Helen of Troy Limited (NASDAQ:HELE) is scheduled to report its second-quarter Fiscal 2023 results on October 5, before the market opens.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Helen of Troy manufactures and distributes various consumer, personal care and household products. It operates through the following segments: Housewares, Healthcare and Home, and Beauty. HELE stock has lost more than half of its market capitalization over the past year.

For Q2, the Street expects HELE to report adjusted earnings of $2.19 per share, much lower than the prior-year period’s EPS of $2.65 per share.

Meanwhile, the consensus revenue estimate is pegged at $519.10 million, implying year-over-year growth of 9.2%.

In the prior quarter’s earnings release, the company trimmed its annual guidance for sales and EPS to reflect an uncertain macro outlook and the impact of rising inflation and interest rates.

The company expects FY2023 sales to come in at around $2.15-$2.20 billion compared to the prior outlook of $2.38-$2.42 billion. Meanwhile, it anticipates adjusted EPS between $9.85-$10.35 versus the $12.73-$13.03 guided earlier.

The company projects its Health & Wellness and Beauty segments to post full-year net sales decline in the range of 8% to 10% and 5% to 7%, respectively. In contrast, it anticipates the net sales of its Home & Outdoor segment to grow in the range of 9% to 11%.

What are Analysts’ Forecasts for Helen of Troy Stock?

As per TipRanks, analysts are cautiously optimistic about Helen Of Troy stock and have a Moderate Buy consensus rating, which is based on one Buy and two Holds. HELE stock’s average price forecast of $190.50 implies a whopping 92.04% upside potential.

However, HELE stock has a Negative signal from hedge fund managers, who sold 53,200 shares during the last quarter.

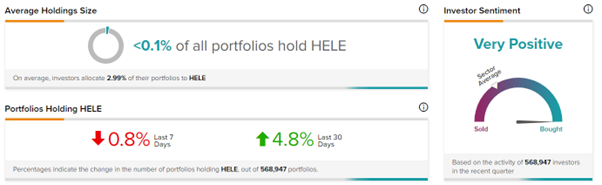

On the positive side, TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on Helen Of Troy stock, with 4.8% of investors on TipRanks increasing their exposure to HELE stock over the past 30 days.