In this piece, I evaluated two energy stocks, Hess (NYSE:HES) and NextEra Energy (NYSE:NEE), using TipRanks’ comparison tool to determine which is better. A deeper analysis suggests a neutral view for Hess and a bullish view for NextEra Energy.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Hess is an independent energy company that engages in the exploration and production of crude oil and natural gas. On the other hand, NextEra Energy is one of the largest capital investors in infrastructure in the U.S., with a goal of leading the nation’s decarbonization efforts.

After tumbling 8% in the last three months, shares of Hess are up 7.9% year-to-date but down 2.7% for the last 12 months. Meanwhile, NextEra Energy stock is off 30% year-to-date after plummeting 14% over the last three months. The shares are off 33% for the last 12 months.

While such a dramatic difference in year-to-date stock-price performance would usually be notable, there is one critical point that sets these two stocks apart. Hess’ valuation is essentially linked to that of Chevron (NYSE:CVX) due to its pending acquisition (more on that below).

Thus, two different methods are needed to gauge the valuations of these two companies.

Hess (NYSE:HES)

At its current price of around $143 a share, Hess is trading in line with Chevron’s current price of $144 per share. Due to the way the pending acquisition was priced, these two stocks should be trading roughly in line with each other. Thus, a neutral view seems appropriate — barring any major sell-off in Hess shares that drops them significantly below Chevron’s price.

When the deal was originally announced in late October, Chevron said it had agreed to acquire all of Hess’ outstanding shares in an all-stock transaction valued at $53 billion, which amounted to $171 per share. Thus, it’s understandable that many analysts would set their price targets around the $171 level.

However, what complicates the matter is the fact that this is an all-stock deal. In fact, the terms of the deal have Hess shareholders receiving 1.025 Chevron shares for every Hess share they own. Thus, wherever Chevron’s share price goes, Hess’ price should follow because shareholders won’t actually receive $171 per share as the original offer stated.

They’ll receive just slightly more than one Chevron share for every Hess share, making these two stocks essentially equal for now.

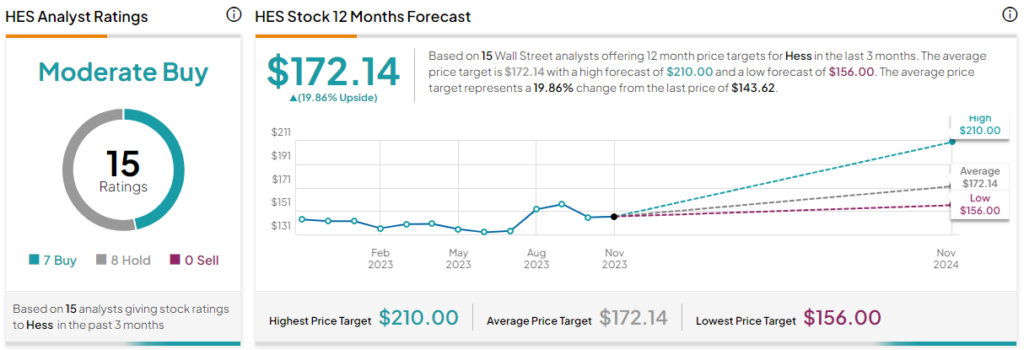

What is the Price Target for HES Stock?

Hess has a Moderate Buy consensus rating based on seven Buys, eight Holds, and zero Sell ratings assigned over the last three months. At $172.14, the average Hess stock price target implies upside potential of 19.9%.

NextEra Energy (NYSE:NEE)

NextEra Energy is an interesting stock because it sits at the intersection of clean energy and the utility sector, combining the benefits of a green-energy stock with the stability of a utility stock. A closer look suggests a bullish view might be appropriate due to the company’s growing profitability, plunging valuation, and attractive dividend.

At a price-to-earnings (P/E) ratio of 14.4, NextEra Energy is trading at a steep discount to its mean P/E of 42.4 since February 2019. For comparison, the renewable energy industry is trading at a P/E of 44.7.

While the P/E ratio is often an excellent way to value companies, one other multiple commonly used for energy and utility companies is the enterprise-value-to-EBITDA (EV/EBITDA) ratio. This ratio compares a company’s total value to its overall profitability and financial performance, with EBITDA meaning “earnings before interest taxes, depreciation, and amortization.”

This ratio reduces the amount of volatility in this stock’s valuation, as NextEra is currently trading at an EV/EBITDA multiple of 12.8 versus its mean ratio of 22.9 since February 2019. In short, the company’s valuation has plummeted since September 2022, when it was trading at an EV/EBITDA multiple of around 37.3.

However, NextEra Energy’s profitability has been growing steadily, as evidenced by its net income margin of 28% over the last 12 months, up from 20% in 2022, 21% in 2021, and 16% in 2020. Clearly, this company isn’t going anywhere, and it’s been sharing its profits with shareholders.

Like many utility stocks, NextEra Energy also pays a dividend with a current yield of 3.3%, which is quite attractive versus the sector average of 2.992%. The company has also boosted its dividend annually for the last 10 straight years, which is another mark of a strong dividend stock.

Based on the positive trends discussed above, the year-to-date selloff in NextEra shares is likely due to the industry-wide selloff in clean-energy stocks rather than there being anything specifically wrong with this company. Notably, the Nasdaq Clean Edge Green Energy Index is down about 23% year-to-date.

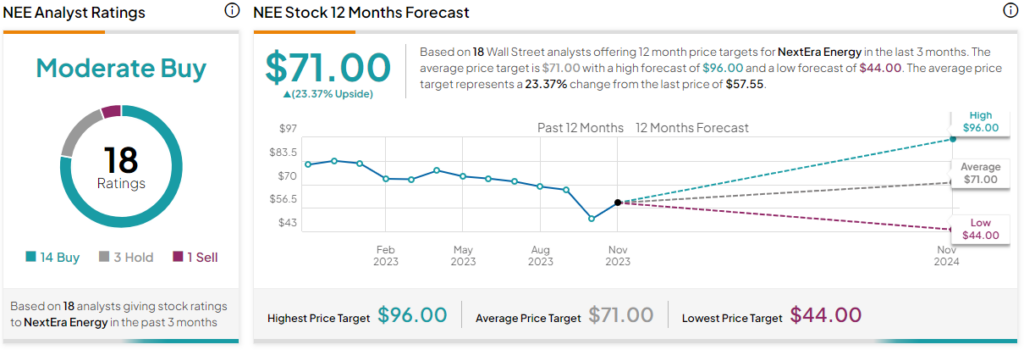

What is the Price Target for NEE Stock?

NextEra Energy has a Moderate Buy consensus rating based on 14 Buys, three Holds, and one Sell rating assigned over the last three months. At $71, the average NextEra Energy stock price target implies upside potential of 23.4%.

Conclusion: Neutral on HES, Bullish on NEE

Although Hess and NextEra Energy operate in the same industries, different valuation methods are needed for each. For Hess, the pending acquisition essentially pegs its shares to Chevron shares, making judging its valuation simple. That deal is expected to close sometime in the first half of 2024.

On the other hand, NextEra Energy’s key valuation multiple, the EV/EBITDA ratio, shows that its valuation has been plummeting over the last year despite its growing profitability. Thus, NextEra’s valuation should revert to the mean at some point. In the meantime, its growing dividend payout, which is relatively high for its industry, makes it a worthy addition to a dividend stock portfolio.