Home Depot (NYSE:HD) stock is definitely a fixer-upper in 2023, but investors can still take a chance as Home Depot just served the market a pleasant earnings surprise, which sent the stock higher. I am bullish on HD stock, even though the company’s management issued a warning about the challenges of selling big-ticket items.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Home Depot operates a popular chain of home improvement stores. If you’re in the U.S. and you’re looking to fix something or make additions to your house, you might end up going to Home Depot.

The market has almost completely ignored Home Depot stock this year, which is a shame, but it also presents an opportunity to get in while the firm successfully navigates a difficult economy.

Analysts Might Regret Their Price Target Cuts

For many years, passive income investors have relied on Home Depot for consistent dividend payouts. Currently, Home Depot offers an annual dividend yield of 2.8%, which easily outpaces the consumer cyclical sector average dividend yield of around 1%.

However, investors haven’t spent much time focusing on dividend stocks this year. Furthermore, three different analyst groups recently slashed their price targets on HD stock before today’s earnings report.

For a while, it seemed like Home Depot just couldn’t catch a break. First, Citigroup (NYSE:C) analyst Steven Zaccone lowered his price target on Home Depot stock from $375 to $333. Zaccone expected Home Depot to report “lackluster” third-quarter 2023 results overall.

Next, Telsey Advisory reduced its price target on Home Depot stock from $330 to $325. The firm expressed concerns about weak sales data from the government and third-quarter results from other home-improvement retailers.

In addition, Stifel analyst W. Andrew Carter lowered his price target on HD stock from $350 all the way down to $306. Carter forecast that Home Depot would report Q3-2023 EPS of $3.73, which would suggest a 12% year-over-year decline. So, did Carter’s pessimistic prediction turn out to be true?

Home Depot Issues a Warning but Still Delivers Street-Beating Earnings

Carter and the other aforementioned analysts may end up revising their price targets for HD stock soon. As it turns out, Home Depot reported third-quarter 2023 EPS of $3.81, beating Carter’s call for $3.73 as well as the consensus estimate of $3.75. This positive result continues Home Depot’s long-standing track record of beating quarterly EPS projections.

Now, I’m not going to claim that everything is perfect with Home Depot and the U.S. economy in general. After all, inflation hasn’t completely gone away, and it’s still difficult for many Americans to afford large home improvement projects.

On that topic, Home Depot CEO Ted Decker warned, “Similar to the second quarter, we saw continued customer engagement with smaller projects, and experienced pressure in certain big-ticket, discretionary categories.” Consequently, even though today’s inflation print might put investors in a good mood, Decker seems to suggest that the U.S. economy isn’t completely out of the woods yet.

Moreover, Decker observed in a conference call, “This year reflects a period of moderation.” Nevertheless, Decker remains optimistic, stating, “We are confident in our ability to navigate through this unique environment.”

His confidence is justified, in my opinion. Along with the EPS beat, Home Depot reported Q3-2023 sales of $37.7 billion, exceeding the consensus forecast of $37.6 billion.

Is Home Depot Stock a Buy, According to Analysts?

On TipRanks, HD comes in as a Moderate Buy based on 13 Buys and 11 Hold ratings assigned by analysts in the past three months. The average Home Depot stock price target is $341.48, implying 11.4% upside potential.

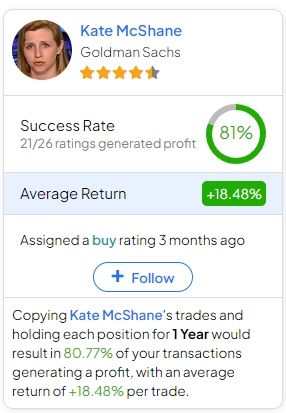

If you’re wondering which analyst you should follow if you want to buy and sell HD stock, the most accurate analyst covering the stock (on a one-year timeframe) is Kate McShane of Goldman Sachs (NYSE:GS), with an average return of 18.48% per rating and an 81% success rate. Click on the image below to learn more.

Conclusion: Should You Consider Home Depot Stock?

Home Depot stock is flying high today, but it’s still below its 52-week high of $347.25 and the company continues to pay a decent dividend. Besides, even Home Depot’s critics can’t argue with the company’s top- and bottom-line earnings beats.

Sure, the economy and the home improvement sector will continue to face challenges in 2023 and 2024. Still, Home Depot appears to be managing its difficulties, and the company’s CEO is confident. Therefore, I believe that investors should consider HD stock, especially if they like to collect dividends every three months.