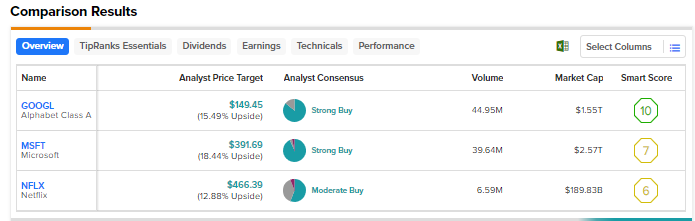

Several tech stocks have recovered strongly this year in hopes of better business conditions and growing expectations about the prospects in generative artificial intelligence (AI). The recently reported results for the June quarter indicate the resilience of the business models of many tech giants. We used TipRanks’ Stock Comparison Tool to place Alphabet (NASDAQ:GOOGL, GOOG), Microsoft (NASDAQ:MSFT), and Netflix (NASDAQ:NFLX) against each other to find the most attractive tech stock as per Wall Street analysts.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Alphabet (NASDAQ:GOOGL, GOOG)

This week Alphabet impressed investors with its upbeat second-quarter results. The Q2 earnings per share (EPS) increased 19% to $1.44, driven by a 7% rise in revenue to $74.6 billion and an improvement in operating margin.

The Google parent attributed the Q2 2023 performance to continued resilience in Search, acceleration of revenue growth in both Search and YouTube, and momentum in Cloud business.

In particular, Google Cloud’s revenue increased 28% year-over-year to $8 billion, with the segment generating an operating income of $395 million compared to an operating loss of $590 million in the prior-year quarter. This marked the second consecutive quarter of operating income for Google Cloud.

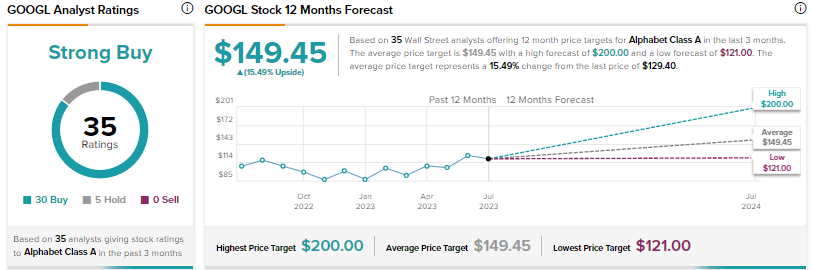

Is GOOGL Stock a Buy or Sell?

Several analysts raised their price target for Alphabet following the results. On Wednesday, Truist analyst Youssef Squali increased his price target for GOOGL to $160 from $122 and maintained a Buy rating on the stock after the Q2 print. Squali believes that the second quarter reflected faster recovery for Search and YouTube and sustained momentum in Google Cloud.

The analyst added that the improvement in Alphabet’s business came in as the management is focusing on controlling costs and directing its investments toward its highest growth priorities. The analyst expects to see further growth acceleration in the second half of this year along with margin expansion.

Wall Street has a Strong Buy consensus rating on GOOGL with 30 Buys and five Holds. The average price target of $149.45 implies 15.5% upside. Shares have rallied about 49% since the start of this year.

Microsoft (NASDAQ:MSFT)

Microsoft has gained a lot of attention this year due to its aggressive initiatives to capture generative AI opportunities and significant investments in OpenAI, the start-up behind ChatGPT.

Earlier this week, the company reported an 8% growth in its fiscal fourth-quarter revenue to $56.2 billion and a 21% rise in EPS to $2.69. Still, shares declined following the results as the company’s guidance fell short of expectations due to persistent weakness in the PC market. Moreover, Azure and other cloud services’ revenue growth of 26% surpassed estimates but marked a deceleration from the 27% growth seen in the fiscal third quarter.

Looking ahead, the company assured that it remains focused on three key priorities – driving further adoption of Microsoft Cloud, investing to lead in the ongoing AI platform shift, and driving operating leverage.

Is Microsoft a Buy, Sell, or Hold?

On Wednesday, RBC Capital analyst Rishi Jaluria increased the price target for Microsoft to $390 from $350 and reiterated a Buy rating on the stock. Jaluria noted that the company delivered strong results and outlook despite the ongoing macro challenges.

However, he thinks that the reason for the stock’s decline following the results lies in investor optimism. Jaluria suggests that investors were too optimistic about the timeline for cloud spending optimization headwinds to fade away and AI benefits to commence.

Nonetheless, Jaluria contends that Microsoft’s multi-year reacceleration story remains intact and will likely start to reflect in the second half of this year.

Microsoft scores a Strong Buy consensus rating based on 28 Buys, one Hold, and one Sell. At $391.69, the average price target implies 18.4% upside. MSFT shares have risen 39% year-to-date.

Netflix (NASDAQ:NFLX)

Streaming giant Netflix’s Q2 2023 adjusted EPS increased 2.8% to $3.29 and handily surpassed analysts’ estimates. However, the company’s revenue of $8.2 billion, which grew 2.7% year-over-year, lagged expectations.

Nonetheless, the company assured investors that it expects its top-line growth to accelerate in the second half of 2023, as it anticipates seeing the full benefits of its paid sharing plans and continued growth in its ad-supported plan.

Netflix expects its Q3 2023 revenue to grow 7% to $8.5 billion, driven by growth in average paid memberships. The company projects its Q3 paid net additions to be similar to the Q2 2023 figure of 5.9 million. Further, Netflix expects its Q4 2023 revenue growth to accelerate “more substantially,” due to a rise in ad revenue and a further crackdown on password sharing between households.

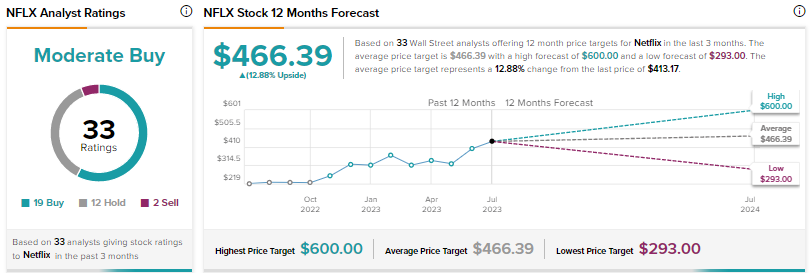

What is Netflix Stock Prediction?

Earlier this week, Baird analyst Vikram Kesavabhotla upgraded his rating on NFLX to a Buy from Hold and boosted the price target to $500 from $340, citing increased confidence in the company’s execution, primarily related to the company’s ad-supported plan and paid sharing, and a strengthening financial profile.

The analyst highlighted certain encouraging details provided by the management, including higher per-user economics being generated by the ad-supported plans compared to the basic ad-free plans globally, healthy early results from paid sharing, and the decision to remove the basic ad-free plan for new and returning users in key markets.

While the analyst acknowledged that NFLX’s valuation is “rich,” he feels his rating upgrade is justified due to the underlying momentum and unique features of the business.

Wall Street’s Moderate Buy consensus rating on Netflix is based on 19 Buys, 12 Holds, and two Sells. The average price target of $466.39 implies about 13% upside. NFLX shares are up 41% year-to-date.

Conclusion

Wall Street is more bullish on Alphabet and Microsoft than on Netflix. Currently, the Street’s average price target indicates a slightly higher upside for Microsoft than Alphabet. Microsoft is well-positioned to drive higher revenue through its Azure business and the integration of AI into its products.