The SPDR S&P 500 ETF Trust (SPY) closely tracks the S&P 500 Index (SPX) and allows an investor to hold a diversified portfolio of over 500 large-cap U.S. stocks without having to buy them individually. The SPY ETF stock has advanced over 17.3% year-to-date, outperforming the S&P 500’s rally of 16.4%. Interestingly, the SPY ETF’s Outperform Smart Score on TipRanks and analysts’ average price target suggest further upside potential from the current level.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

What Makes SPY ETF Attractive?

One of the major factors worth considering is the SPY ETF’s considerably low fees. It has an expense ratio (the cost of managing the ETF) of 0.09%, which makes it an attractive investment.

Remarkably, the ETF has delivered an average annualized return of 12.1% in the past decade as of March 2023. Moreover, SPY pays a 1.47% annual dividend yield, which enhances investors’ returns over the long run.

Lastly, the diversification offered by the ETF allows investors convenient access to the stock market. Also, it eliminates the need for individual stock research, analysis, and portfolio management.

Favorable Smart Score

According to TipRanks’ Smart Score System, SPY has a Smart Score of 8 out of 10, which indicates that the ETF could outperform the broader market over the long term. It is worth highlighting that more than 50% of the holdings boast an Outperform Smart Score (i.e., a score of 8 or higher).

The stock has a Positive signal from retail investors. Our data shows that about 8.3% of TipRank’s retail investors changed their holdings of the SPY in the last 30 days. Moreover, The SPY ETF enjoys bullish blogger sentiment and Positive news sentiment on TipRanks.

Is SPY Stock a Buy, According to Analysts?

SPY has a Moderate Buy consensus rating on TipRanks. Further, the average SPY stock price target of $482.85 implies 8.9% upside potential. Among the 6,340 analysts providing ratings on its 504 holdings, 59.67% have given a Buy rating, 34.94% have assigned a Hold rating, and 5.39% have given a Sell rating.

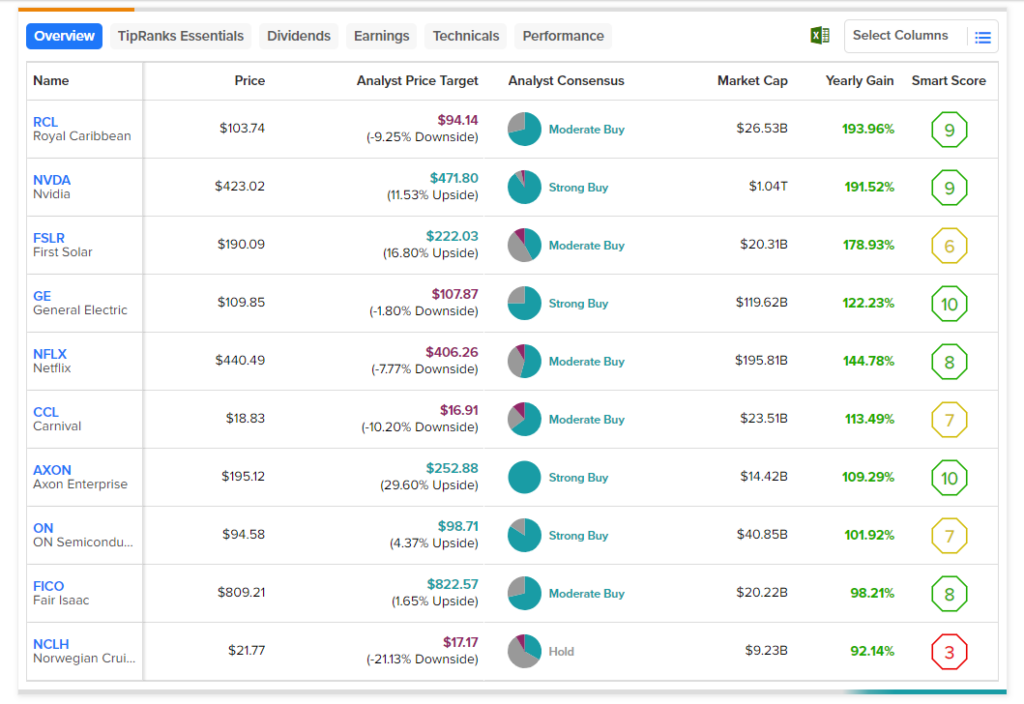

Several of the SPY ETF’s holdings have witnessed strong returns over the past year. Among these, the following 10 stocks are key winners, as they gained over 90%. Importantly, analysts see further upside potential in most of these stocks.

- Royal Caribbean Cruises (RCL)

- Nvidia Corporation (NVDA)

- First Solar (FSLR)

- Netflix, Inc. (NFLX)

- General Electric (GE)

- Carnival Corporation (CCL)

- Axon Enterprise, Inc. (AXON)

- ON Semiconductor Corporation (ON)

- Fair Isaac Corporation (FICO)

- Norwegian Cruise Line (NCLH)