After last week’s better-than-expected October inflation data, stocks saw broad gains. The tech-heavy NASDAQ led the way with a jump of 7.67%, and the S&P 500 was more than 5% up at the end of the week. Gains like that can spread out, and cloud stocks were among the NASDAQ’s best performers.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Jim Cramer, the well-known host of CNBC’s ‘Mad Money’ program, points out that this sharp rally gives investors a chance to clear the chaff out of their cloud stock portfolios and focus on high-quality names.

“I recommend using this incredible rebound actually as a rare opportunity to sell the weaker cloud stocks into strength. That said, some of them might be worth keeping, but only the highest quality names,” Cramer said.

Cramer lists several factors that he used to weed out the less attractive cloud stocks, including a market cap below $1 billion and an expectation of near- to mid-term unprofitability. From the remainder, Cramer picked out the three that he likes best, the ones he believes investors should hang on to. If you own some of these names, and are thinking of dumping them, Cramer advises that you hold your fire for the moment.

In fact, Cramer is not the only one singing these stocks’ praises. According to the TipRanks platform – each gets a ‘Strong Buy’ from the analyst consensus, and each shows plenty of upside potential for the year ahead. Here are the details, along with commentaries from the Street’s analysts.

CrowdStrike Holdings (CRWD)

First up is CrowdStrike, a leader in the cybersecurity world. CrowdStrike’s line of products, featuring its Falcon Endpoint Protection, offers users the industry standard in digital security for online and network protection. The company’s product line includes a wide range of cloud modules through the Software-as-a-Service subscription model.

CrowdStrike won’t report its next quarterly numbers until the end of this month, but we can get a feel for the company’s strong niche by looking at its last quarterly release, for fiscal 2Q23.

To start with, the company has recorded powerful gain in revenue and earnings in recent quarters. The most recent report showed $535.2 million at the top line, an increase of 58% year-over-year; the gain was driven by a 60% y/y increase in subscription revenue, to $506.2 million. Annual recurring revenue (ARR), an important indicator of future income, rose to $2.14 billion in fiscal Q2, up 59% y/y.

The company’s top line gains unsurprisingly came along with solid additions to the customer base. CrowdStrike reported a record quarterly gain of 1,741 new customers in its 2Q23 release.

These gains all led to the fifth quarter in a row of sequential EPS gains. The non-GAAP EPS was reported at 36 cents, up from 31 cents in fiscal Q2 and more than double the year-ago figure.

Lastly, the company showed an impressive cash flow in the quarter. Cash from operations rose 94% and hit a total of $210 million. This included an 84% y/y gain in free cash flow, to $136 million.

At the same time that the company has been posting solid financial results, its share price has also suffered from the twin blows in increasing inflation and increasing interest rates. CRWD stock is 30% down so far this year.

But CrowdStrike has deep pockets to weather a storm, and has made Cramer’s list of favorite cloud computing stocks. And Cramer is hardly the only one to take an upbeat position on CrowdStrike.

