Applied Materials, Inc. (NASDAQ: AMAT) is scheduled to report its third-quarter results on August 18, 2022, after the market closes. The results are forecasted to be on the weaker side, with revenues missing estimates and earnings coming in line with expectations.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Applied Materials operates in the semiconductor industry by supplying manufacturing equipment, services, and software to the companies in the industry.

Q2 Results Snapshot

Applied Materials’ second quarter results were disappointing, with both revenue and earnings failing to top Street estimates. However, both the metrics reported growth from the previous year.

Revenues for the quarter came in at $6.25 billion, up 12% from the prior year and lower than the consensus estimate of $6.37 billion.

Meanwhile, the company reported earnings per share (EPS) of $1.85, which signifies a growth of 13% from the prior year. However, like revenues, the EPS figure also missed the consensus estimate of $1.90.

Company Guidance and Analyst Expectations

For the third quarter, the company had provided a revenue forecast of $6.25 billion, plus or minus $400 million. This represents only marginal growth from the previous year. Moreover, the figure is considerably lower than the analyst community’s consensus estimate of $6.73 billion.

Notably, EPS estimates for the third quarter by the company came in the range of $1.59 to $1.95. The Street’s consensus estimate of an EPS of $1.78 is in line with the midpoint of the company’s forecast range.

Is AMAT a Buy or Sell?

The consensus among analysts for Applied Materials stock is a Strong Buy based on 18 Buys and five Holds. The AMAT average price target of $136 implies an upside potential of 25.4% from current levels. Shares have declined 15.8% over the past year.

Despite multiple headwinds, such as a concentrated customer base and a substantial portion of its revenues (30%) coming from China, the stock has found favor with the analyst community. This is because of the overall solid growth prospects of the semiconductor industry and the strong demand for chips from data center customers.

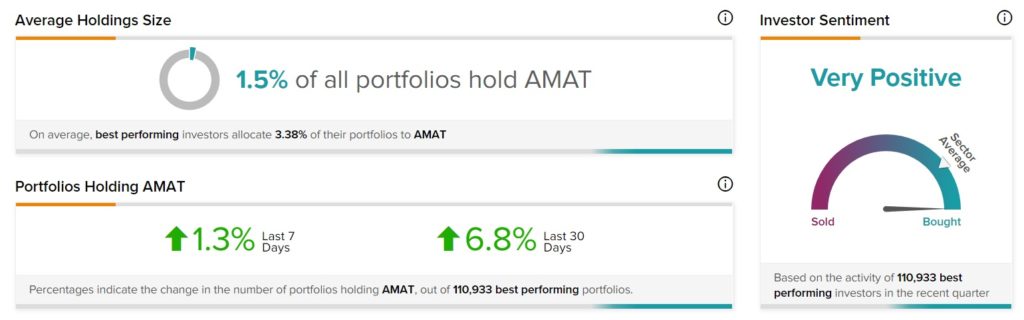

Meanwhile, top investors also seem convinced about the company’s prospects and are loading up on the company’s stock despite the prediction of somewhat weak third-quarter results.

TipRanks’ Stock Investors tool shows that top investors currently have a Very Positive stance on AMAT. Further, 6.8% of the top portfolios tracked by TipRanks, increased their exposure to AMAT stock over the past 30 days.

Key Takeaways

Although the company continues to witness heightened demand from data centers, it seems that it will not be able to offset the muted demand in the PC and consumer electronics markets. Therefore, the third quarter results are expected to be on the weaker side.

However, all is not doom and gloom for Applied Materials. This is because one of the company’s top customers, Taiwan Semiconductor Manufacturing Company (TSM), has planned to spend over $40 billion in capital expenditure this year, which bodes well for the company’s top line in the future.

Read full Disclosure