US-listed Chinese stocks had a bit of a meltdown on Monday. All bled profusely after President Xi Jinping’s pivot for absolute power saw him secure an unprecedented third term as Chinese leader. Stuffing his core team with yes-men and publicly humiliating his predecessor Hu Jintao by escorting him out of the Communist Party’s gathering, the market got jittery around concerns the far east giant is pivoting further away from policies which are seen as accommodating to markets, businesses and overall growth.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

It’s not as if Chinese stocks were on the up beforehand, with many already retreating by large amounts over the past year. But with several Chinese tech giants hitting multiyear lows, the question is whether Chinese stocks have now hit rock bottom.

Investors scurried to the exit gates but calling the sell-off “disconnected from fundamentals,” J.P. Morgan’s chief global markets strategist Marko Kolanovic certainly thinks now is a good time to lean into Chinese stocks.

“China growth data surprised positively over the weekend, but their equity market is selling off strongly,” said Kolanovic. “We believe this is a good opportunity to add given an expected growth recovery, gradual COVID reopening, and monetary and fiscal stimulus.”

With this in mind, let’s delve into the TipRanks database and take a look at two stocks which sold off sharply but whose prospects remain sound, according to the experts. Alibaba shares fell by 12.5% in the rout, while Nio’s shed 16%. Both, however, are rated as Strong Buys by the analyst consensus and predicted to deliver triple-digit returns over the coming year. Let’s see why the analysts are getting behind these two beaten-down names.

Nio (NIO)

We’ll start in China’s fast-growing electric vehicle sector, where Nio has been delivering working EVs for the past four years. Currently, Nio has six EV models on the market, ranging from mid-size sedans to 5-seater SUVs, and the company has also pioneered Battery as a Service (BaaS) battery swapping technology to save customers time and money. Nio has benefitted over the past few years from the active policy of the Chinese government to promote the use and consumer switch to EVs, and its total deliveries last year, 91,429, were up 109% year-over-year.

At the same time, Nio’s shares in New York are down 70% year-to-date. Those share losses have come while Nio held its revenues steady, at or near $1.55 billion, from 4Q21 through 2Q22. The September release of the Q2 numbers showed $1.54 billion at the top line, but a net loss of $412 million, the deepest quarterly loss since 3Q21. Q2’s vehicle deliveries, reported at 25,059, were down 2.8% sequentially – but were up more than 14% y/y.

In a more recent data release, made public early this month, Nio reported its September monthly deliveries and its 3Q delivery totals. For September, the company delivered 10,878 vehicles, slightly more than 1/3 of Q3’s 31,607 total deliveries. The Q3 total was a quarterly record for the company, and was up 29.3% from 3Q21.

In his coverage of Nio’s stock for Deutsche Bank, analyst Edison Yu takes cognizance of Nio’s strong sales and sees the stock gaining ground going forward.

“We think two factors will drive outperformance at NIO, allowing it to emerge as a leader among EV upstarts. First, the ET5 mid-size sedan could become a top-selling premium model (amongst EV and ICE) in short order with initial customer reception being exceedingly positive and production leveraging NIO’s new plant. Second, while NIO’s existing gen-1 products are older and more expensive than competing products, they continue to deliver relatively stable volumes; we believe this represents thoughtful pricing and emphasis on branding+service,” Yu opined.

“We believe the company’s efforts around user experience, battery swapping, overseas expansion, and internal battery cell development go very much underappreciated and will eventually show clear differentiation as the local Chinese market gets increasingly competitive,” the analyst added.

Yu’s upbeat stance on NIO shares backs up his Buy rating, and his price target of $39 indicates his belief in a robust 290% upside for the coming year. (To watch Yu’s track record, click here)

Overall, the Strong Buy consensus rating on Nio is backed up by a unanimously positive 7 analyst reviews. Shares in Nio are trading for $10.09 and their average target of $32.97 implies a 226% upside over the next 12 months. (See Nio stock forecast on TipRanks)

Alibaba Holdings (BABA)

For the second stock we’ll look at, we’ll turn to the online retail sector, where Alibaba has built a reputation and a niche as China’s e-commerce giant. While China has a lower internet penetration than most Western nations, its far larger population means that Alibaba’s domestic customer base exceeds 800 million.

