Oracle (NYSE:ORCL) is scheduled to report its second-quarter Fiscal 2023 results on December 12, after the market closes. The company’s top line is expected to have benefitted from the strong momentum in the cloud services market. Further, the Cerner acquisition, completed on June 8, 2022, is anticipated to have contributed to Oracle’s healthcare-related revenues.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The company’s efforts to increase cloud services and license support (about 84% of total revenue) offerings are likely to have supported performance. As per IDC’s Worldwide Semiannual Software Tracker, the software industry is benefitting from the global “push for more automation and digitalization to save costs and improve supply chains” and is unlikely to be impacted by current macroeconomic concerns.

The Street expects Oracle to post earnings of $1.17 per share in Q2, lower than its prior-year period’s figure of $1.21 per share. Meanwhile, revenue is pegged at $12 billion, representing a year-over-year jump of 15.4%.

In the Q1 earnings call, management said that it expects second-quarter revenues to rise 21% to 23% on a constant currency basis. Also, cloud revenues are likely to increase from 46% to 50%. Furthermore, adjusted EPS is expected to fall by 1% to 5%.

Jefferies analyst Brent Thill finds ORCL to be an exception in the software market as it continues to keep a “bullish outlook amid a deteriorating IT environment.” Also, the analyst is of the opinion that ORCL stock has the potential to benefit from its growth efforts.

Ahead of the Q2 earnings release, Thill maintained a Hold rating on Oracle but raised the price target to $85 from $75.

Should You Buy ORCL Stock?

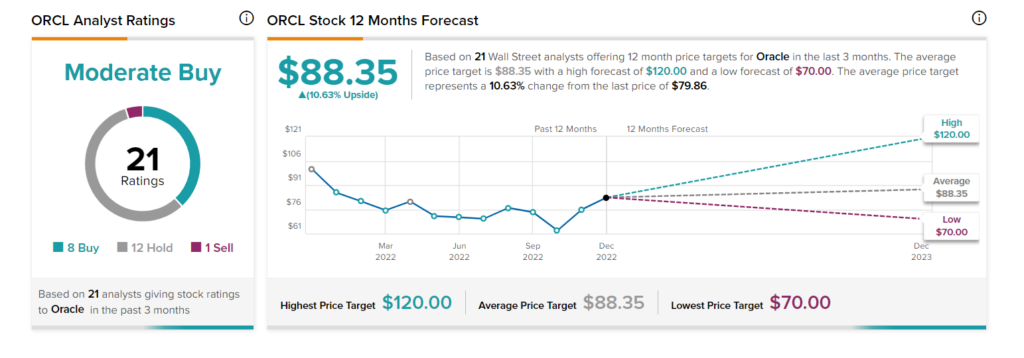

Overall, Wall Street is cautiously optimistic about Oracle. The stock has a Moderate Sell consensus rating based on eight Buys, 12 Holds, and one Sell. The average ORCL stock price target of $88.35 implies 10.6% upside potential. The stock has declined nearly 8% year-to-date.

Closing Note

During the earnings call, investors are likely to keep a close watch on Oracle’s update on its efforts to expand multi-cloud solutions.

Moreover, at its recent investor day, the company provided bullish long-term financial targets, including hitting revenue of $65 billion in 2026. Also, Oracle is among the several technology companies to have been awarded cloud computing contracts by the Pentagon. Given the encouraging news received ahead of results and the company’s strong performance in the Cloud business, it looks like there is room for upside in the near term.