In this piece, I evaluated two TV stocks, Gray Television (NYSE:GTN) and Sinclair Broadcast Group (NASDAQ:SBGI), using TipRanks’ comparison tool to determine which is better.

These have not been good times for TV station operators, and this reality is baked into both these stocks. Gray Television has plummeted 34% year-to-date, extending its 12-month decline to more than 62%. Sinclair Broadcast has held up slightly better, having gained 2% year-to-date, although it’s off 32% for the last 12 months.

However, Wall Street hasn’t given up entirely on TV stocks. Currently, the broadcasting industry is trading at a price-to-earnings (P/E) ratio of about 15.3 times versus its three-year average of 12.9. The industry is also trading around its three-year average price-to-sales (P/S) ratio of 1.0.

With Gray and Sinclair down so much, some investors might be wondering whether either could be a diamond in the rough, so a closer look is in order.

Gray Television (NYSE:GTN)

Gray is trading at a P/E of about 4.5 and a P/S of about 0.2, suggesting at first glance that it could be significantly undervalued. However, a closer look reveals some potential issues with this company, suggesting a bearish view may be in order — even after the steep sell-off.

Gray Television’s revenue has been steadily increasing in recent years, which is certainly a great thing considering the state of the broadcasting industry. The company is also profitable, another bonus during a challenging time for traditional media companies.

On the other hand, Gray had net debt of $6.5 billion at the end of 2022, a slight improvement from the year before. However, Gray faces an uphill battle, given that it only generated $455 million in net income in 2022.

Gray is also facing a major legal and financial overhang. The Federal Communications Commission said in late 2022 that it would move forward with a fine for allegedly violating ownership rules on a pair of TV stations in Alaska. Gray is opposing the FCC in court, but if it loses, it could be on the hook for a significant amount of money relative to its annual net income.

Finally, although Gray pays a dividend yield of 4.5%, the only reason the yield is so high is because of how much its stock has plummeted.

What is the Price Target for GTN Stock?

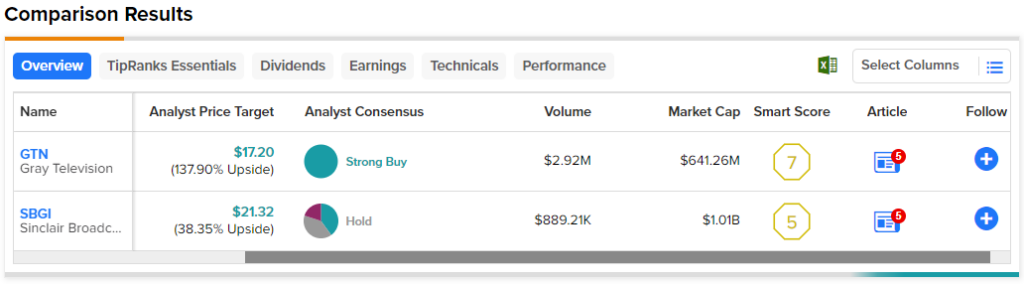

Believe it or not, Gray Television has a Strong Buy consensus rating based on five Buys, zero Holds, and zero Sell ratings assigned over the last three months. At $17.20, the average Gray Television stock price target implies upside potential of 137.9%.

Sinclair Broadcast Group (NASDAQ:SBGI)

At a P/E of 4.6 and a P/S of 0.3, Sinclair also looks undervalued at first glance. However, it’s currently weighed down by the bankrupt Diamond Sports Group, making a neutral view seem appropriate.

TV station operators do tend to have fluctuating revenues because of political advertising, which generates far more revenue in election years. However, in the fourth quarter, Sinclair’s revenue plunged 35% year-over-year due to ongoing problems with Diamond Sports Group.

Removing the owner of the Bally Sports Regional Network from the company’s revenue showed an 18% year-over-year revenue increase due to robust political spending. Diamond didn’t make a large $140 million interest payment and owes about $2 billion to the NBA, NHL, and MLB for the media rights to broadcast their games and filed for bankruptcy in March. Sinclair can’t unload it fast enough, as it was forced to write off $4.2 billion of the value of Diamond Sports in 2020 after the pandemic ravaged live sports programming.

The good news is that Sinclair is starting to make the transition to online. The company announced a distribution agreement with YouTube TV in April. However, that agreement came after Hulu dropped Sinclair’s ABC stations in March. Sinclair is also in the process of reorganizing, which could unlock value in some of its hidden assets after the removal of Diamond Sports.

Finally, Sinclair pays an attractive dividend yield of 6.1%, which may make it an ultra-risky but decent dividend play.

What is the Price Target for SBGI Stock?

Sinclair Broadcast Group has a Hold consensus rating based on two Buys, two Holds, and one Sell rating assigned over the last three months. At $21.32, the average Sinclair Broadcast Group stock price target implies upside potential of 38.35%.

Conclusion: Bearish on GTN, Neutral on SBGI

While TV stations are losing out to online sources, it doesn’t mean all traditional media companies are dead in the water. The sector does offer a few compelling options, but close analysis is required.

In this pairing, Sinclair looks like the winner, but even its future remains murky at best. Thus, a review seems in order after the reorganization and separation from Diamond Sports.