2023 was a big year for the stock market with all the major indexes enjoying the bull market’s spoils.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

However, the gains were mostly driven by the tech giants and not all sectors of the market flourished. For instance, Utilities stocks had a tough year, meaningfully underperforming the broader markets. But as every savvy investor knows, opportunity often lies when sentiment is low, and looking at the segment’s prospects in 2024, Guggenheim analyst Shahriar Pourreza thinks investors should take note.

“The sector looks materially undervalued and after steep ’23 underperformance, utility valuations look poised to snap back sharply in ’24,” the analyst recently said. “Key factors for utilities performance in 2024: 1) Coming off valuation relative lows, we see utilities at a fundamental discount vs. our regression/PEG valuation models, 2) Interest rates certainty and/or softening… 3) We see financing and balance sheet concerns of 2023 subsiding after a broadly stronger than expected set of EEI disclosures, and we believe these will carry into year-end results… 4) Utility fundamentals remain strong, decades high load growth from various customer classes… 5) Concerns around renewables deployment starting to ease…”

Against this backdrop, Pourreza has homed in 3 sector names which he thinks represent smart bets for the coming year, so we’ve decided to check them out. By running them through the TipRanks database, we can also see what the rest of the Street thinks lies in store for these names. Here are the details.

NextEra Energy (NEE)

First on our Guggenheim-endorsed list is NextEra Energy, a utility company with a strong bent toward the clean and renewable areas of the energy industry. NextEra has a market cap of $117.7 billion, and from its base in Juno Beach, Florida it owns the largest electric utility in the US, Florida Power & Light. FPL sells more power than any other electric utility provider in the US market, and boasts nearly 5.8 million customer accounts – or a total of 12 million people across the state of Florida.

On the generation side, NextEra has 67 gigawatts of power supply in operation, and more than half of that is based on renewable sources rather than fossil fuels. The company boasts a wide ranging network of power generation assets, including wind, solar, and nuclear facilities, as well as extensive battery solutions for power storage. NextEra operates across most of the continental US and in four Canadian provinces, including the two most populous, Ontario and Quebec.

NextEra has recently doubled down on its long-term commitment to renewable power, through large-scale investments in hydrogen energy. The company has plans to put as much as $20 billion into hydrogen projects, and is working in concert with US government agencies on the initiative. By 2026, NextEra plans to have up to 15 gigawatts of hydrogen power generation up and running.

The company will release its Q4 results tomorrow (January 25), but we can hark back to the Q3 results for a snapshot of where the company stands. The readout showed a top line of $7.17 billion, up year-over-year by 6.7%, but skating just under the forecast, by $10 million. The company’s bottom line, listed as a non-GAAP earnings per share of 94 cents, was up 9 cents per share y/y, and was 6 cents per share better than had been anticipated.

All in, the performance was unable to shift general sentiment, and over the past year, the shares have retreated by ~30%.

For Guggenheim’s Pourreza, this adds up to an opportunity. In fact, he names NextEra as a Best Idea, and writes of the stock, “NEE is our new 2024 Best Idea and top utility pick — if an investor must own one utility in 2024, NEE should be the pick, in our view, based on: NEE checks all the boxes we highlight for drivers in our ’24 sector note, including: 1) Oversold position on any of our absolute/relative metrics, 2) Valuation disconnect with several industry and macro level tailwinds, 3) Several near-term company-specific catalysts including March developer day and, 4) Scarcity value for its asset base including high quality renewable assets and a DevCo… Basically, the stock is oversold in our view, with arguably the most to gain from improving fundamentals/macro backdrop, and we believe NEE could further lift the entire sector as datapoints continue to improve beginning with the 4Q earnings call.”

Accordingly, Pourreza rates NEE shares as a Buy, and he puts an $80 price target on the stock to show his trust in a one-year upside of 39.5%. (To watch Pourreza’s track record, click here)

There are 12 recent analyst reviews on this stock, and they break down to 9 Buys, 2 Hold, and 1 Sell – for a Moderate Buy consensus rating from Wall Street. The shares are trading for $57.38 and their $70.09 average price target implies a gain of 22% on the one-year time-frame. (See NEE stock forecast)

Eversource Energy (ES)

The second energy company we’ll look at is Eversource Energy, a major power provider in the New England states of Connecticut, Massachusetts, and New Hampshire. The company employs almost 10,000 people, provides energy for 4.4 million customers, and has more than 4,000 miles of electric transmission infrastructure in place. The company has major projects underway to enhance grid modernization, improve capabilities to meet customer demand for power, and to improve the resilience of the transmission network.

Eversource has been deeply involved in the establishment of wind-powered energy generation projects off the coast of New England, in partnership with the Danish company Orsted. Eversource has 50% stakes in three large offshore windfarms, which it is currently negotiating to sell. The company is taking a steep financial hit here, due to a combination of rising construction costs and changes in the market value of the projects. The company announced recently that it will take an impairment charge of $1.4 billion to $1.6 billion related to its windfarm interests.

This stock was already under pressure, even before the impairment charge announcement made it worse. A zoom-out look shows a 12-month loss for the stock of approximately 31%, with almost half of the losses taking place this January.

Despite the loss in share value, Eversource has kept up its regular quarterly dividend. The last payment went out on December 29, at 67.5 cents per common share. This annualizes to $2.70 per share, and gives a forward yield of 5.1%.

