Advanced Micro Devices (NASDAQ:AMD) might be playing catch up with Nvidia in the AI chip game, but it intends to do all it can to rein in the present AI champ.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Going by what was on offer at the company’s Advancing AI event on Wednesday, Nvidia will certainly need to keep its eye on the ball.

AMD launched its latest lineup of AI chips, featuring two new AI data center processors within its MI300 series. One is designed specifically for generative AI applications, while the other is tailored for supercomputing purposes. The generative AI processor, MI300X, incorporates enhanced high-bandwidth memory to elevate its performance capabilities.

Signaling a growing preference among tech companies for alternatives to the costly Nvidia chips that have played a crucial role in AI, Meta, OpenAI, and Microsoft have announced their intention to utilize the MI300X.

As a whole, demand appears to be growing at a much faster pace than initially expected. The anticipated AI TAM total addressable market is on the rise, with AMD last year projecting around $30 billion by the end of 2023 and a 50% CAGR (compound annual growth rate), reaching over $150 billion by 2027. However, that has now been adjusted with the TAM for 2023 now estimated to be closer to $45 billion. Furthermore, AMD has revised its CAGR expectations to 70%, aiming for an overall AI TAM of approximately $400 billion by the end of 2027.

Deutsche Bank analyst Ross Seymore thinks the company is setting its stall up to be an AI leader. “We believe the event highlighted how AMD remains extremely well positioned to take advantage of the rapidly expanding AI TAM, as they continue to stack up customer partnerships and roll out products with impressive (and extremely competitive) performance metrics,” the 5-star analyst said.

While competing with current undisputed AI leader Nvidia is no easy task, Seymore believes AMD’s open-source approach could be a “potential differentiator” vs. Nvidia’s strategy.

However, Seymore refrains from turning into an outright AMD bull right now. “While we remain extremely impressed by AMD’s depth of technological capabilities and a burgeoning ecosystem of customers/partners, we retain our Hold rating until the cyclical headwinds lessen or valuation risk/reward becomes more appealing,” he summed up.

That Hold (i.e., Neutral) rating is backed by a $110 price target, suggesting the shares are currently overvalued by ~12%. (To watch Seymore’s track record, click here)

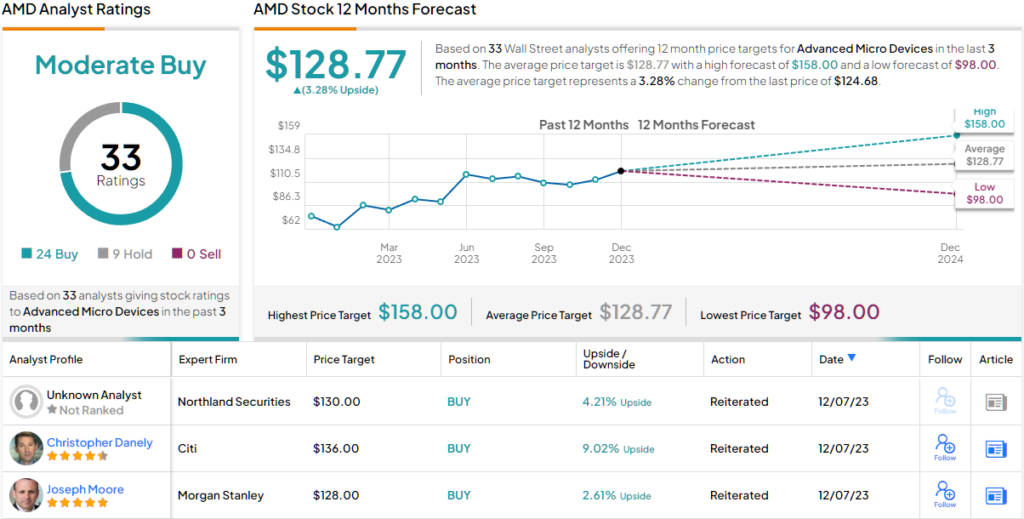

Turning now to the rest of the Street, where 8 other analysts join Seymore on the sidelines but with an additional 24 Buys, the stock claims a Moderate Buy consensus rating. Going by the $128.77 average price target, a year from now, investors will be recording gains of a modest 3%. (See AMD stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.