The iShares Core High Dividend ETF (NYSEARCA:HDV) and the Schwab U.S. Dividend Equity ETF (NYSEARCA:SCHD) are two popular dividend ETFs from blue-chip sponsors. Both are cost-effective options with low expense ratios, feature portfolios of well-known dividend stocks, and have dividend yields ranging from 3.5% to 3.7%. In this article, we’ll go over what separates these ETFs and which is the better choice for dividend investors.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

What Is the HDV ETF’s Strategy?

According to iShares, HDV invests in “an index composed of relatively high dividend paying U.S. equities.”

The fund invests in “established, high-quality U.S. companies” and gives investors “access to 75 dividend-paying domestic stocks that have been screened for financial health.”

What Is the SCHD ETF’s Strategy?

Meanwhile, according to Charles Schwab, SCHD invests in an “index focused on the quality and sustainability of dividends.” SCHD “invests in stocks selected for fundamental strength relative to their peers, based on financial ratios.”

Portfolio Analysis

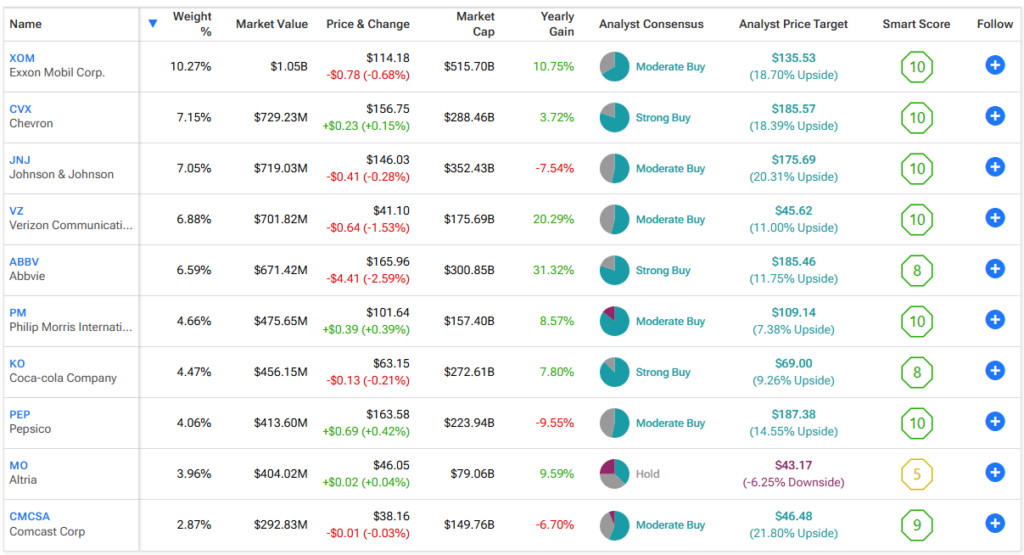

HDV holds 75 stocks, and its top 10 holdings make up 57.9% of its portfolio, so the fund is a bit concentrated. Below, you’ll find an overview of HDV’s top 10 holdings using TipRanks’ holdings tool.

HDV’s top holdings feature a strong assortment of Smart Scores. The Smart Score is a quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market key factors. A score of 8 or above is equivalent to an Outperform rating. An impressive nine out of HDV’s top 10 holdings receive Outperform-equivalent Smart Scores of 8 or higher, and its four largest holdings, ExxonMobil (NYSE:XOM), Chevron (NYSE:CVX), Johnson & Johnson (NYSE:JNJ), and Verizon (NYSE:VZ) boast “Perfect 10” Smart Scores.

HDV’s holdings also collectively feature attractive valuations. According to iShares, they sport an average price-to-earnings ratio of 16.4, which is just two-thirds the valuation of the broader market, as the S&P 500 (SPX) currently trades for 24 times earnings.

Meanwhile, SCHD is a bit more diversified and a bit less concentrated than HDV. It holds 100 stocks, and its top 10 holdings account for 40% of its assets. Below, you’ll find an overview of SCHD’s top 10 holdings using TipRanks’ holdings tool.

Seven of SCHD’s top 10 holdings feature Outperform-equivalent Smart Scores, which is a respectable total, but HDV has the edge in this area.

HDV and SCHD share a handful of top 10 holdings in common, including Verizon, Chevron, AbbVie (NYSE:ABBV) and Coca Cola (NYSE:KO). The valuation of SCHD’s holdings is also remarkably similar to those of HDV’s, as its portfolio sports a price-to-earnings ratio of 16.1 (as of May 31), so both funds offer a real discount to the broader market.

