Robinhood (HOOD) is slashing its headcount by 23%, and its second-quarter numbers fell short of expectations. The online trading platform’s IPO last year was the talk of the town, but fortunes can change fast on Wall Street. Shares are trading at $9.2 levels, which is a far cry from its 52-week high of $85 and short interest in the stock is running high at around 9.3%.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Moreover, monthly active users dropped by 1.9 million to 14 million in June as investors continued to shy away from trading. This figure was 21.3 million a year ago. Impressively, our website traffic tool could have helped investors in the stock get a glimpse of this decline ahead of the results.

HOOD’s Website Data Reflects Poor Show

Data shows the total number of website visits to Robinhood globally and across devices dropped by around 23% to 31.91 million in Q2 as compared to Q1. Concurrently, shares have dropped from $14 to the current $9 level during this period. This change is more pronounced than the total website visits of 76.6 million and the mobile visitor growth of 73.4% in the year-ago period.

Learn how Website Traffic can help you research your favorite stocks.

Dismal Q2 Numbers

Net revenue dropped 43.7% over the prior year to $318 million, missing estimates by $3.5 million. The net loss per share at $0.34 came in wider than consensus by $0.02.

The online broker is seeing dwindling metrics as retail trading activity drops amid a broader market slump. During the quarter, options and equity transaction-based revenue dropped 11% and 19%, respectively, as compared to the first quarter.

HOOD Cuts Headcount

Robinhood CFO, Jason Warnick, commented, “We managed our costs down 5%, leading to a $97 million sequential improvement in net loss and a $63 million improvement in Adjusted EBITDA. While the decision to make an additional reduction in force was a difficult one, we believe that it was the right decision and positions us to deliver on our mission of democratizing finance for all.”

This cost-cutting push has meant a headcount reduction of 23%, on top of the 9% reduction announced earlier in April this year. This impact is expected to be felt heavily on its operations, marketing, and program management functions.

Robinhood CEO and Co-founder, Vlad Tenev, noted the 9% reduction in April “did not go far enough and we are operating with more staffing than appropriate. As CEO, I approved and took responsibility for our ambitious staffing trajectory- this is on me.”

Takeover Talk

As the company focuses on streamlining costs, the possibility of a potential takeover remains. FTX’s Sam Bankman Fried has picked up a sizable chunk of Robinhood shares and the possible takeover chatter remains despite Robinhood’s $6 billion strong cash pile. Nonetheless, a possible takeover may be a daunting task for any suitor as a major part of the company’s voting control remains with Vlad Tenev and Robinhood Co-founder Baiju Bhatt.

Crypto Failure

Finally, while Robinhood is also focusing on new product launches to diversify revenue streams, other bumps in the journey remain. Its crypto vertical was fined $30 million in New York for falling short of compliance with money laundering and cybersecurity rules.

The superintendent of New York’s Department of Financial Services, Adrienne Harris, noted, “Robinhood Crypto failed to invest the proper resources and attention to develop and maintain a culture of compliance-a failure that resulted in significant violations of the Department’s anti-money laundering and cybersecurity regulations.”

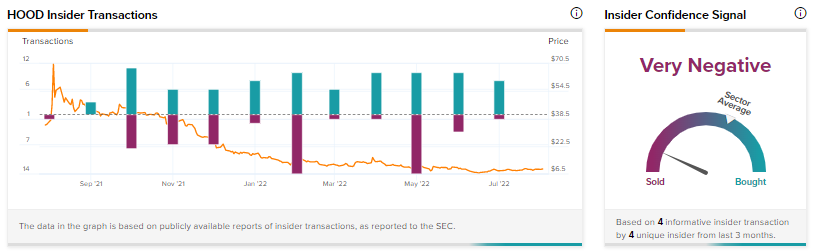

Negative Insider Actions

Our data dive at Tipranks also shows insiders have been dumping the stock. This also includes Jason Warnick, who sold $180,000 worth of Robinhood shares last month.

Closing Note

The Street has a Hold consensus rating on the stock with a price target of $11.28. A beta of 1.6, a return on equity of 67.31%, and a Tipranks smart score of 1 suggest the stock may underperform the broader markets as a host of concerns overhang in the air.

How Robinhood’s focus on costs and new product launches pans out remains to be seen as market dynamics continue to remain challenging.

Read full Disclosure