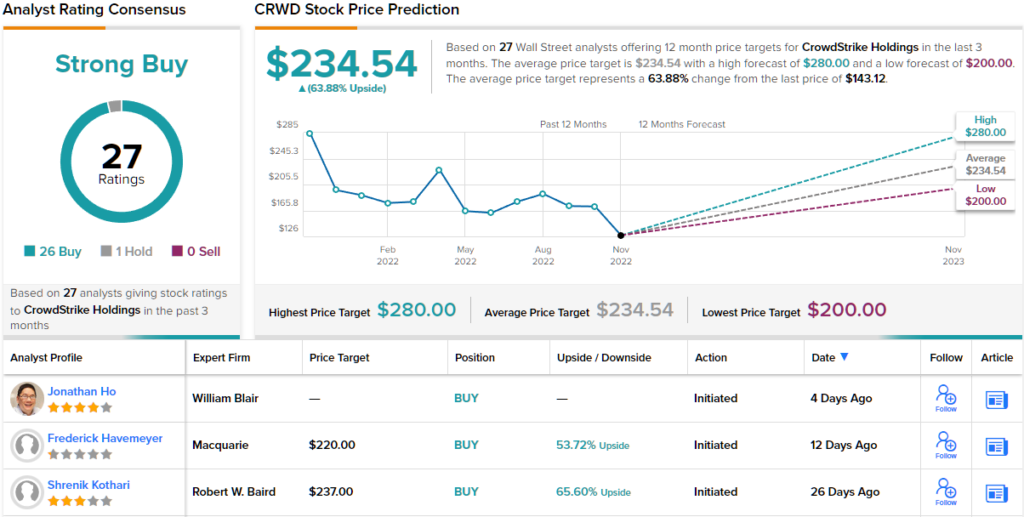

Standing squarely in the bull camp, Baird analyst Shrenik Kothari rates CRWD an Outperform (i.e. Buy), and his $237 price target implies a robust upside of 66% for the next 12 months. (To watch Kothari’s track record, click here)

Backing his bullish view, Kothari writes: “We view CRWD as the best-of-breed leader in this space, with impeccable track record and extended runway in its target markets to support durability of future growth. We believe CrowdStrike will meet its short-term (FY23) and mid-term (FY24) targets, even if new business slows due to protracted recession. Our bullish stance rests on CRWD maintaining leadership in the EPP market, cloud-security trends to accelerate (new CIEM capability), and new products such as Falcon LogScale…”

Tech stocks attract plenty of Wall Street attention, and CRWD shares have no fewer than 27 recent analyst reviews. These include 26 Buys against just 1 Hold, for a Strong Buy consensus rating. The price per share comes in at $143.12, and the average price target of $234.54 implies an upside potential of ~64% in the next 12 months. (See CRWD stock forecast on TipRanks)

ServiceNow, Inc. (NOW)

The second stock on our list of Cramer’s cloud picks is ServiceNow, a software firm offering IT management packages as cloud subscriptions. The company is based in Silicon Valley, and its suite of cloud products lets users improve their help desk functionality through better tracking and improvement of workflow management. The company generates solid revenues, but has seen its share price fall 37% this year.

The company has seen both the top and bottom lines rise consistently in recent years, through a succession of quarterly reports showing sequential gains. In the most recent quarter, 3Q22, ServiceNow reported $1.83 billion in total revenues, up 21% year-over-year. This total included a 22% increase in subscription revenue, to $1.74 billion. ServiceNow’s earnings came to $1.96 per diluted share, a 26% gain year-over-year.

Two additional metrics will serve to show ServiceNow’s strong position. First, the company reported a 60% y/y jump during Q3 in the number of customers paying over $10 million in annual contract value – a key point, that shows ServiceNow is receiving a solid return on its marketing and retention efforts. And second, the current remaining performance obligation at the end of Q3 came to $5.87 billion, up 18% y/y and indicating a solid base going forward.

This stock has caught the eye of JMP analyst Patrick Walravens, who, like Cramer, sees it as a solid option for investors.

“We continue to view ServiceNow as an excellent opportunity for long-term capital appreciation for several reasons including that it has superior, organically built platform and product set, addresses a huge TAM estimated to grow to $175B by 2024, is ably led by veteran software CEO Bill McDermott and CFO Gina Mastantuono, and is executing very well in a challenging macroeconomic environment, in part because of its focus on cost savings, productivity and quick time to value,” Walravens opined.

These comments support Walravens’ Outperform (i.e. Buy) rating, while his $553 price target indicates room for ~35% upside potential by the end of next year. (To watch Walravens’ track record, click here)

Overall, the Street’s analysts are drawn to essential services, such as IT management, and ServiceNow has picked up 21 analyst reviews recently, with a breakdown of 20 Buys and 1 Hold to support the Strong Buy consensus view. The current trading price is $409.91, and the average price target of $508.71 suggests a 24% share appreciation in the next 12 months. (See NOW stock forecast on TipRanks)

Datadog, Inc. (DDOG)

Last on today’s ‘Cramer pick’ list is Datadog, a company offering its customers cloud-based observability tools – the tools necessary to monitor, track, and secure cloud-based apps and platforms in real time. The tools offered in Datadog’s packages include automation, source control and bug tracking, troubleshooting and optimization, and basic monitoring and instrumentation. Customers can navigate through their logs, following key metrics and traces, allowing proactive product management based on high-quality data collation.

