These might look like dangerous days for social media companies, and Pinterest (NYSE:PINS) is no exception. Or at least, it probably shouldn’t be. So why is it up in today’s trading session? The answer is surprisingly simple: an upgrade at Goldman Sachs. Analyst Eric Sheridan hiked Pinterest from “neutral” to Buy, believing that Pinterest could not only maintain its current growth but also pull in further advertiser dollars, despite issues in the macroeconomic environment.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Pinterest is riding high on its new upgrade, but is this sustainable? I’m less certain this is the case. In fact, I’m neutral on Pinterest and most social media. There are paths to victory for Pinterest and for social media in general. However, they depend on the successful movement of a lot of moving parts, and that’s not a particularly likely outcome.

Investor Sentiment is Fairly Upbeat for PINS Stock

While social media may have a limited value proposition in times like these, you wouldn’t know it by looking at the investor sentiment metrics. Currently, Pinterest has a Perfect 10 Smart Score on TipRanks. That’s the highest level of “outperform”. Maxing out the scale in such a fashion suggests that Pinterest is as likely as it gets to do better than the broader market.

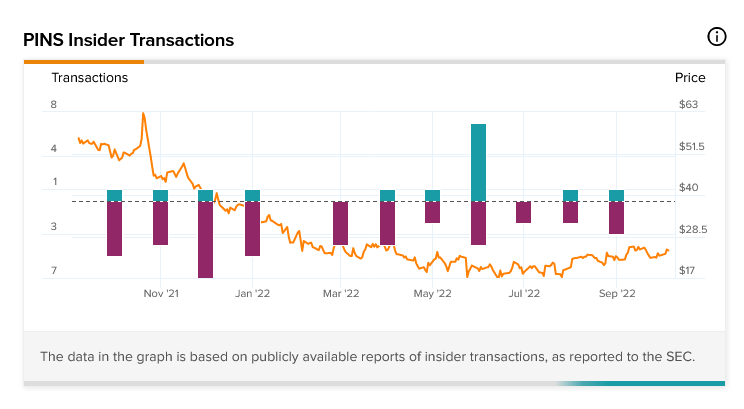

Insider trading at Pinterest suggests a pretty clear agreement with that notion, at least by some measures. Informative buys are heavily leading informative sales, as insiders bought $5 million in shares in the past three months. This effort was spearheaded by the company’s own CEO and director William Ready, who bought $4.998 million himself.

The aggregate tells a somewhat less emphatic story, however. There has certainly been buying throughout the last 12 months on Pinterest, but it’s drowned out by rather emphatic selling. In the last three recorded months, there were just two purchases from insiders. Insiders sold stock on seven occasions.

Meanwhile, in the last 12 months, the ratio of purchases to sales is 15 buys to 42 sales. While the raw numbers provided suggest a clear buying interest, there are quite a few Pinterest insiders who are jumping ship and cashing out.

Bad Environment, but Good Potential for PINS Stock

Here’s the bad news for Pinterest in a nutshell: this is pretty much one of the worst environments around for any industry that depends on advertising. Yes, some advertising must take place. It’s part of the nature of marketing that anyone who doesn’t advertise will go unnoticed.

Those who fail to do so will be ignored by customers altogether. Established brands will quietly slip away until shoppers wonder about whatever happened to “insert brand name here”. Less-established brands, meanwhile, will be relegated to “wasn’t there a thing called this” status.

However, the law of diminishing returns in advertising is valid, particularly in bad macroeconomic conditions. Eventually, advertisers overspend and get less for their dollar because the maximum point of effectiveness is reached.

With customers reining in their spending, that maximum point arrives much sooner. Customers look at even the most effective ad, then impulsively open their wallets…only to find them empty. What value does that ad have now?

For social media, a field that depends on advertising, difficult macroeconomic conditions mean a decline in overall operations. Worse, there’s a potential that users will regard social media as a bigger problem than help.

A Pew Research study from 2020 revealed that a majority of Americans surveyed believe that social media had a mostly negative impact on the state of the U.S.

However, if social media does have a potentially negative impact, and will likely suffer from declining advertising, then how can it pull ahead? Its best bet is probably to focus its greatest skill, marketing, directly on itself.

A report from Convince & Convert revealed that social media can cast itself as a way to improve customers’ ability to make discriminating buying decisions. In a down economy, discriminating purchases become crucial.

Customers may be less willing to spend, but few stop spending altogether. Feeling better about their purchases, therefore, becomes more important than ever.

Better yet, social media can become a means for customers to make money. In an environment where every dollar counts, having more dollars counts for more. Thus, those who turn to Pinterest and others to make money improve their position. That means more eyes on Pinterest and more value for advertisers.

Of course, Pinterest in particular can also market itself as a means to save money. Pinterest is swimming in recipes for the at-home cook using just about any appliance or food around. A Google search for “cheap recipes” on Pinterest revealed around 477,000 results.

Top of the list: “740 best cheap meals ideas” and “900+ best budget recipes ideas.” That’s tailor-made for a family fighting inflation at the grocery store.

Then there’s the matter of Pinterest’s own fundamentals. As Goldman Sachs pointed out, the company’s user growth trends and engagement are on the rise, both over the short-term and the medium-term.

That’s going to make Pinterest more attractive to advertisers. Advertisers want the most impact for their advertising dollars. They’re likely to get that impact here.

Is PINS a Good Stock to Buy?

Turning to Wall Street, Pinterest has a Moderate Buy consensus rating. That’s based on eight Buys and 13 Holds assigned in the past three months. The average Pinterest price target of $26.32 implies 1.5% upside potential. Analyst price targets range from a low of $18 per share to a high of $35 per share.

Conclusion: Not Much Upside Potential for PINS Stock

The good news is that Pinterest does indeed have the potential to survive in the long run. It may even come out ahead. However, Pinterest isn’t giving investors much of a buy-in point. The current upside is down in the low-single-digits range.

Large-scale wins here will require sudden and explosive upward trends. Those aren’t likely to hit in an environment like the one we’re in now, especially not for established firms.

That, ultimately, is why I’m neutral on Pinterest. There’s no good buy-in point. Most of the upward potential is spent, but for those who already have Pinterest shares, it’s worth hanging on to them.

Pinterest might be one of the most likely social media venues to come out ahead after the latest downturn passes by. It’s got a unique value proposition. While it won’t drive explosive upward growth, it will help ensure the company survives the downturn.