Trends often have a tendency to snowball and gain momentum. One recent phenomenon in which an increasing number of Street analysts seem to be participating is the reassessment of the outlook for Tesla (NASDAQ:TSLA) shares.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Having gained over 100% year-to-date, one thing most seem to be agreeing on is that Tesla shares have soared enough for now. The latest to throw the hat in with a downgrade is Goldman Sachs’ Mark Delaney.

The analyst lowered his rating from Buy to Neutral, while lifting his price target from $185 to $248. The new figure suggests shares will stay range-bound for the foreseeable future. (To watch Delaney’s track record, click here)

“While the primary reason for the change in our view is that we think the market is now giving the stock more credit for its longer-term opportunities, we are also cognizant of the difficult pricing environment for new vehicles that we think will continue to weigh on Tesla’s automotive non-GAAP gross margin this year,” the 5-star analyst said, explaining his new stance.

Looking ahead to the next 6 to 12 months, Delaney thinks there are both “positive and negative fundamental factors to consider.”

On the plus side, it appears that 2Q23 deliveries are going well and given April and May’s ‘solid’ sales data, Delaney believes Q2 volumes will be more or less the same as the consensus estimate of 445-450,000.

Moreover, products such as the Cybertruck and potentially a ‘refreshed’ Model 3, in addition to broad based EV adoption driven by ongoing government support, ‘strength’ in Energy and keeping costs down, could all act as tailwinds.

Nonetheless, Delaney anticipates that the decline in prices of new vehicles and the weakening balance between supply and demand in the industry will pose a challenge.

And while the EV leader’s “breadth and depth of engineering resources and data access,” means Tesla’s positioning in AI/FSD (full self-driving) could make it a long-term winner, these catalysts are still a while away. “The timing of when Tesla will enable situational eyes-off (e.g. L3) or robotaxi-type (L4) functionality could occur beyond the next 12 months in our view,” Delaney opined.

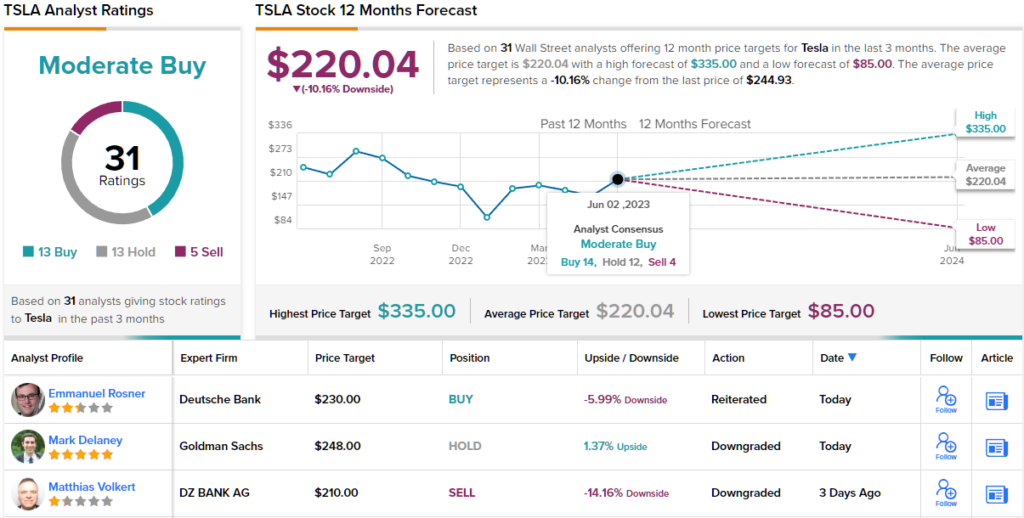

So, that’s Goldman Sachs’ view, how does Tesla fare amongst others on the Street? All told, the stock claims a Moderate Buy consensus rating, based on a total of 13 Buys, 13 Holds and 5 Sells. However, the $220.04 average target suggests the shares have ~10% downside for the months ahead. (See Tesla stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.