With a market cap of $850 billion, investors are driving Tesla (NASDAQ:TSLA) closer to rejoining the exclusive $1 trillion club. Nevertheless, the path ahead is unlikely to be a smooth one, as underscored by its Q3 delivery performance.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In that quarter, the company delivered 435,059 vehicles, missing not only analysts’ expectations but also falling below the previous quarter’s 466,140 units.

Tesla’s reaction in the face of waning demand is one already taken several times over the past year: another round of price cuts. All variants of the Model 3/Y in the US have now been a subject to another trim – by ~$2,000 or 4%.

While the rounds of price cuts have been put in place to spur demand, they haven’t quite had the desired effect. Despite around a $10,000 decline for global ASPs (average selling prices) and the January 1st addition of $7.5k in US consumer EV credit, Evercore analyst Chris McNally notes that Tesla’s global orders continue to track below 450,000 per quarter year-to-date.

So, what kind of impact with all the above have on the financial side? “We believe the ~$2k US ASP cut translates to 10-12% Q4 GM pressure (spot Auto GMs now trending low 15%),” says McNally.

What this ultimately means, says the analyst, is that investors will have to factor in a sub-$4 2024 EPS (the consensus estimate currently stands at $4.70), given the prospect of a ~70c Q4 EPS (the previous figure was 80c), and that annualizes to ~$2.80.

The reason for focusing on Q4 as a run-rate for 2024 is simple, says McNally: Demand. McNally’s Q4 estimates are based on expecting 475,000 units (annualized to 1.9 million annualized) but that already represents a big step up from the present global order pace of ~450,000. And that will require some calibration to current Street expectations.

“Even if we assume incremental EV adoption (tough given US already received ’23 tax credit bump, EU recent flattening penetration on removal of subsidies, & low market share in China), we think the Street will soon see 2.10-2.15MM units as more realistic of a ‘24 target vs the consensus of ~2.3MM,” McNally said.

All told, McNally reiterated an In Line (i.e., Neutral) rating on Tesla shares, alongside a $165 price target. The analyst, however, might as well have said Sell, as that figure represents downside of 38% from current levels. (To watch McNally’s track record, click here)

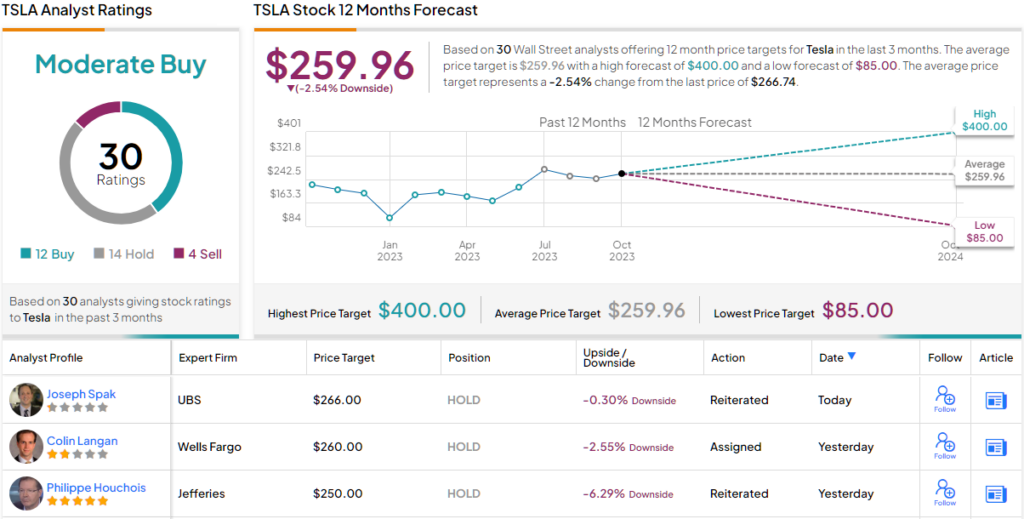

With 12 additional Buys, 13 Holds, and 4 Sells, TSLA stock claims a Moderate Buy consensus rating. The average target is more ‘optimistic’ than McNally’s objective; at $259.96, it suggests shares have a modest downside of 2.5%. (See Tesla stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.