Eversource’s case didn’t get any help from its last quarterly report. For 3Q23, the company reported misses in both revenues and earnings. The revenue total of $2.79 billion, was $620 million below the forecast, and was down more than 13% y/y. On earnings, the non-GAAP EPS figure of 97 cents per share missed expectations by a penny.

For Pourreza, the wind impairment charge brings an advantage for investors – a clearer view of what’s in store for this stock. In addition, he sees the stock’s recent decline in value as opening up a buying opportunity, and he writes, “Valuation getting hard to ignore at this point, with more clarity on wind and the credit backdrop coming in the weeks ahead. In our view the current juncture provides an attractive entry point, with management’s recent wind impairments providing a useful reset to the street around the prospect for very low proceeds from a sale – bringing expectations closer to our prior view and removing a tail risk many investors have been waiting for. As positioned today, any proceeds would be incremental to our model and an offset to the $2B in total equity we have in plan between now and 2028.”

Looking ahead, Pourreza upgrades ES shares from Neutral to Buy, and sets a $72 price target that implies a 12-month share appreciation of 36%.

Wall Street isn’t quite ready to get that bullish here. This stock has a Hold consensus rating, with 12 recent reviews shaking out just 2 Buys to 10 Holds. The stock is priced at $52.88 and has an average price target of $64.18; these predict a 21% upside potential for the coming year. (See Eversource stock forecast)

Edison International (EIX)

Last up, Edison International, a major public power utility in Southern California. The firm is known for providing clean and reliable power and is a holding company that operates through two main subsidiaries. The first, Southern California Edison, is the electric utility. SCE operates across a 50,000 square mile region of the state, and serves some 15 million people. The power utility has been in operation for over 130 years.

Some basic numbers will tell the story of just how big this electric power provider is. Edison International employs more than 13,000 people, and at the end of 2022 reported $17.2 billion in revenues and $1.8 billion in core earnings.

The company last reported results for 3Q23, and showed $4.7 billion at the top line. However, that was down 10% year-over-year, and was $150 million below the forecast. The utility’s non-GAAP EPS was $1.38, also below what had been anticipated, by 7 cents.

Edison pays out a decent dividend, and in its last declaration, in December of 2023, it announced a 5.8% increase in the payment. The new dividend, of 78 cents per common share, annualizes to $3.12 and gives a yield of 4.65%. Edison International has regularly increased its common share dividend payment over the past 20 years.

For Guggenheim’s Pourreza, there is plenty of potential in Edison International – and he lays it out in a clear note: “We are upgrading EIX from Neutral to Buy as we see underappreciated value (13% discount vs. peers) in the stock with a conservative earnings guidance and a backlog of upside catalysts and capex… While the median case still points to an attractive valuation for the stock (i.e., reversion to group average P/E for a wildfire-derisked, fully regulated, electric T&D utility), cost of capital adjustments, easing interest rate concerns, and legacy claims recovery are becoming a potential upwards earnings/value rebase. Additionally, we reassess our earnings forecast to include cost of capital tailwinds and now fully embed claims debt and parent debt repricing…”

The analyst’s upgraded Buy rating comes along with an $84 price target, suggesting a 25% potential upside in the next 12 months. (To watch Pourreza’s track record, click here)

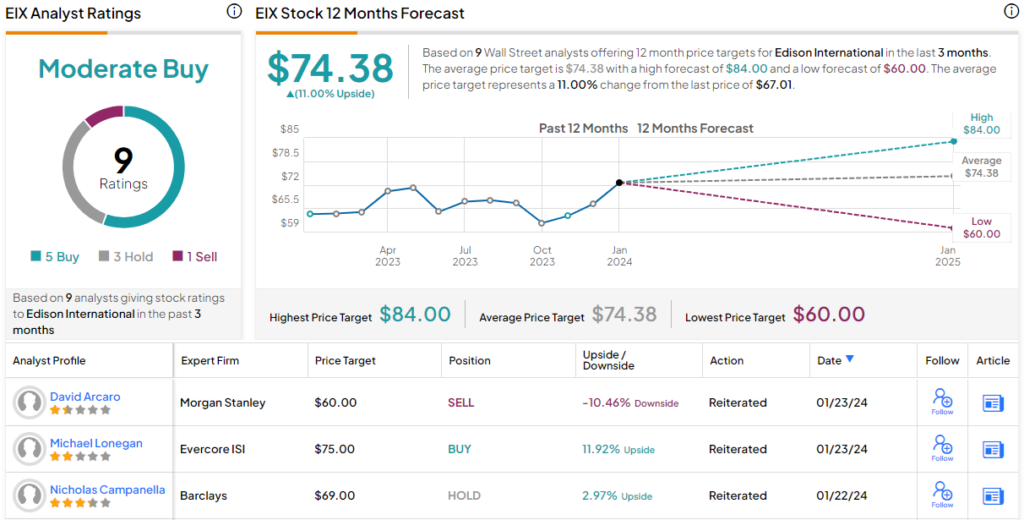

The stock has a Moderate Buy consensus rating from Wall Street, based on 9 recent reviews that include 5 Buys, 3 Holds, and 1 Sell. Shares last closed at $67.01 and their $74.38 average target price points toward an 11% gain this year. (See EIX stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.