The extreme anti-COVID policies that China implemented this year hurt Alibaba, just as they hurt China’s economy generally, and the forecasts for the company’s last reported quarter – Q1 of fiscal 2023, the quarter ending on June 30 – were full of doom and gloom. Alibaba, however, reported a Q1 top line of $30.7 billion, beating the forecast by just over 1%. Nevertheless, as a reflection of difficult operating environment, the revenue print was flat year-over-year for the first time in the company’s history.

The overall revenue number was negatively impacted by a 1% drop in Chinese e-commerce, the company’s largest segment, but that was partly offset by a 10% gain in the Cloud services segment. These results brought the company $1.62 in earnings per share (American Depositary Shares, traded in New York), a result that was down 29% y/y – but was also up 47% from the previous quarter, which had featured more extensive COVID-related restrictions.

Turning back to Deutsche Bank, we’ll check in with Leo Chiang, who writes of BABA, “We believe that global macro challenges have continued to weigh on BABA’s topline growth across its various business lines (e.g., China ecommerce, cloud, and international commerce) in Sep Q. However, we anticipate a meaningful margin improvement (driven by cost optimization via new initiatives), making adj. EBITA turn positive yoy in the quarter (earlier than our previous expectation).”

“In the near term, while we believe that BABA’s topline recovery may continue to fluctuate due to macro uncertainties, we remain confident in its earnings resilience, helped by its strong cost optimization efforts…. we see upside potential from a faster-than-expected macro improvement,” the analyst added.

To this end, Chiang gives BABA shares a Buy rating, along with a $140 price target that suggests a 121% upside on the one-year time frame. (To watch Chiang’s track record, click here)

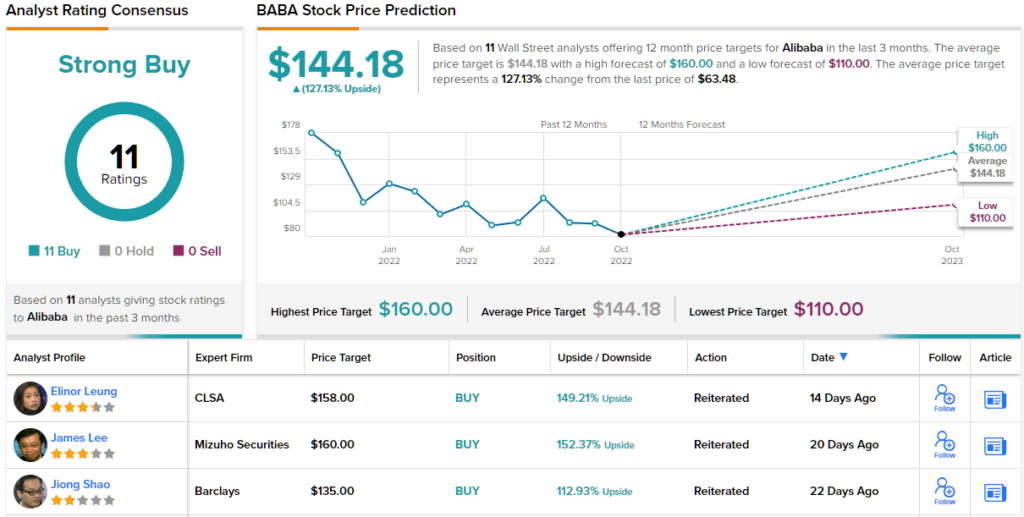

Similarly, other Wall Street analysts like what they’re seeing. All 11 of the recent analyst reviews on file for Alibaba’s stock are positive, backing up the shares’ Strong Buy consensus rating. The stock is trading for $63.20 and its $144.18 average target implies a gain of 127% in the coming year. (See BABA stock forecast on TipRanks)

To find good ideas for Chinese stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.