q4’s figures to get a feel for the financial trends. Revenue reached $7.9 billion, for a 26.5% year-over-year increase while coming in $110 million above the analysts’ expectations. Likewise on the bottom-line, EPS climbed by 76% from the year-ago period to $0.71, outpacing the $0.68 forecast. The company achieved free cash flow of ~$900 million in the quarter as cash flow from operations hit $1.6 billion.

BlackRock clearly recognizes the sheer force of Schlumberger. With a massive position worth $5.52 billion, based on a total holding of 105,972,586 shares, BlackRock is fully onboard with Schlumberger’s vision for the future.

Assessing this company’s prospects, Barclays analyst David Anderson thinks investors should pay attention to Schlumberger’s global positioning, while he also expects another strong display in the upcoming quarterly readout.

“Since the beginning of the year, we’ve been arguing to own those with the most exposure to the Middle East and offshore, markets defined by duration with several years of visibility,” Anderson said. “With the largest footprint in the Middle East and arguably best positioned in offshore technology, SLB should once again rise above the fray this quarter… SLB has beat EBITDA estimates for the past five consecutive quarters and we don’t see any reason for this quarter to be any different… SLB remains the name to own, in our view, especially over a medium- to longer-term investment horizon.”

As such, Anderson rates SLB shares an Overweight (i.e., Buy) rating backed by a $74 price target. Should that figure be met, investors will be pocketing gains of 42% a year from now. (To watch Anderson’s track record, click here)

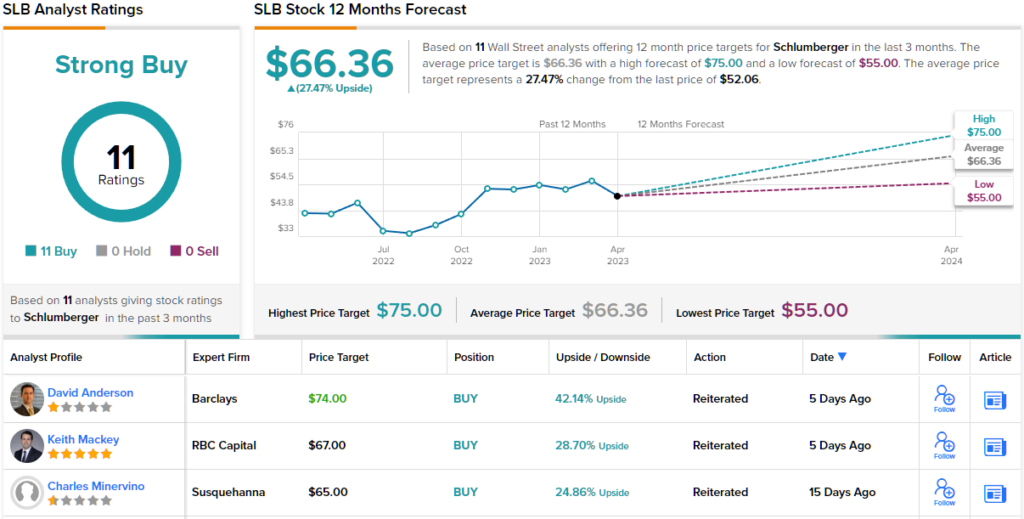

Overall, SLB seems to meet all the criteria for the Street’s analysts. All 11 recent reviews are positive, naturally making the consensus view a Strong Buy. Meanwhile, the average target currently stands at $66.36, implying an a 27% upside potential from the current levels. (See SLB stock forecast)

CVS Health (CVS)

For our final BlackRock-endorsed stock, let’s now turn to another giant but one that operates in an entirely different field. American healthcare colossus CVS Health is one of the world’s largest healthcare companies, and boasts a $95.92 billion market cap. It also currently takes 4th spot on the Fortune 500 list.

The business offers, among other things, pharmacy services, telemedicine care, chronic disease prescription coverage, and health plans for commercial and specialty insurance and amongst its owned brands, you can find retail pharmacy chain CVS Pharmacy, pharmacy benefits manager CVS Caremark, and a health insurance provider Aetna.

Befitting a company of its size, CVS generates huge amounts of revenue. In the latest report, for 4Q22, the company showed $83.8 billion at the top-line, beating the Street’s call by $7.43 billion. Adj. EPS of $1.99 also came in above the $1.93 predicted by the analysts.

The company also prides itself in having paid out dividends for 105 consecutive quarters. The current payout stands at $0.60, and yields 3%.

That said, despite the strong earnings and consistency, shares have sold off this year, as investors appear to be questioning the company’s strategy and how it could affect the dividend. In recent times, CVS has splashed out billions on primary care specialist Oak Street Health and home health firm Signify Health.

BlackRock, however, must remain a big believer in the CVS story. It holds 94,974,082 shares, which at the current market price are worth a whooping $7.2 billion.

Looking at CVS’s prospects, Jefferies analyst Brian Tanquilut thinks the investments will pay off and highlights the appealing share price. He writes: “We continue to have a positive view on CVS given our belief that EPS growth should accelerate post-2024 as the execution of mgmt’s strategic goals yields concrete P&L benefits (i.e., growth should benefit from increasing earnings contribution from Oak Street & Signify), as well as synergies realized across CVS’s other business lines. Valuation and cash generation remain compelling, just as CVS proves the resilience of its businesses to broader macro factors.”

To this end, Tanquilut has a Buy rating for CVS shares while his Street-high $143 price target suggests the stock is undervalued to the tune of 89%. (To watch Tanquilut’s track record, click here)

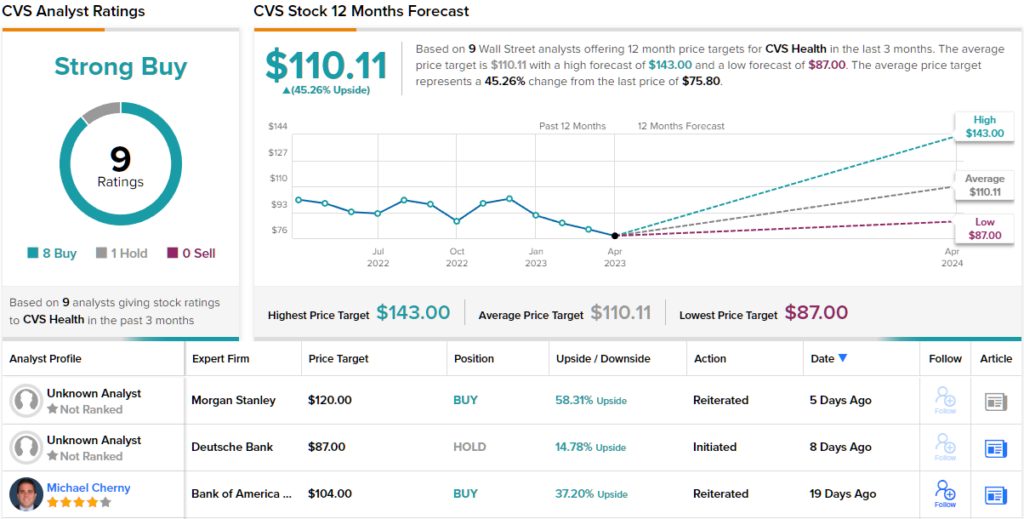

This is another name with robust support from the Street. While one analyst prefers sitting this one out, all 8 other reviewers say Buy, culminating in a Strong Buy consensus rating. Considering the $110.11 average target, in a year’s time, investors could be sitting on gains of 45%. (See CVS stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.