Joe Biden will become the 46th president of the U.S., and Wall Street is rejoicing. Analysts have previously stated that regardless of the winner, the end of the election will reduce a significant amount of uncertainty, and potentially pave the way for stocks to move higher.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Now, investors are waiting to see which party will gain control of the Senate, although it appears that the Republicans are in the lead. This is the favored outcome among investors as a divided government would take the more ambitious policies from either side out of the equation.

Against this backdrop, five-star analyst Salveen Richter from investment firm Goldman Sachs is pounding the table on two stocks in particular, noting that each could surge over 40% in the year ahead.

After running both tickers through TipRanks’ database, we found out that the rest of the Street is also standing squarely in the bull camp as each boasts a “Strong Buy” analyst consensus.

Kronos Bio (KRON)

First up we have Kronos Bio, which targets dysregulated transcription factors, or proteins that convert DNA to RNA, and their associated transcriptional regulatory networks (TRNs), which drive oncogenic activity. With several potential catalysts on the horizon, it’s no wonder Goldman Sachs thinks investors should get on board.

Looking more closely at the approach, TRNs are a complex network of proteins that work to control gene expression programs, and whose interactions are bi-directional, interdependent and dynamic. When they are dysregulated, they can create an oncogenic state.

“Despite the complicated interplay of TRNs (which has been historically difficult to characterize), KRON’s differentiated approach leverages its product engine for mapping of oncogenic TRNs to identify critical nodes (proteins, genes, or enzymatic substrates) that may be vulnerable to therapeutic intervention and uses the proprietary small molecule microarray (SMM) platform to identify potent and selective drug candidates against previously undruggable targets,” Richter explained.

The biopharma’s immediate efforts center around its two lead programs, entospletinib (designed as an SYK inhibitor) and KB-0742 (its CDK9 inhibitor). To this end, Richter argues that several developments related to these assets could push shares higher. An end-of-Phase 2 meeting is slated for 1H21, with KRON set to discuss its plans for the pivotal trial design and endpoints for evaluating entospletinib in 1L NPM1+ AML patients with regulatory agencies.

“We expect the key area of focus will be on the use of measurable residual disease (MRD) negative status as an acceptable endpoint for regulatory approval – we note prior precedents for its use in hematologic malignancies and evidence that NPM1 mutation absence is correlated with improved overall survival and relapse prevention in AML – thus we are optimistic on the path forward,” Richter mentioned. It should be noted that any decisions here will have “important implications on trial size and length of study,” in the analyst’s opinion.

Additionally, now that IND-enabling studies have wrapped up, KRON is planning to submit an IND for KB-0742 in Q4 2020, meaning initiation of the Phase 1/2 dose escalation and expansion trial could come in 2021.

Richter stated, “In our view, initial positive data will serve to partially de-risk KRON’s approach in identifying and targeting dysregulated transcription factors and provide confidence in the use of the SMM platform to differentially identify potent and selective inhibitors.”

If that wasn’t enough, when the company kicks off the Phase 1/2 entospletinib trial in R/R FLT3+ AML in 2021 and it files the IND for one of its discovery programs in 2022, Richter believes there could be even more upside. Commenting on the latter, the analyst said, “We see the areas of focus as logical given synergies across programs (e.g. targeting MYB for AML or ARv7 for solid tumors/prostate cancer) and look to advancement of a third program to provide visibility into the portfolio outlook.”

All of the above prompted Richter to initiate coverage with a Buy rating and $45 price target, suggesting 48% upside potential. (To watch Richter’s track record, click here)

