In this piece, I used TipRanks’ comparison tool to evaluate two big bank stocks, Goldman Sachs Group (NYSE:GS) and Morgan Stanley (NYSE:MS), to determine if they’re worth buying. Upon closer analysis, it looks like both stocks are attractive, leaving me bullish.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

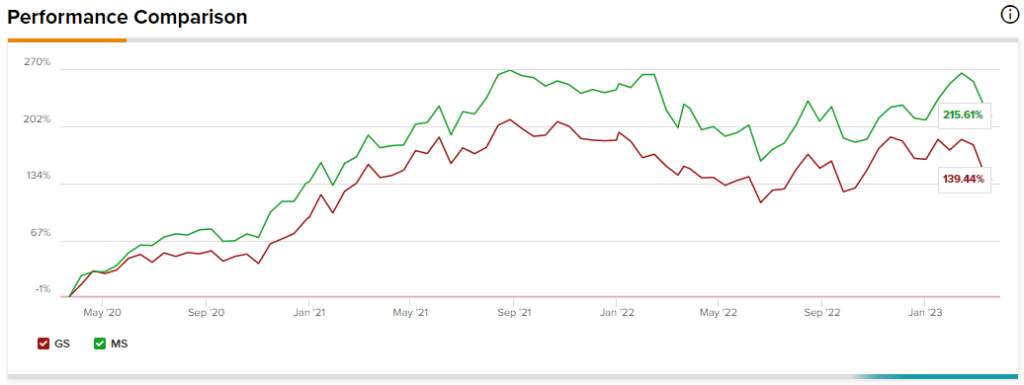

A review of the two firms’ year-to-date returns reveals that Morgan Stanley is holding up much better than Goldman Sachs, up 4.4% versus Goldman’s 7.7% decline. Both firms reacted negatively to the collapses of Silicon Valley Bank and Signature Bank, but there’s more to the story. Let’s examine.

Goldman Sachs Group (NYSE:GS)

Shares of Goldman Sachs are down 7.7% year-to-date amid the turmoil in the banking sector. Those problems have had an outsized impact on Goldman versus Morgan Stanley due to its greater focus on consumer banking. However, Goldman is trading at a price-to-earnings (P/E) ratio that’s below the industry average, and a transformation is underway, making a long-term bullish view seem appropriate.

First, Goldman Sachs is trading at a P/E of about 10.3 times, while the financial sector is trading at a P/E of 16.4 times, slightly higher than the three-year average of 14 times. The sector is also trading at a price-to-sales (P/S) ratio of 2.1 times versus its three-year average of 2.4 times, which is roughly what Goldman is trading at now.

Unfortunately, the firm’s management has made some major missteps over the years, choosing to focus more on consumer banking and lending, which has become an even bigger issue as a recession threatens. In 2022, the so-called “Platform Solutions” business, which is essentially the consumer business, made up only 3% of Goldman’s business, but it generated net losses of $1.7 billion.

Goldman’s business model is also causing other problems right now. For example, the yield on the two-year Treasury note has been plummeting at its fastest pace since 1987 recently, which is having an outsized impact on Goldman Sachs. Sources told The Financial Times that the firm lost about $200 million at its trading desk that deals with interest rate products.

However, Goldman’s new management is working to rectify these issues. At the firm’s recent investor day, management highlighted their ongoing pivot toward the more profitable Asset and Wealth Management division.

Finally, financial stocks often pay dividends, and Goldman Sachs is no different. Its trailing dividend yield of 3% is higher than the industry average of 2.1%.

What is the Price Target for GS Stock?

Goldman Sachs has a Moderate Buy consensus rating based on 11 Buys, six Holds, and zero Sell ratings assigned over the last three months. At $410.63, the average Goldman Sachs stock price target implies upside potential of 29.4%.

Morgan Stanley (NYSE:MS)

Morgan Stanley has held up better than Goldman this year, having gained 4.4% year-to-date, and it’s easy to see why. The focus on its less capital-intensive Wealth Management business rather than consumer banking has made all the difference in its earnings results. Even during 2022’s deep bear market, Morgan Stanley managed a more than 30% return on equity in its Wealth Management division. Morgan Stanley’s valuation multiples also suggest a long-term bullish view may be appropriate.

At a P/E of 14.4 times, Morgan Stanley is trading at a slight discount to its sector’s current valuation, although its P/S is on the high side at 2.7. However, the firm deserves this premium versus Goldman due to its wise business model decisions. The market has punished Goldman for its identity crisis this year while boosting Morgan Stanley.

I believe the banking sector’s recent sell-off has created a buying opportunity in Morgan Stanley. While it may not offer as much near-term upside as Goldman because its stock hasn’t fallen as far, Morgan Stanley is in an attractive position for long-term growth.

Finally, Morgan Stanley has an attractive trailing dividend yield of 3.4%.

What is the Price Target for MS Stock?

Morgan Stanley has a Moderate Buy consensus rating based on 10 Buys, six Holds, and two Sell ratings assigned over the last three months. At $100.30, the average Morgan Stanley stock price target implies upside potential of 13%.

Conclusion: Long-Term Bullish on GS and MS

Both Goldman Sachs and Morgan Stanley look like long-term Buys, but for different reasons. The financial sector’s recent sell-off has created buy-the-dip opportunities for both.

However, Goldman Sachs faces an identity crisis and is undergoing a transformation. Thus, the bull thesis could take a while to play out, and the firm faces execution risk.

On the other hand, the market has rewarded Morgan Stanley for its clarity and the success of its business model. While the near-term upside from the sell-off might not be as high for Morgan Stanley, its strength demonstrates staying power, potentially making it a long-term buy-and-hold position.