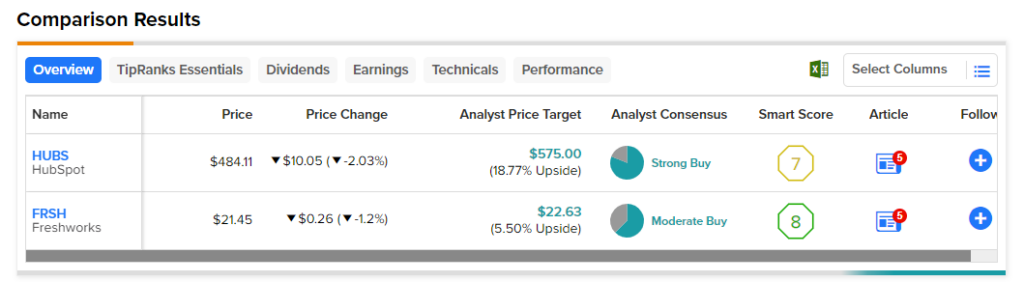

In this piece, I evaluated two enterprise software stocks, HubSpot (NYSE:HUBS) and Freshworks (NASDAQ:FRSH), using TipRanks’ comparison tool to determine which is better. HubSpot develops and markets software for sales, inbound marketing, and customer service, while Freshworks offers cloud-based customer service software.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

HubSpot is up 70% year-to-date after plummeting by over 15% in the last five days, although it remains up 35% over the last 12 months. Meanwhile, Freshworks has rallied 17% in the last five days, bringing its year-to-date gain to 46% and its 12-month return to 36%.

Despite those year-to-date rallies, neither HubSpot nor Freshworks is profitable on an annual basis, and neither is their industry. Thus, to gauge their valuations, we’ll compare their price-to-sales (P/S) ratios. The U.S. application software industry is currently trading at a price-to-sales (P/S) of 7.9 versus its three-year average P/S of 10. While both firms trade at higher P/S ratios, there’s more to consider.

HubSpot (NYSE:HUBS)

At a P/S of 12.7, HubSpot looks overvalued relative to its industry, although its five-year mean P/S is 16, significantly higher than the industry’s three-year average P/S. However, while most analysts seem to expect the company to be profitable in 2025, its losses continue to widen. Thus, a bearish view seems appropriate.

First, it’s important to note that for HubSpot to be profitable in 2025, it would have to average an annual earnings growth rate of 68% in 2023, 2024, and 2025. However, while HubSpot managed year-over-year revenue growth of 47% and 33% in 2021 and 2022, respectively, its net losses have continued to widen.

HubSpot’s net income margin fell from -6% in 2021 to -6.5% in 2022 and -10.5% for the last 12 months. In short, more sales are not resulting in growing profits, leaving some major question marks about HubSpot’s profitability timeline.

On the plus side, HubSpot is generating positive free cash flow and did post a beat-and-raise quarter for the second quarter. However, this year’s rally has simply made the company’s stock too expensive, especially if profitability is further away than what Wall Street is expecting.

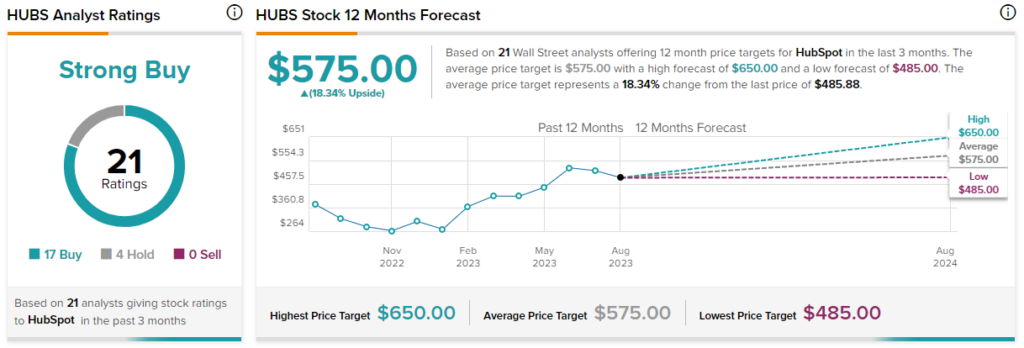

What is the Price Target for HUBS Stock?

HubSpot has a Strong Buy consensus rating based on 17 Buys, four Holds, and zero Sell ratings assigned over the last three months. At $575, the average HubSpot stock price target implies upside potential of 18.3%.

Freshworks (NASDAQ:FRSH)

At a P/S multiple of 11.7, Freshworks also looks expensive compared to its industry, although its current valuation is in line with its mean P/S of 11.8 since November 2021. The company generated its first adjusted operating profit in the second quarter and guided for its first annual operating profit this year. Achieving profitability could be a significant catalyst over the next six to 12 months, making a bullish view seem appropriate.

Importantly, the U.S. application software industry as a whole is unprofitable, so Freshworks is running ahead of its industry in this respect. On a previous earnings call, management said that it expects increasing efficiencies to drive steady, quarter-over-quarter improvements in profitability.

In February, management guided for a non-GAAP operating loss of $6 million in the second quarter. However, Freshworks actually reported non-GAAP operating income of $11.7 million for the quarter. Also in February, management had expected the company to approach breakeven in the third quarter and turn positive for the first time by the fourth quarter.

Thus, it looks like things could be running ahead of even management’s profitability schedule. Importantly, Freshworks is also advancing on a GAAP basis, posting a GAAP net loss of $35 million for the second quarter, compared to its net loss of $68.2 million in the year-ago quarter.

Its GAAP loss from operations declined by 54% year-over-year to $43.5 million. GAAP profitability is particularly important because it reveals real profits rather than adjusted profits, which exclude things like stock-based compensation. Freshworks also generated an impressive $18.1 million in free cash flow during the second quarter, versus the -$9.65 million in free cash flow it generated in all of 2022.

Finally, Freshworks also has a highly-attractive balance sheet with $1.2 billion in cash and short-term investments and total liabilities of $342.7 million.

What is the Price Target for FRSH Stock?

Freshworks has a Moderate Buy consensus rating based on 10 Buys, six Holds, and zero Sell ratings assigned over the last three months. At $22.63, the average Freshworks stock price target implies upside potential of 5.7%.

Conclusion: Bearish on HUBS, Bullish on FRSH

A deep dive into both companies reveals Freshworks as the clear winner based on profitability. Finally, investors should consider whether HubSpot, with its widening losses, deserves a $24 billion market capitalization, while Freshworks, which just posted its first non-GAAP operating profit, has a market cap of only $6.1 billion. Although Freshworks is a fraction of the size of HubSpot in terms of revenues, Freshworks stock could break out in the coming months due to its profitability milestones.