Home Depot (NYSE:HD) is scheduled to announce its earnings for the fourth quarter of Fiscal 2022 on Tuesday, February 21. Analysts expect the company’s growth rates to decelerate in the fiscal fourth quarter, as high mortgage rates and inflation are putting pressure on the housing market.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Analysts’ Q4 Estimates Indicate Slowdown

Home Depot’s Q3 FY22 (ended October 30, 2022) sales increased 5.6% year-over-year to $38.9 billion and comparable sales grew 4.3%. Moreover, earnings per share (EPS) rose 8.2% to $4.24, driven by higher sales and operating margin expansion. Both sales and EPS topped expectations. Despite macro challenges, the company’s Pro (business addressing the needs of professional customers) and DIY (do-it-yourself) units grew in the third quarter.

Home Depot reaffirmed its FY22 guidance of a 3% growth in comparable sales and mid-single-digit percentage growth in EPS. Furthermore, it guided for positive comparable sales growth for the fiscal fourth quarter.

Meanwhile, analysts expect Home Depot’s Q4 sales to rise nearly 1% year-over-year to $36 billion and EPS to rise more than 2% to $3.28. Both of these key estimates reflect a slowdown compared to the growth rates seen in Q3 FY22.

Is HD a Good Stock to Buy?

Ahead of the Q4 results, Evercore ISI analyst Greg Melich added Home Depot to his firm’s “Tactical Underperform” list. Melich believes Home Depot will announce a cautious outlook for FY23, given high mortgage rates, declining existing home sales, decelerating home prices, and web traffic indicating a slower start year-to-date compared to the last two years.

Nonetheless, Melich believes in the company’s long-term prospects and reiterated a Buy rating on Home Depot with a price target of $370.

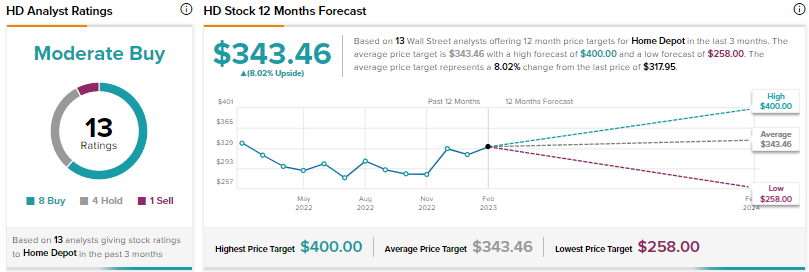

Wall Street is cautiously optimistic about Home Depot, with a Moderate Buy consensus rating based on eight Buys, four Holds, and one Sell. The average HD stock price target of $343.46 suggests 8% upside potential. Shares are essentially flat compared to the start of this year.

Conclusion

Near-term macro pressures are expected to weigh on Home Depot’s Q4 FY22 results and FY23 guidance. Nonetheless, shares might rise if the company reports upbeat numbers and reflects resilience in a tough business backdrop.