Inflation is a theme that has loomed large over American life over the last two years. One way that investors can fight inflation, or at least try to keep pace with it, is to invest in real assets. The FlexShares Morningstar Global Upstream Natural Resources Index Fund (NYSEARCA:GUNR) enables investors to do just this by investing in stocks with exposure to a wide range of real assets and natural resources, all in one convenient vehicle.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

I’m bullish on GUNR based on its diversified portfolio of companies involved in real assets and natural resources, its dividend payout, and its performance in recent years.

What is the GUNR ETF’s Strategy?

GUNR is a $7.1 billion ETF from Northern Trust’s FlexShares. FlexShares explains that the ETF is meant for investors “seeking the potential of an expanded definition of global real assets.”

To give investors exposure to global real assets, GUNR invests in companies involved in a wide variety of natural resources, including metals, energy, agriculture, water, timber, and more.

Real assets like gold or oil are widely seen as asset classes that benefit from inflation. In fact, many investors view them as hedges against inflation. While governments can always print more currency, natural resources like gold, silver, or oil all have intrinsic value and are viewed as finite resources, so their value tends to increase during times of inflation. Furthermore, these are tangible, physical assets that many appeal to investors during times of economic or geopolitical uncertainty.

What I like about GUNR is that while there are plenty of ETFs that invest in energy companies or invest in gold, GUNR invests in them all, giving investors exposure to a wider range of real assets and natural resources.

GUNR’s Portfolio is Diversified

What does a portfolio of these kinds of companies look like? Altogether, GUNR owns 120 stocks, and its top 10 holdings make up 37.7% of the fund, so this is a diversified ETF.

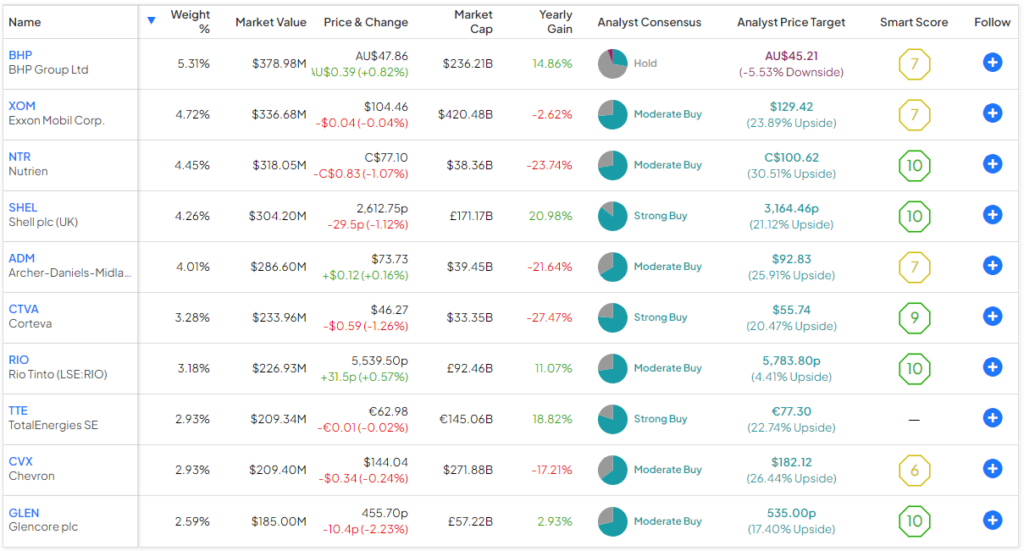

Below, you can take a look at an overview of GUNR’s top 10 holdings using TipRanks’ holdings tool.

As you can see, GUNR’s holdings span the globe and give investors exposure to a wide variety of natural resource companies.

Top holding BHP Group (NYSE:BHP) is the world’s largest mining company by market cap. BHP is based in Australia and is involved in the exploration and production of metals like iron ore, metallurgical coal, and copper. Meanwhile, the second-largest holding, ExxonMobil (NYSE:XOM), is a U.S.-based energy giant with worldwide operations involved in all aspects of oil and gas exploration, production, and refining.

Other prominent miners in GUNR’s top 10 holdings include Glencore (OTC:GLNCF) and Rio Tinto (NYSE:RIO), while energy is also represented through Shell (NYSE:SHEL), TotalEnergies (NYSE:TTE), and Chevron (NYSE:CVX).

But real assets aren’t limited to metals or oil. Farmland is also a finite and attractive asset that benefits from inflation. As Mark Twain once famously said, “Buy land, they’re not making it anymore.” That’s why GUNR holds large positions in agribusiness stocks like Nutrien (NYSE:NTR), and Corteva (NYSE:CTVA). Canada’s Nutrien is a major producer of crop nutrients and fertilizer, while Corteva makes seeds and crop protection solutions.

Beyond its top 10 holdings, GUNR even owns stocks like Weyerhauser (NYSE:WY), which owns timberland, and Cameco (NYSE:CCJ), which produces uranium.

Altogether, GUNR gives investors exposure to a wide world of real assets and natural resources, leaving no stone unturned.

GUNR’s Long-Term Performance

Based on GUNR’s performance over the last few years, if you didn’t know anything else about it, you might assume that it’s a red hot tech stock. Over the past three years, GUNR has returned a scintillating 17.2% on an annualized basis (as of October 31) as inflation picked up. During this timeframe, GUNR easily outperformed the broader market indices like the S&P 500 (SPX) and the Nasdaq (NDX) by a considerable margin.

Over a longer time frame, GUNR’s five- and 10-year annualized returns of 8.0% and 4.5%, respectively, aren’t quite as compelling, but if inflation is here to stay, or is at least around for a while, the ETF should continue to impress.

How’s Its Dividend?

Additionally, GUNR pays an attractive dividend and currently yields 3.1%, nearly double the average yield of the S&P 500. Notably, the fund has paid a dividend for nine consecutive years.

Elevated Expense Ratio

My only qualm about GUNR is that its expense ratio of 0.46% seems a bit high for an index fund.

This 0.46% expense ratio means that an investor putting $10,000 into GUNR will pay $46 in expenses over the course of year one of investing in it. However, these fees start to add up over time. Assuming the fund returns 5% per year going forward and the expense ratio remains at 0.46%, this investor will pay $590 in fees over the course of a 10-year investment timeline.

Is GUNR Stock a Buy, According to Analysts?

Turning to Wall Street, GUNR earns a Moderate Buy consensus rating based on 68 Buys, 49 Holds, and three Sell ratings assigned in the past three months. The average GUNR stock price target of $47.05 implies 16.8% upside potential.

Investor Takeaway

GUNR is a strong ETF that has posted fantastic results over the past few years. It helps investors hedge against inflation by investing in a diversified and all-encompassing mix of companies involved in real assets like metals, energy, agriculture, and beyond. It also pays out a healthy 3.1% dividend yield.

GUNR’s only drawback is that its expense ratio of 0.46% is a bit on the higher end for an index fund. However, if the fund keeps performing well for investors, this will be water under the bridge.

Overall, GUNR is a great fit for the portfolios of all investors as a hedge against inflation and a way to add exposure to a wide mix of natural resources and real assets while collecting a solid dividend payout in the process.