The SPDR S&P 500 ETF Trust (SPY) is an exchange-traded fund that aims to replicate the performance of the S&P 500 Index (SPX). It has several features that make it an attractive investment.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For one, by investing in SPY, one can gain exposure to a diverse range of sectors and companies. For another, the SPY ETF boasts a favorable Outperform Smart Score on TipRanks, signaling positive performance signals. Additionally, the analysts’ average price target suggests there is potential for further growth.

What Makes SPY ETF Attractive?

One of the key attractive facets of the SPY ETF is that it’s a highly liquid investment. Investors can easily buy or sell the ETF, making it appealing for any investment horizon.

Moreover, the ETF has delivered solid returns over the long term, with an increase of 69.7% over the past five years, making SPY a popular choice for those seeking market growth. Also, it has a low expense ratio (the cost of managing the ETF) of 0.09%, which draws investors to this ETF.

Lastly, the diversification offered by the ETF allows investors convenient access to the stock market. With 505 holdings, a hefty 40% are in the Technology sector, but SPY’s holdings also include stocks from nine other sectors.

Outperform Smart Score

As per the TipRanks’ Smart Score System, SPY has a Smart Score of 8 out of 10, which indicates that the ETF could beat the broader market over the long term. According to our data, retail investors have displayed a Very Positive signal towards the stock. About 14.4% of TipRanks’ retail investors have increased their holdings of the SPY ETF in the last 30 days.

Furthermore, the SPY ETF enjoys bullish sentiment from bloggers and Positive news sentiment on TipRanks.

Is SPY a Good Buy Right Now?

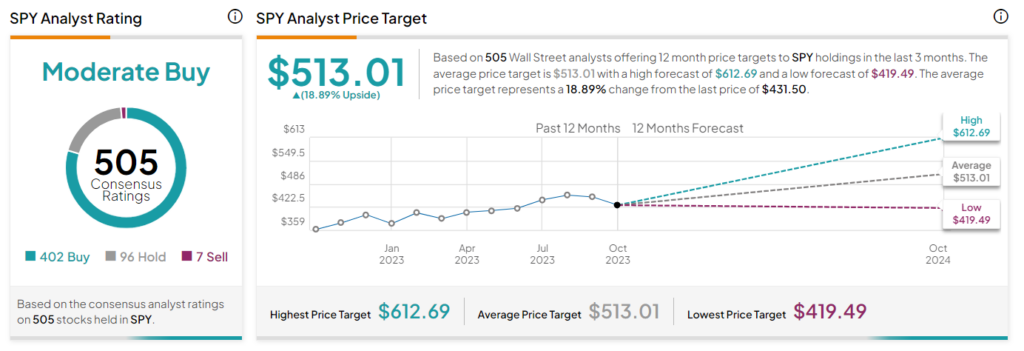

SPY has a Moderate Buy consensus rating on TipRanks. Further, the average SPY stock price target of $513.01, based on the weighted consensus analyst ratings on its 505 holdings, implies an 18.8% upside potential.

Top 10 Performing Stocks in SPY ETF

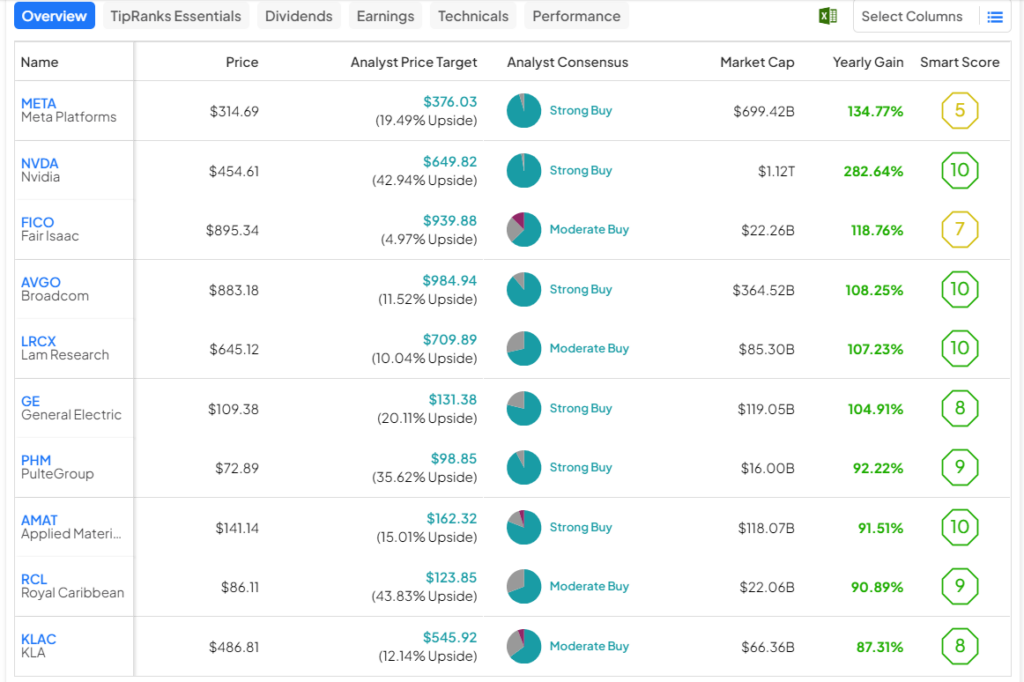

Some of the stocks within the SPY ETF have delivered impressive returns over the past year. Here is a list of the top 10 stocks that stand out as notable winners with gains exceeding 80%. Importantly, analysts believe there is further upside potential for all of them.

- Nvidia Corporation (NVDA)

- Meta Platforms, Inc. (META)

- Fair Isaac Corporation (FICO)

- Broadcom Inc. (AVGO)

- Lam Research Corp. (LRCX)

- General Electric (GE)

- Pultegroup (PHM)

- Applied Materials, Inc. (AMAT)

- Royal Caribbean Cruises (RCL)

- Kla Corporation (KLAC)

Ending Thoughts

The SPDR S&P 500 ETF Trust is a smart investment choice for those seeking diversified exposure to the U.S. stock market. Its simplicity, liquidity, and historical performance make it a strong choice for both novice and experienced investors.