If you are looking to avoid stock market losses in 2023, your stock picks will require a strong defense.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

It is safe to say that market participants entered 2023 with a sense of hope and optimism – typical at the onset of a new year where commitments to resolutions are tested and new beginnings are underway!

However, as any experienced investor can attest, yesterday’s news is not always a thing of the past.

As a matter of fact, the economic environment of our past very much remains our present. Inflation remains stubbornly high, currently at 6.4% for the United States. The labor market remains robust, at a historical low rate with unemployment hovering at 3.4% – a rate not seen since 1969! And finally, we have a Federal Reserve that has been reluctant to veer from its hawkish stance, which keeps investors in a state of flux when it comes to market certainty.

So, how should investors invest during 2023?

In a word? Prudently.

Missing Guidance

Especially as earnings season only gave way to more market uncertainty given nil guidance shared across the board by key executives from some of America’s top retailers like Walmart’s (WMT) Doug McMillon and Lowe’s (LOW) Marvin Ellison. Furthermore, J.P. Morgan’s (JPM) Jamie Dimon recently affirmed his 2023 outlook, stating that the Federal Reserve has “lost a little but of control of inflation,” and that is “scary stuff,” which should raise red flags.

Not to mention, Federal Reserve Chairman Jerome Powell’s congressional testimony just primed the market for the Central Bank to move aggressively regarding rate hikes, as Powell informed Congress rates will likely be “higher than previously anticipated.”

For investors who can afford the remainder of the year’s worth of time, there is plenty of hope and moreover, opportunities!

JNJ Offers Opportunity

Take Johnson & Johnson (JNJ), for example. the stock is currently down 12.9% year-to-date after a peak share price of $178.96 this year.

Fundamentally, Johnson & Johnson is a fortress as a $405.12B market capitalized pharmaceutical, medical device and consumer goods powerhouse. However, a clean balance sheet with little debt does not make a company immune to lawsuits.

Recently, thousands of talc lawsuits have spooked investors out of their J&J position, but it is worth an analysis for the longer-term, post what very well may near-term trouble.

According to 7 best performing analysts offering 12 month price targets for Johnson & Johnson, there is 19.32% worth of upside expected with a average forecasted JNJ share price of $183.86.

TXN – Opportunity Abounds

Outside of the healthcare sector, investors may want to focus their attention on a more conservative, yet paramount, behind-the-scenes technology opportunity, with Texas Instruments (TXN).

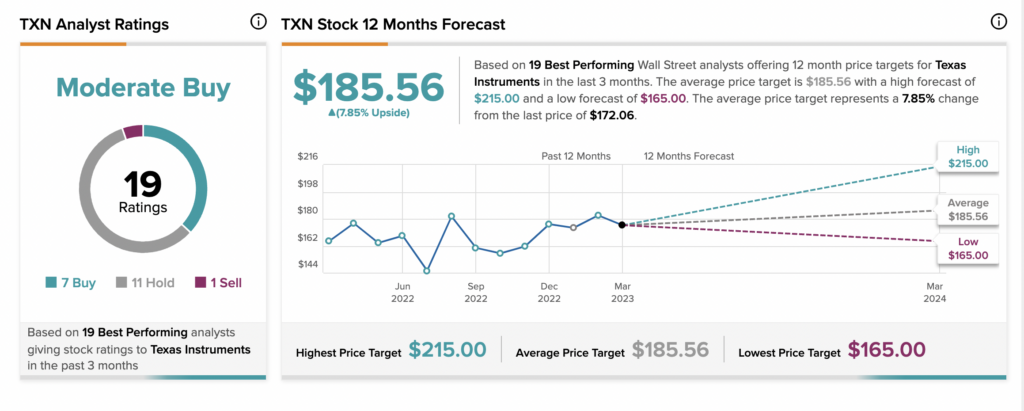

This global semiconductor industry leader is down from its 2023 peak of $184.72, trading for $172.06 per share with a Price-to-Earnings ratio under 20, at 18.7.

While the current economic environment may ultimately be hindering Texas Instrument sales as companies adjust product production and sales forecasts, an economic turnaround is arguably inevitable, meaning chip-makers still have plenty of room to run!

Analysts are rating Texas Instruments a Moderate Buy. Based on 19 best performing analysts, Texas Instruments may experience 7.85% worth of upside over the next 12 months, resulting in the TXN share price rising to $185.56 per share.

SCHD ETF – An Opportunity Worth Considering

But if individual stocks appear to be too risky of a bet, investors should focus on Exchange Traded Funds ETFs that can deliver reliability and a level of income predictability.

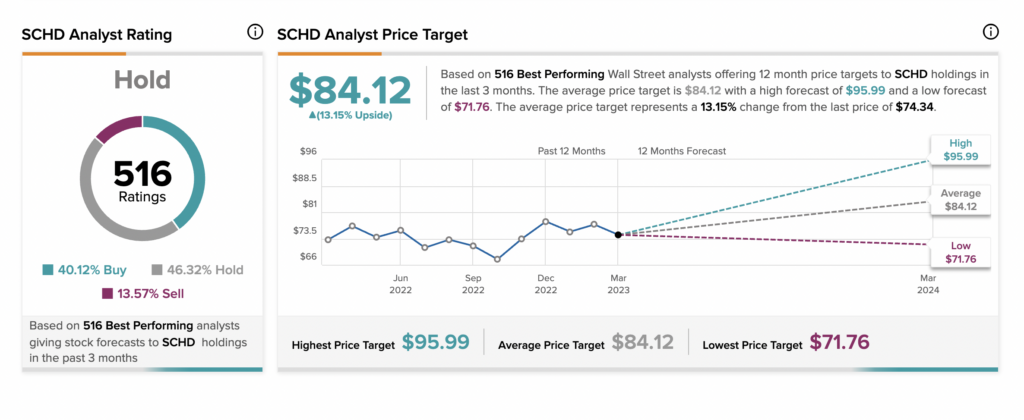

Schwab US Dividend Equity ETF (SCHD) may be ideal, with 101 total holdings within the fund that each have reliable histories worth of dividend payments – that rarely experience the shock-waves of volatility from mounting market fears.

Companies within this ETF vary from Broadcom Inc. (AVGO) to Pepsico (PEP).

Based on 516 Best Performing Wall Street analysts offering 12 month price targets to SCHD holdings in the last 3 months, the average price target is $84.12 – that represents a 13.15% change from the last price of $74.34.

Conclusion

While 2023 has not exactly presented the entry into a bull market that market participants expected, investors should not be deterred from investing. After all, investing is about having time in the market as opposed to timing it, but every investor will simply want to exercise prudence as they invest. Ultimately, they will be prepared for the worst, yet hopeful for the best!