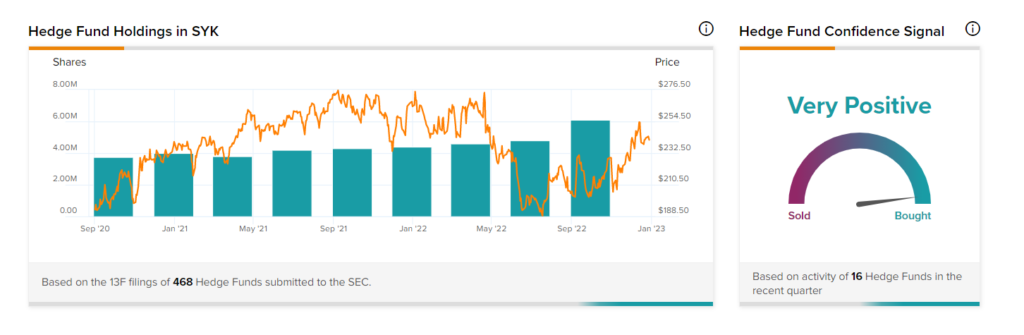

TipRanks provides several tools that can support investors in making informed investment decisions. One such tool is the Hedge Fund Trading Activity tool, which gives insights into the sentiments of ace hedge fund managers based on their latest investments in the stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

One of the healthcare sector stocks that hedge funds are currently optimistic about is Stryker Corporation (NYSE:SYK). The Michigan-based company provides medical technology products and services.

According to the tool, hedge funds bought 1.3 million SYK shares last quarter. Six hedge fund managers added the stock to their portfolios, including Ken Fisher of Fisher Asset Management and Ric Dillon of Diamond Hill Capital Management. Overall, Stryker has a very positive Hedge Fund Confidence Signal at present.

Why Are Hedge Funds Buying SYK Stock?

High demand for medical devices along with the launch of new products is likely to keep supporting Stryker’s top-line growth. According to Fortune Business Insights, the global medical devices market is expected to grow at a compound annual growth rate of 5.5% in the 2022-2029 period.

Furthermore, in its third-quarter earnings report, the management was optimistic about its Fiscal 2023 performance despite persistent inflationary and supply chain headwinds. The company expects its higher pricing and cost-reduction measures to drive earnings next year.

Also, the company’s capital deployment activities are impressive. Stryker has been increasing its quarterly common stock dividend every year since 2009, with the latest hike of 7.9% announced earlier this month.

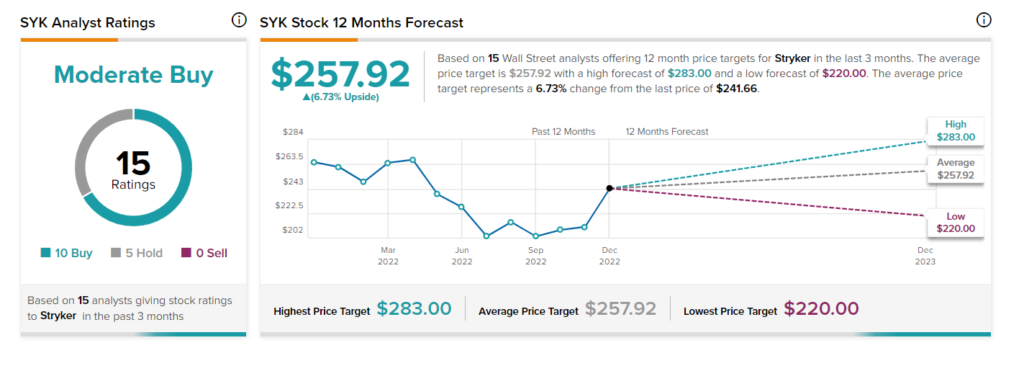

Last week, BTIG analyst Ryan Zimmerman reiterated a Buy rating on SYK and raised the price target to $268 from $232. The analyst expects Stryker’s shares to swing up and down in the first half of 2023 as the company “works through continued supply chain challenges.”

Should You Buy SYK Stock?

Wall Street is cautiously optimistic about Stryker’s prospects. The stock has received 10 Buy and five Hold recommendations for a Moderate Buy rating consensus. The average price target of $257.92 implies 6.7% upside potential.

Ending Thoughts

Sound growth prospects for the medical devices market and the company’s efforts to launch new products might support Stryker’s performance in the near future.

Find out which stock the biggest hedge fund managers are buying right now.

Special end-of-year offer: Access TipRanks Premium tools for an all-time low price! Click to learn more.