Ahead of the highly anticipated launch of the iPhone 14 on September 7, three Wall Street analysts reiterated a Buy rating on Apple Inc. (NASDAQ:AAPL) on August 29. This shows that the Street is impressed with CEO Tim Cook’s endeavor in achieving the target launch date despite supply chain issues and COVID-19-related shutdowns. The analysts who have recently reiterated a Buy rating on Apple stock are David Vogt of UBS (NYSE:UBS), Samik Chatterjee of J.P. Morgan (NYSE:JPM), and Daniel Ives of Wedbush.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

While Vogt did not provide a price target, Chatterjee has furnished a price target of $200 (24% upside potential) on AAPL stock. Further, with a price forecast of $220, Ives sees a 36.3% upside for the stock.

Commenting on the iPhone 14 launch, which is expected next week, Ives said that the tech giant already has an initial order of 90 million units, which speaks volumes about the strong underlying demand for iPhones, as of the one billion iPhone users across the world, 240 million “have not upgraded their phones in over 3.5 years.”

Ives expects the base model’s price to remain unchanged, while the iPhone 14 Pro and Pro Max are likely to cost $100 more. Specification-wise, the new model will feature a 48-megapixel camera, A16 chip, and enhanced storage.

Further, the California-based company plans to launch an upgraded version of the iPhone 14 over the next six to nine months and expects a minimum demand of 220 million units in the next fiscal year, according to the Wedbush analyst.

Meanwhile, Ives anticipates Apple’s services business to total around $90 billion in the Fiscal Year 2023 and surpass $100 billion in the Fiscal Year 2024. “On a growth and EBITDA basis, we believe Apple’s services business is worth alone north of $1 trillion which coupled with the flagship hardware business makes the risk/reward very compelling at current levels,” the analyst added.

Is Apple Stock a Buy or Sell?

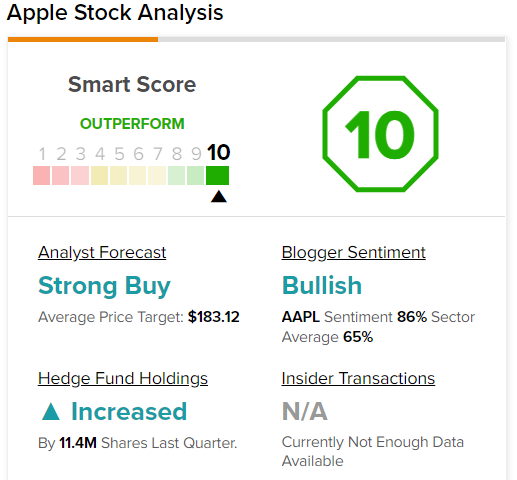

On TipRanks, Apple stock has a Strong Buy consensus rating based on 22 Buys, four Holds, and one Sell. AAPL’s average stock forecast of $183.12 implies 13.5% upside potential.

Further, Apple stock scores a “Perfect 10” on TipRanks’ Smart Score rating system, suggesting that it has strong potential to outperform market expectations. Hedge funds and bloggers are also positive about the stock. TipRanks data shows that 86% of bloggers are Bullish on AAPL stock, compared to the sector average of 65%, and hedge funds have increased their stakes in the company by 11.4 million shares in the last quarter.

Read full Disclosure