Stocks of major fertilizer companies CF Industries (NYSE:CF), Mosaic Industries (NYSE:MOS), and Nutrien (NYSE:NTR), have outperformed the broader market. These companies gained from the spike in fertilizer prices triggered by the Western sanctions against Belarus potash firms and the Russia-Ukraine conflict. Heading into the Q3 results of these fertilizer companies, Wall Street analysts seem cautiously hopeful about their prospects.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Fertilizer prices have been quite volatile recently and have fallen from the highs seen earlier this year. However, they are still high when compared to the prior year.

A recent Bloomberg report highlighted that fertilizer prices are under pressure as farmers are pulling back their purchases and reconsidering decisions around fertilizer applications due to higher prices. The report also noted that Brazilian farmers are also halting their purchases, driving down fertilizer prices further. Prices in Brazil are also down due to piled-up inventories as the country imported fertilizers at a record pace this year to ensure adequate supply.

Meanwhile, Reuters reported that several fertilizer producers in Europe are shutting down operations due to soaring natural gas prices. The major component of nitrogen-based fertilizers is ammonia, the production of which requires significant amounts of natural gas. This situation in Europe is favorable for U.S. nitrogen fertilizer companies as it will lead to higher exports and support high prices.

Amid these supply-demand dynamics, fertilizer prices could remain volatile over the near term.

CF Industries Holdings (CF)

CF Industries is one of the world’s largest manufacturers of nitrogen-based fertilizers. The company’s Q2 EPS jumped to $5.58 from $1.14 and revenue surged 113.4% to $3.4 billion, thanks to higher prices driven by strong demand and limited global supply.

CF Industries is expected to announce its Q3 results on November 2. Analysts expect Q3 revenue to grow 75.5% to $2.39 billion and adjusted EPS to come in at $3.34.

What is the Target Price for CF Industries Stock?

Earlier this month, RBC Capital analyst Andrew Wong upgraded CF Industries stock to Buy from Hold and increased the price target to $135 from $110, given the improved outlook for nitrogen fertilizer.

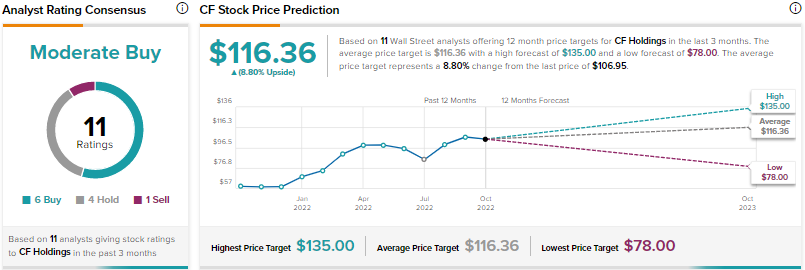

Overall, Wall Street has a Moderate Buy rating on CF Industries stock based on six Buys, four Holds, and one Sell. The average CF stock price target of $116.36 suggests 8.8% upside potential. Shares have surged by an impressive 51.2% year-to-date.

The Mosaic Company (MOS)

Mosaic is a leading producer of phosphate and potash fertilizer. Mosaic’s Q2 revenue increased 92% to $5.4 billion and adjusted EPS jumped 211% to $3.64 amid a favorable demand backdrop.

The company is slated to announce its Q3 results on November 7. Analysts expect the company’s Q3 adjusted EPS to increase over 150% year-to-over to $3.38 and revenue to rise 68.3% to $5.75 billion.

Is MOS a Good Stock to Buy?

Recently, RBC analyst Wong downgraded Mosaic to a Hold from Buy and slashed the price target to $65 from $85 as he feels that the company faces risks in phosphate output. Wong stated, “We still see fertilizer markets as very supply-constrained, but shift our preference to nitrogen and potash versus phosphate.”

Wong noted that phosphate contributes nearly 40% of Mosaic’s EBITDA, while potash generates nearly 50%. However, the analyst sees less potential for higher phosphate production despite favorable factors that support prices, like high crop prices, China’s export restrictions, and supply constraints. The analyst also highlighted the impact of hurricane Ian on Mosaic’s phosphate production.

All in all, consensus among analysts for Mosaic stock is a Moderate Buy based on four Buys, three Holds, and one Sell. The average MOS stock price prediction of $66.63 implies 24.5% upside potential. MOS stock has rallied 36.4% year-to-date.

Nutrien Ltd. (NTR) (TSE:NTR)

Canada-based Nutrien is the largest producer of potash (based on capacity) and one of the leading producers of nitrogen and phosphate fertilizers. Supply restrictions on potash from Russia and Belarus kept potash prices at historically high levels in the first half of 2022, benefiting Nutrien immensely.

Higher realized selling prices across the company’s crop nutrient businesses and solid performance of the retail business drove 49% rise in Q2 sales to $14.5 billion. Adjusted EPS skyrocketed 181% to $5.85.

Nutrien is scheduled to announce its Q3 results on November 2. Wall Street expects adjusted EPS to rise 191% to $4.02. Revenue is projected to grow by nearly 51% to $8.75 billion.

Is Nutrien Stock a Buy?

Recently, Bank of America Securities analyst Steve Byrne reiterated a Buy rating on Nutrien stock but lowered the price target to $130 from $141 to reflect a softer potash and phosphate outlook. However, the analyst feels that the impact on NTR’s profitability is “somewhat cushioned by a more stable Retail and stronger Nitrogen business.”

On TipRanks, Nutrien stock has a Moderate Buy consensus rating that breaks down into eight Buys, three Holds, and one Sell. The average NTR stock price target of $109.82 implies nearly 32% upside potential. Nutrien’s U.S.-listed shares have risen nearly 11% year-to-date.

Conclusion

Wall Street is cautiously optimistic about fertilizer stocks because of demand destruction due to high prices and fears of a looming recession. However, supply constraints amid the Russia-Ukraine conflict are expected to keep supply tight and support high prices.

The upcoming results of major fertilizer companies and their management’s commentary on the near-term outlook will give investors more clarity about the growth prospects of CF Industries, Mosaic, and Nutrien.