Netflix’s (NASDAQ:NFLX) efforts to revive its business and boost its customer base have impressed investors. NFLX shares have advanced 12% over the past month, bringing the year-to-date rally to more than 49%. Investors cheered the streaming giant’s crackdown on password sharing and its rollout of an ad-supported plan. While many analysts have recently raised the price target on NFLX to reflect further upside, others believe that optimism is already baked into the stock.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Analysts’ Opinions

Netflix ended the first quarter with 232.5 global streaming paid memberships, up 4.9% year-over-year. The company’s initiatives to address password sharing are expected to boost its subscriptions and drive higher revenue. Earlier this year, Netflix said that more than 100 million households were sharing accounts. Given this massive number, the company believes that the roll-out of paid sharing will ensure a bigger revenue base.

Earlier this month, BofA Securities analyst Jessica Reif Ehrlich highlighted that when the password-sharing clampdown became effective, Netflix witnessed “four single largest days of U.S. user acquisition” in the four and half years that analytics company Antenna started tracking the trend.

Ehrlich estimates that Netflix could generate an additional $2 billion in revenue if just over 60% of account sharers become paid subscribers. The analyst is also positive about the ad tier and thinks that price-conscious consumers who are about to lose their account due to the curb on password sharing might opt for the $6.99 ad-supported tier. Based on her bullish stance, the analyst reiterated a Buy rating on NFLX and boosted the price target to $490 from $410.

Ahead of Netflix’s Q2 results on July 19, Citigroup analyst Jason Bazinet initiated a “positive catalyst watch” on the stock and raised the price target to $500 from $400 while maintaining a Buy rating. Bazinet is more bullish on the possibility of the success of the advertising tier but thinks that paid sharing may add “very little” incremental revenue. He estimates 82 million new subscribers and $10.6 billion of incremental revenue.

Meanwhile, on June 14, Barclays analyst Kannan Venkateshwar increased the price target for NFLX stock to $375 from $250 and reiterated a Hold rating. While Venkateshwar believes that Netflix continues to be the best positioned to gain from the shift toward streaming, its valuation “seems to more than adequately reflect potential upside from near-term growth optimization tools like paid sharing and advertising.”

Is Netflix a Buy, Sell, or Hold Right Now?

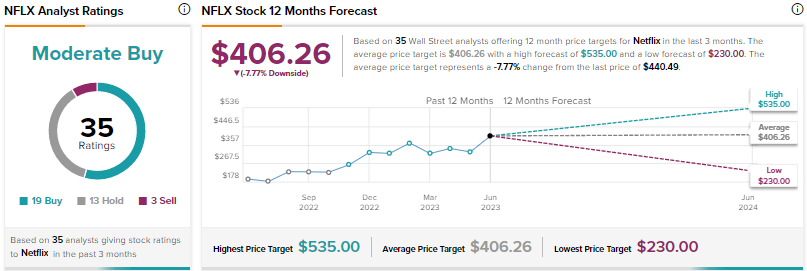

Wall Street is cautiously optimistic about Netflix stock, with a Moderate Buy consensus rating based on 19 Buys, 13 Holds, and three Sells. The average price target of $406.26 implies a possible downside of over 8% from current levels.

Conclusion

Several analysts are optimistic about Netflix’s initiatives to expand its customer base and boost its revenue. While some analysts see further upside in the stock, others have valuation concerns. Currently, the average price target of Wall Street analysts indicates a possible sell-off in the stock.