Hess Corporation (HES) is doing really well as an energy company. With the demand for oil and gas on the upswing, Hess is seeing a massive profitability increase, leading to a stellar set of second-quarter results. It is also one of the few companies up substantially in the year thus far, by double digits. Tailwinds in the energy industry set HES up for a solid rest of the year. I am bullish on HES stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Hess Corporation is a global energy company with an exploration, production, refining, and marketing focus. It also produces natural gas & gasoline, and other refined products. Hess also has a significant presence in the retail market through its Hess Express convenience stores.

In addition to its upstream and downstream businesses, it also has a strong portfolio of midstream assets, including crude oil pipelines and terminals, gas processing plants, and power generation facilities.

The energy industry is changing daily, and it’s impossible to know what the future holds. With changes in both production and demand, many risks cannot be ruled out – including a recessionary economic downturn which could lead people away from buying petroleum products; an event such as COVID-19 can also cause significant disruption to supply chains if they’re not properly prepared beforehand (something no one wants). Also, technology innovations may create new challenges altogether.

Overall, though, Hess appears to be a great investment because it is a well-run company with a diversified portfolio of assets. The company has an enviable track record of generating lots of cash and has a strong balance sheet.

Hess’ Earnings Demonstrate High Growth

Hess Corporation reported earnings on July 27 and delighted investors. Shares of the global independent energy company shot up after revenues increased 88% year-over-year to $2.89 billion. Net income also grew significantly to $667 million from the $73 million loss in the same quarter last year.

The company beat analyst expectations, posting an EPS of $2.15, which narrowly beat analyst estimates of $2.14. Looking ahead, analysts are estimating EPS of $2.73 for the third quarter.

A few months ago, oil prices began to increase, almost doubling from around the $60 per barrel mark in just a year. It’s clear that oil demand has increased and should continue to do so. We’ve already reached the 100 million barrel per day level that we were at before COVID-19, and even though there have been occasional drops in price, it’s still around $90 per barrel.

It is expected that this crisis caused by the Russian invasion of Ukraine will not end soon. For many countries, a global gas shortage has been an ongoing problem. In some cases, prices have gone up eightfold since there aren’t enough natural resources available to supply the demand. However, energy companies are making money off this situation. Hess is no exception to this broader trend.

Hess’ Production is Soaring

The energy company is increasing production. It has brought 50 wells online during the second quarter. In comparison, there were only 32 wells that came online in the first half of this year. Hess expects its production rates in the Bakken to steadily increase to an estimated 200,000 barrels of oil equivalent per day (boe/d) by 2024.

The energy company also recently discovered two offshore wells in Guyana. This adds to the Stabroek Block, roughly 120 miles offshore Guyana, which is estimated to have 11 billion barrels of oil equivalent.

Such developments will help ensure HESS manages to attain its financial goals. The forecast for Hess Corporation is that, by 2026, its annual free cash flow (FCF) yield will be at 10%. This means the compound annual growth rate, or CAGR, will be 25% in the five-year period from 2021 to 2026.

Wall Street’s Take on HES Stock

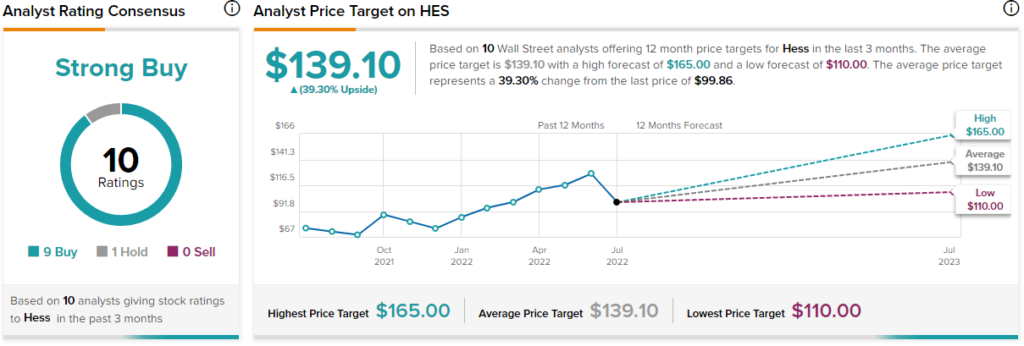

HES has a Strong Buy consensus rating on the back of nine Buys and one Hold. The average HES stock price target for the energy company is $139.10, implying upside potential of 39.3%.

The Bottom Line: Hess is a Solid Energy Play

Hess Corporation looks like it could be a great energy stock to invest in. The company has a strong presence in offshore and onshore drilling, and its Hess Infrastructure Partners subsidiary owns and operates pipelines and terminals. Hess also has a growing business in renewable energy.

The stock has performed well in recent years, and the company is expected to continue to grow at a healthy pace. With the global energy crisis unlikely to stem anytime soon, it’s a good time to consider HES stock.