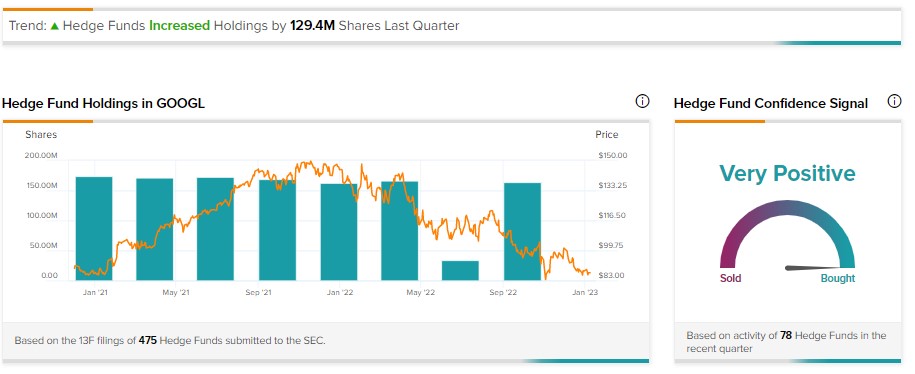

Shares of big tech companies lost substantial value in the past year due to macro challenges (high inflation and rising interest rates). While inflation has moderated a bit, economic uncertainty and the Fed’s hawkish stance continue to pose challenges. Despite headwinds, hedge fund managers have accumulated shares of Alphabet (NASDAQ:GOOGL), Microsoft (NASDAQ:MSFT), Amazon (NASDAQ:AMZN), Nvidia (NASDAQ:NVDA), and Apple (NASDAQ:AAPL) in the last three months.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Using TipRanks’ Hedge Fund Trading Activity tool (it provides hedge fund signals based on data from Form 13-F), let’s find out which of these big tech stocks hedge funds bought in bulk.

Big Tech: Which Stock Did Hedge Funds Buy the Most?

Our tool shows that hedge funds bought more GOOGL stock than any other stock in the last three months. Per the tool, hedge funds bought 129.4M shares of GOOGL. Several hedge fund managers increased their holdings in Google’s stock. The list includes Bridgewater Associates’ Ray Dalio, Caxton Associates LP’s Andrew Law, and PYA Waltman Capital, LLC’s J. William Waltman, Jr.

Besides for GOOGL stock, hedge funds acquired 33.2M shares of Microsoft. Further, they bought 26.3M shares of Amazon.

During the same period, hedge funds bought 9.6M shares of Nvidia. Furthermore, they increased their exposure in Apple stock by adding 671.9K shares.

While hedge funds bought GOOGL stock in bulk, should investors follow?

Is GOOGL a Buy, Sell, or Hold?

Along with hedge fund managers, GOOGL stock also has positive signals from Wall Street analysts. It has received 32 unanimous Buy recommendations for a Strong Buy consensus rating on TipRanks. Moreover, these analysts’ average price target of $126.09 implies 44.37% upside potential.

Tigress Financial analyst Ivan Feinseth sees the recent pullback in GOOGL stock as a “major buying opportunity.”

Feinseth is upbeat about the ongoing strength in GOOGL’s Cloud and Search segments. Moreover, he expects the company to benefit from its investments in AI (Artificial Intelligence).

Overall, with positive indicators from hedge funds and analysts, GOOGL stock has a maximum Smart Score of “Perfect 10.” (Stay abreast of the best that TipRanks’ Smart Score has to offer.)

Bottom Line

Hedge fund managers are known to deliver market-beating returns. Thus, retail investors could benefit from following their trades. As for GOOGL stock, positive signals from hedge funds and analysts and the momentum in its core business make it an attractive long-term play.

Find out which stock the biggest hedge fund managers are buying right now.