All in all, Datadog’s services fill a vital niche for app developers and site masters, platform managers and cloud activity monitors. These customers are willing to pay a premium for high-end tools, and that has been reflected in Datadog’s financial results in recent quarters. The company has been consistently beating the forecasts on EPS; in the recent 3Q22 report, the diluted EPS of 23 cents came in 7 cents, or 43%, above expectations.

That income was derived from total revenues that grew 61% year-over-year to reach $436.5 million. The company also saw solid cash flows, with cash from operations hitting $83.6 million and including $67.1 million in free cash flow. Datadog had $1.8 billion in liquid assets, including cash, on the books as of September 30.

In a metric that bodes well for this company going into next year, there was a 44% y/y increase in the number of customers with at least $100,000 in annual recurring revenue (ARR). The company reported 2,600 of these ‘high-yield’ customers as of the end of 3Q22, compared to 1,800 in the year-ago period.

Analyst Kingsley Crane, covering Datadog for Canaccord, sees a clear path forward for the company to maintain profitability. He writes, “Looking to FY23, we see mid- to high-30% growth as feasible but expect initial guidance to come in near 30%. We think hyperscaler spend rationalization is unfairly dominating the DDOG story, opening up room to be bullish…. At these levels, we see an attractive set-up with potential growth upside in FY23 on reset expectations. Product leadership and long-term opportunity make a limited downside digestible.”

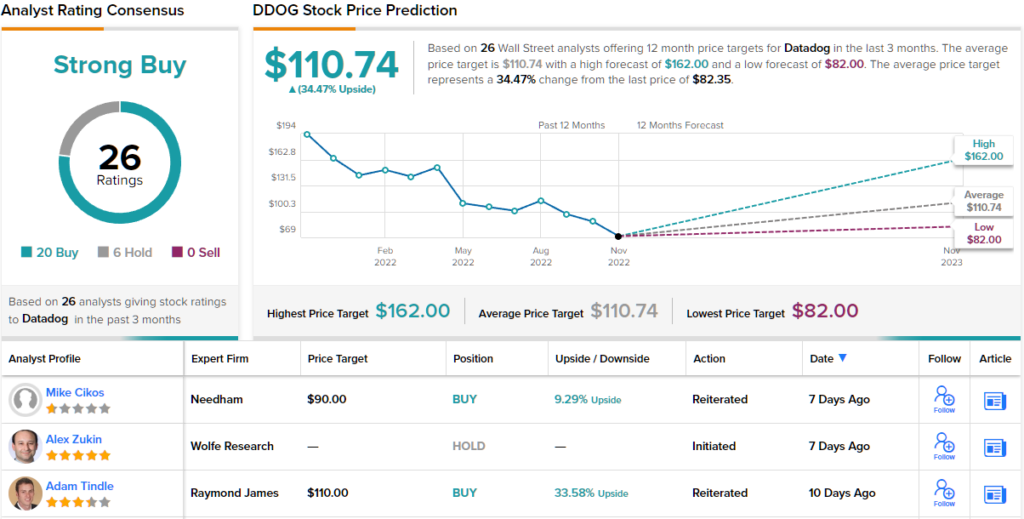

To this end, Crane rates DDOG shares a Buy, with a $110 price target implying an upside of 34% for the coming year. (To watch Crane’s track record, click here.)

As with the stocks above, this one has also picked up plenty of love from Wall Street. The 20 recent positive reviews outweigh the negatives, for a 20 to 6 breakdown of Buys versus Holds – and a Strong Buy analyst consensus rating. The shares have a trading price of $82.35 and the $110.74 average price target suggests a 34% one-year upside potential. (See DDOG stock forecast on TipRanks)

To find good ideas for tech stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.