As we head into the final months of 2024, economic conditions appear to be improving. The rate of inflation has slowed down nearly to the Fed’s target rate, the central bank has begun lowering interest rates, and the last jobs report showed a surge in employment. In response, Wall Street’s experts are outlining their top investment picks for the coming few years, offering valuable insights for investors.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

KeyBanc analyst Matthew Gillmor is focusing on healthcare service stocks, a sector that has multiple potential tailwinds lining up. The Baby Boomer generation is rapidly aging and consuming more healthcare services, while government policies such as Obamacare are ensuring wider spread coverage and payment. Gillmor sees these and other factors as determinative here.

“We believe the U.S. healthcare system will require significant efficiency gains over the next 5-10 years, driven by fiscal pressures and demographics,” Gillmor opined. “Healthcare services will likely be at the epicenter of innovation, disruption, and opportunity… Our proprietary hospital card data indicates utilization remains strong in September and 3Q. We expect hospitals and post-acute providers will beat/raise with 3Q earnings… We favor efficient providers competing against inefficient non-profits.”

Against this backdrop, Gillmor has taken a deep dive into the details on Humana (NYSE:HUM) and Privia Health Group (NASDAQ:PRVA), companies that approach the sector from widely different directions. He evaluates both and highlights one as the top healthcare stock to buy right now. Let’s dive into the details.

Humana

We’ll start with Humana, the fifth-largest health insurer in the $1.4 trillion US health insurance market. Humana boasts a 7.3% market share in its industry, and a $31 billion market cap. The company’s four-quarter revenue total – of $112 billion over the 2H23 and 1H24 – ranks it eighth among all US insurance companies, regardless of their specific market. Humana is an important provider of medical, dental, and vision plans for individuals and families in the US private health insurance sector, and is also a provider of various plans under Medicaid, based on client eligibility. In addition, Humana is known for offering a range of Medicare Advantage plans, covering medical, routine dental, vision, and hearing benefits for eligible patients.

That Medicare Advantage coverage has generated headlines for Humana recently, and not ones that the company wants to see. The Centers for Medicare and Medicaid Services (CMS), the Federal regulatory overseer of Medicare and Medicaid insurance providers, recently downgraded a large share of Humana’s Medicare offerings. This has important implications for the company’s revenues going forward, as insurers with higher-star rated programs can receive bonus payments from Medicare. Humana has seen a sharp drop in the proportion of Medicare Advantage members enrolled in 4-star plans for 2025, as compared to this year.

This is not the only potential stumbling block that Humana has reported recently. In January of this year, the insurer reported a larger proportion of its covered members were older patients seeking care, a demographic change that can bite into revenues.

All of that said, Humana still reported revenue gains in Q2 of this year, the last quarter reported. The top line came to $29.54 billion, beating the forecast by $1.1 billion and having grown more than 10% year-over-year. The company’s non-GAAP earnings, of $6.96 per share, beat expectations by $1.09. Looking ahead to Q3, we’ll see the earnings release at the end of this month. Analysts are expecting quarterly revenues of $28.65 billion – which would translate to an 8.4% year-over gain.

For KeyBanc analyst Matthew Gillmor, this stock presents a mixed picture, and he outlines reasons for both optimism and pessimism: “Bull case compelling but margin recovery weighted to 2027+. HUM is under-earning across its MA book due to v28 changes, rising utilization during 2023-2024, and lower benchmark updates. Efforts to improve margins through plan exits should provide some benefit next year; however, TBC thresholds and weaker 2025 Stars likely push a meaningful margin recovery into 2027+. We estimate a normalized MA margin (~3.5%) against a reasonable, long-term earnings multiple (~15x) could yield $600+ stock at some point.”

Going forward, however, Gillmor sides with caution and writes, “We see a long-term bull case for HUM, but we’d like to gain visibility to the timing of the MA margin recovery before potentially getting more constructive.”

To quantify his stance here, the analyst gives HUM shares a Sector Weight (Neutral) rating and declines to set a fixed price target.