HDV’s portfolio features a higher number of stocks with Outperform-equivalent Smart Scores, but SCHD is slightly more diversified and slightly less concentrated. Essentially, these portfolios are fairly similar and sport remarkably similar valuations.

Similar Dividends

The funds also feature remarkably similar dividend yields. SCHD has a dividend yield of 3.7% and has been paying a dividend and growing the size of its payout for 12 consecutive years. HDV yields 3.5% and has also paid a dividend for 12 consecutive years, but it has only grown its payout for two consecutive years.

Furthermore, SCHD has grown its payout at a strong 11.8% CAGR over the past five years, while HDV has grown its payout at a much lower 4.5% CAGR.

While the funds have similar yields, SCHD is the winner in this category based on its better dividend growth.

Looking at Their Long-Term Returns

It’s also important to see how these two dividend ETFs stack up when it comes to their returns over the long term. Over the past three years, HDV has returned 7.8% on an annualized basis (as of May 31), which is actually better than SCHD’s annualized three-year return of just 4.2% (as of the same date)

However, zooming out to a longer five-year time frame, SCHD significantly outperforms HDV, with a total annualized return of 13.4% versus HDV’s return of 8.3% (as of May 31).

SCHD also significantly outperformed HDV on a 10-year basis, with an annualized total return of 11.0% versus HDV’s more pedestrian 10-year return of 7.9% (as of May 31).

So, while HDV has performed better in the recent past, SCHD has posted a stronger performance over both the past five and 10 years, making it the hands-down winner when it comes to long-term returns.

Cost-Effective Options

Both funds are great choices for investors based on their low fees. HDV’s expense ratio is just 0.08%, meaning that an investor in the fund will pay just $8 in fees on a $10,000 investment annually. SCHD is even cheaper, with an expense ratio of 0.06%, meaning that an investor putting the same amount into SCHD will pay just $6 in fees on a yearly basis.

Assuming that each fund returns 5% annually going forward, the investor putting $10,000 into HDV will pay $105 in fees over a 10-year time frame, while an investor in SCHD will pay just $77.

These are both cost-effective options for investors, and with fees this low, the difference is fairly negligible. However, SCHD has a slight edge in this category.

Is HDV Stock a Buy, According to Analysts?

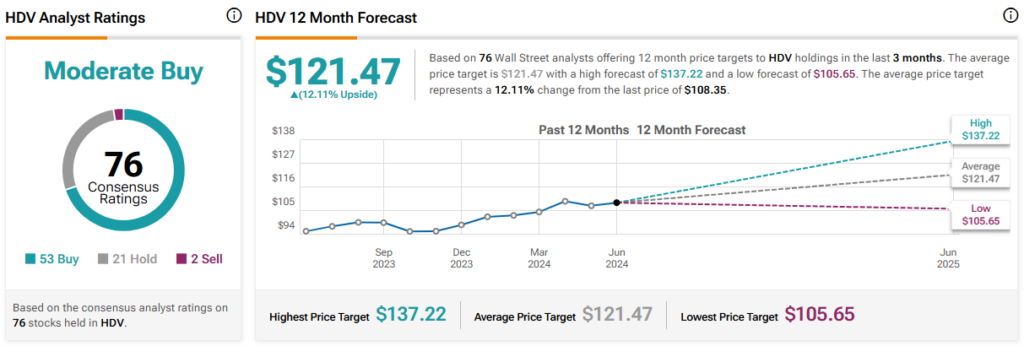

Turning to Wall Street, HDV earns a Moderate Buy consensus rating based on 53 Buys, 21 Holds, and two Sell ratings assigned in the past three months. The average HDV stock price target of $121.47 implies 12.1% upside potential from current levels.

Is SCHD Stock a Buy, According to Analysts?

SCHD also earns a Moderate Buy consensus rating based on 48 Buys, 46 Holds, and seven Sell ratings assigned in the past three months. The average SCHD stock price target of $86.27 implies 11.4% upside potential from current levels.

Choosing a Winner

These two ETFs feature similar dividend yields, similar 12-month upside based on average analyst forecasts, and similarly cheap expense ratios. While they feature some differences, both portfolios trade at remarkably similar valuations.

HDV has outperformed SCHD over the last few years, but SCHD has soundly outperformed HDV over the past five and 10 years. This long-term outperformance, coupled with SCHD’s better dividend growth, makes it the better choice for investors in my book. While I’m neutral on HDV, I’m bullish on SCHD based on its dividend yield, track record of growing its dividend payout, and attractive dividend growth rate.