After several years of underperformance, 2023 has been marked by a bit of a comeback for Intel (NASDAQ:INTC). The chip giant’s Q2 results exceeded expectations, boosted by indications the PC market is gradually rebounding.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

With the company readying to release its Q3 statement on Thursday (October 26th after the close), can the turnaround story truly take shape?

That is still up for debate, says Stifel’s Ruben Roy, a 5-star analyst rated in the top 2% of the Street’s stock pros. On the one hand, there are positives taking place, and based on management’s recent commentary that Q3 is tracking above the midpoint of the guide, a “better print and guide appears within investor expectations” says the 5-star analyst.

Roy’s Q3 revenue forecast of $13.5 billion is slightly above the guide’s midpoint ($13.4 billion) and the same as consensus. Looking ahead, Roy’s Q4 revenue estimate of $14.5 billion is slightly above the Street’s forecast.

Additionally, Roy expects commentary made by management will likely “remain positively skewed” regarding its progress towards meeting medium-term goals and objectives. Likewise, the recently laid out plan to spin-off of its FPGA business is “yet another step in the right direction.” And while Roy does not anticipate Intel to share additional information about their 18A process pre-payment customer during the earnings call, he does expect an announcement to be made in the coming months and that could be a “positive catalyst” to the shares.

Moreover, while the recovery of the PC market remains steady, although at a pace “somewhat behind expectations,” come 2024, Roy is anticipating a “stronger environment.”

With all that said, lingering issues remain. And that makes Roy unwilling to get his bullish hat on just yet. “Our concerns on longer-term execution remain, though, and for now, we await more evidence that would indicate that INTC is indeed on track to deliver on its ambitious medium-term targets,” the analyst summed up.

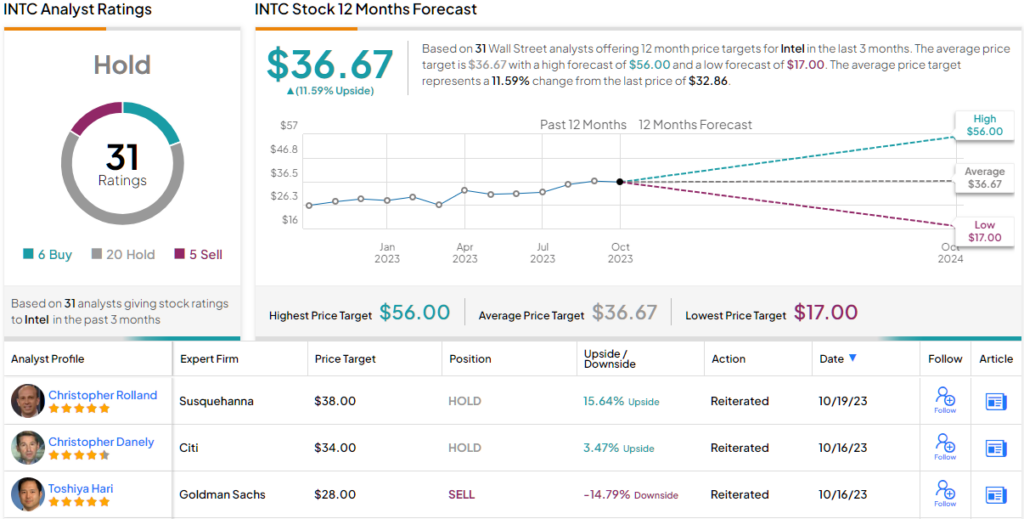

All told, ahead of the print, Roy maintained a Hold rating on Intel shares, backed by a $32 price target, suggesting shares have downside of ~3% from current levels. (To watch Roy’s track record, click here)

Out on the Street, most analysts are backing Roy’s stance. The stock claims a Hold consensus rating based on 20 Holds, 6 Buys and 5 Sells. Going by the $36.67 average target, a year from now, the shares are expected to show growth of ~12%. (See Intel stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.