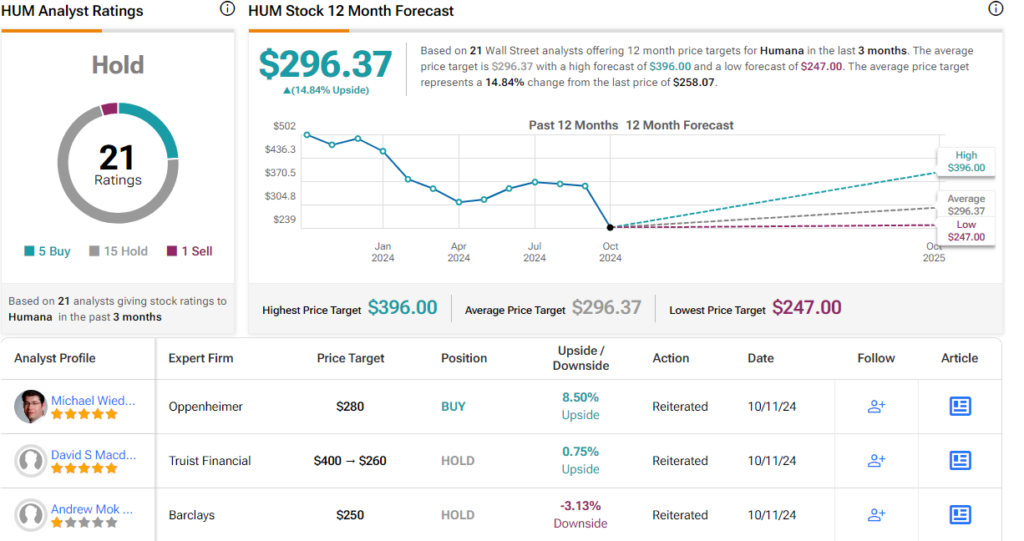

Overall, the Street view is in line with KeyBanc. The consensus on HUM stock is a Hold, based on 21 reviews that include 5 to Buy, 15 to Hold, and 1 to Sell. The stock is currently priced at $258.07 and its $296.37 average target price implies a 15% gain in the next 12 months. (See Humana stock forecast)

Privia Health Group

The second stock on our list, Privia Health Group, is a physician organization with a national footprint – and the tech-savvy to deliver the tools and talent that doctors and other healthcare providers need to bring the best care to their patients. The company’s goal is to help physicians optimize their practices for improved patient experiences, making the best care available in both office and virtual settings.

Privia works directly with healthcare providers, who in turn realize the benefits of independent action and group membership. It’s an innovative way to combine the efficiencies of scale with small-scale physician groups. From the patient perspective, the benefit comes in more personalized care. The company currently works with more than 4,500 providers in over 1,100 locations, who are collectively treating more than 5 million patients.

On the financial side, Privia beat expectations in its last earnings report, released in August and covering 2Q24. The company brought in $422.3 million in revenues, amounting to a 2.2% increase over the previous year’s quarter and beating the Street’s forecast by $10.84 million. Privia’s bottom line came to 19 cents per share in non-GAAP measures, ahead of the prognosticators by a penny.

For the full year 2024, the consensus on Privia’s revenue is $1.67 billion. The company is expected to report more than $413 million in Q3 revenue next month, so it will need to generate over $430 million in Q4 to reach that full-year expectation. We should note that Privia generated over $440 million in 4Q23 – and has been seeing year-over-year quarterly revenue growth for the past several quarters.

KeyBanc’s Gillmor thinks that Privia has solid prospects ahead of it and writes of the company, “In our view, physician groups are often looking to solve multiple problems (eroding FFS economics, labor pressures, unsuitable Medicare/MA economics). PRVA’s platform improves FFS (fee-for-service) rates, reduces practice expense, and creates incremental VBC (value-based care) economics. We also see advantages to PRVA’s integrated EMR (electronic medical record), especially as it relates to driving physician behavior change and operating visibility to drive VBC performance… PRVA creates significant value for payors (quality measures, RAF (risk adjustment factor) documentation, sustains PCP (primary care physician) network), and we think the Company could be a logical takeout candidate under the right circumstances.”

In line with these comments, Gillmor rates PRVA shares as Overweight (Buy) with a $23 price target that implies a one-year upside potential of 31%.

This stock has earned a Strong Buy consensus rating from the Street’s analysts, based on 12 recent recommendations that break down to a lopsided 11 to 1 in favor of Buy over Hold. The shares have a $17.55 trading price, and the $24.80 average target price indicates room for a gain of 41% by this time next year. (See Privia stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.