In this piece, I evaluated two project management stocks, GitLab (NASDAQ:GTLB) and ServiceNow (NYSE:NOW), using TipRanks’ comparison tool to determine which is better.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

With over 30 million registered users, GitLab operates a software package that can develop, secure, and operate software, enabling remote teams to collaborate more easily. ServiceNow also enables remote collaboration by digitizing and automating siloed processes. It reports that 85% of Fortune 500 companies have modernized their technology with its digital-first business model.

ServiceNow shares have exploded this year, climbing 46% year-to-date, and they’re up 31% over the last year. GitLab shares have jumped 19% year-to-date but remain in the red for the last 12 months, down 3%.

For context when valuing the two companies, the software industry is trading at a price-to-earnings (P/E) ratio of 74.8, versus its three-year average of 59.7 and a price-to-sales (P/S) ratio of 10.4, which is in line with its three-year average. However, the application software industry is trading at a P/S of 7.9 versus its three-year average of 10.1.

GitLab (NASDAQ:GTLB)

Unfortunately, GitLab is unprofitable, and it’s trading at a P/S of 16.9, which immediately makes it look overvalued versus its industry. On the one hand, the company has been a growth stock due to its tremendous revenue growth over the last several years, but on the other, management expects a dramatic slowing of its growth this year. Thus, a bearish view seems appropriate.

While GitLab’s revenue has grown steadily since it went public, its operating margins have remained in the -47% to -51% range in the fiscal years that ended in January 2022 and January 2023 and for the last 12 months.

In its fourth-quarter earnings report, the company guided for Fiscal 2024 revenue in the $529 million to $533 million range, a significant deceleration in growth from the previous year’s revenue of $424.34 million (which saw a growth rate of 68%). Thus, GitLab stands on the precipice of no longer being considered a high-growth stock — with all the benefits that typically entails.

Nevertheless, the company did beat its first-quarter guidance for both revenue and non-GAAP losses and boosted its Fiscal 2024 guidance. Additionally, it has $937.6 million in cash and short-term investments on its balance sheet, with only $348.5 million in total liabilities, which should enable it to withstand a period without profits.

However, GitLab is still in the red on free cash flow, and its stock likely received an artificial boost this year due to the hype over artificial intelligence (AI). Virtually any publicly-traded company that has mentioned AI in any of its earnings reports or conference calls has soared this year.

Ultimately, investors have to decide whether a company with $500 million in annual revenue and no expectations of turning a profit anytime soon deserves a market capitalization in excess of $8 billion.

What is the Price Target for GTLB Stock?

GitLab has a Moderate Buy consensus rating based on 10 Buys, four Holds, and zero Sell ratings assigned over the last three months. At $53.77, the average GitLab stock price target implies downside potential of 0.65%.

ServiceNow (NYSE:NOW)

At a P/S of 15 and a P/E of 286, ServiceNow also looks overvalued relative to its industry. However, its five-year mean P/S is 18.8, and it’s now trading at a P/S of roughly where it was in 2018 — when it was unprofitable. Thus, ServiceNow looks relatively cheap at its current P/S ratio, suggesting a long-term bullish view may be appropriate.

With $7.2 billion in revenue for Fiscal 2022, ServiceNow is much further along than GitLab. The company’s revenue and net income trends over the last few years have been positive, indicating steady growth on both the top and bottom lines.

While its revenue growth slowed to 23% in 2022, ServiceNow is growing off a significantly larger base than GitLab. The company is also seeing steady, albeit decelerating, free cash flow growth, up from $1.8 billion in 2021 to $2.2 billion in 2022.

While it’s cheap versus its own history, ServiceNow isn’t discounted relative to its industry, although its fundamentals show why it deserves a premium. However, it might take some time to see significant gains in this stock after the recent rally, so it may be better as a long-term buy-and-hold stock.

What is the Price Target for NOW Stock?

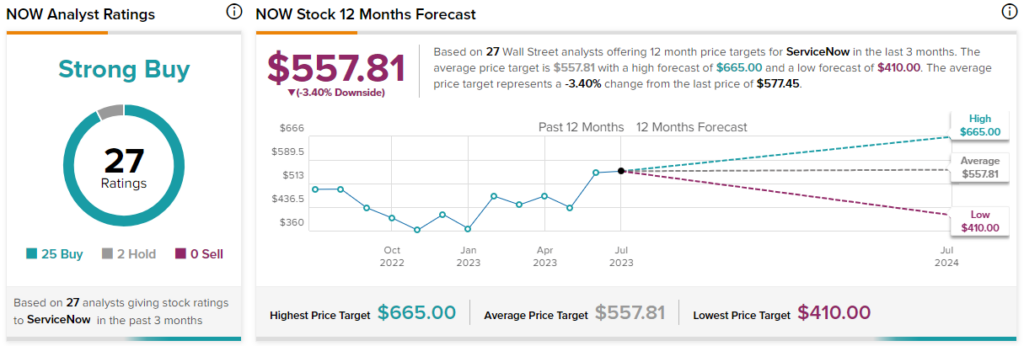

ServiceNow has a Strong Buy consensus rating based on 25 Buys, two Holds, and zero Sell ratings assigned over the last three months. At $557.81, the average ServiceNow stock price target implies downside potential of 3.4%.

Conclusion: Bearish on GTLB, Bullish on NOW

A review of both companies’ fundamentals reveals ServiceNow as the clear winner. Notably, ServiceNow trading at a lower P/S than GitLab despite its profitability and much larger scale. However, it could take some time for this bull thesis to play out, so a long-term buy-and-hold strategy seems appropriate for ServiceNow.