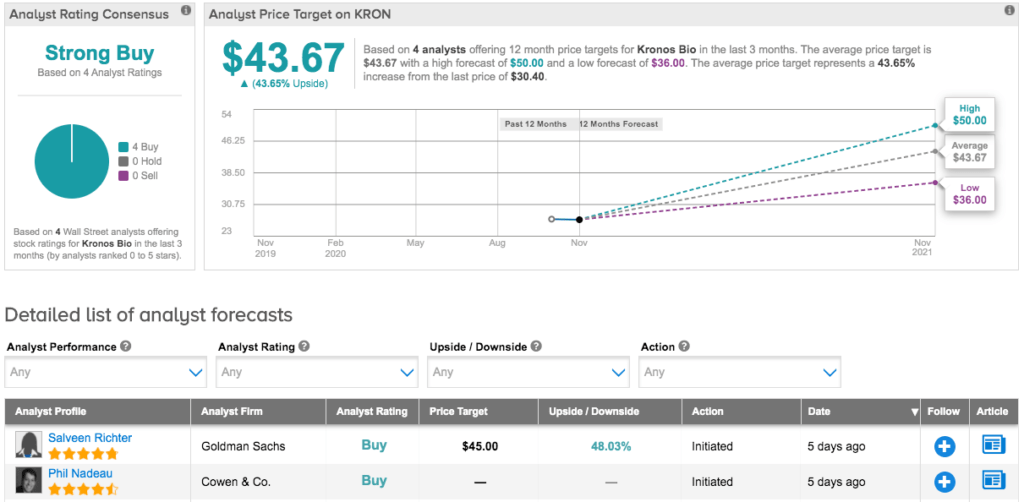

Are other analysts in agreement? They are. Only Buy ratings, 4 to be exact, have been issued in the last three months. Therefore, the message is clear: KRON is a Strong Buy. Given the $43.67 average price target, shares could rise 44% in the next year. (See Kronos Bio stock analysis on TipRanks)

Allogene Therapeutics (ALLO)

Focused on developing allogeneic chimeric antigen receptor T cell (AlloCAR T) therapies, Allogene Therapeutics hopes to find the next immunologic breakthrough in cancer. Ahead of an upcoming data readout, Goldman Sachs likes what it’s seeing.

According to Richter, investors are waiting for the first look at Phase 1 ALLO-715, its allogeneic CAR T cell therapy targeting BCMA, (UNIVERSAL) data in R/R multiple myeloma (MM). This data will be released as part of an ASH presentation. The Phase 1 UNIVERSAL trial is evaluating four dose levels of ALLO-715 and several lymphodepletion regimens, as well as ALLO-647 (its anti-CD52 antibody) 39 mg divided over three days.

“As we have previously noted, if successful, alternative routes of lymphodepletion could introduce greater flexibility of administration (cy/flu lymphodepletion is generally carried out only at the academic centers that specialize in stem cell transplants) and could potentially be an important step towards advancing the allogeneic CAR T therapies to an outpatient clinic,” Richter told clients.

Looking at the available clinical data, a dose-response with a 60% ORR was witnessed at dose level 3, with the ASH presentation potentially providing more clarity on dose level 4 and the benefit of a higher ALLO-647 dose within the preconditioning regimen. In one of the groups, one of the two responders was classified as having achieved a stringent complete response (sCR), with the other achieving a very good partial response (VGPR).

That being said, Richter will be monitoring the tolerability profile as one of the patients developed a non-neutropenic fever and multifocal pneumonia following the ALLO-715 infusion, and progressed to respiratory failure, with the death tied to the preconditioning regimen. Additionally, four patients had Gr3+ infections, but management stated that elevated infection risk is consistent with the underlying medical condition.

“We would note no changes to the trial protocol have been implemented with management maintaining confidence in the potential benefit of higher dose ALLO-647,” Richter said.

On top of this, Richter argues the Phase 1 ALLO-501 (its allogeneic CAR T cell therapy targeting CD19) data in relapsed and refractory non-Hodgkin lymphoma (NHL), which is expected in 1H21, will “provide a more robust view of durability and optimization of levers (including repeat dosing), which alongside ALLO-501A (its CAR T cell therapy targeting CD19 devoid of the rituximab switch) dose escalation data, will inform the pivotal trial design (2021 start).” The IND filings for ALLO-715 plus Springworks Therapeutics’ nirogacestat in R/R MM and ALLO-316 (an anti-CD70 CAR T) in renal cell carcinoma are also on track for YE20.

In line with her optimistic approach, Richter sides with the bulls, reiterating a Buy rating. She also bumped up the price target from $66 to $67. This new target conveys her confidence in ALLO’s ability to climb 141% higher in the next year.

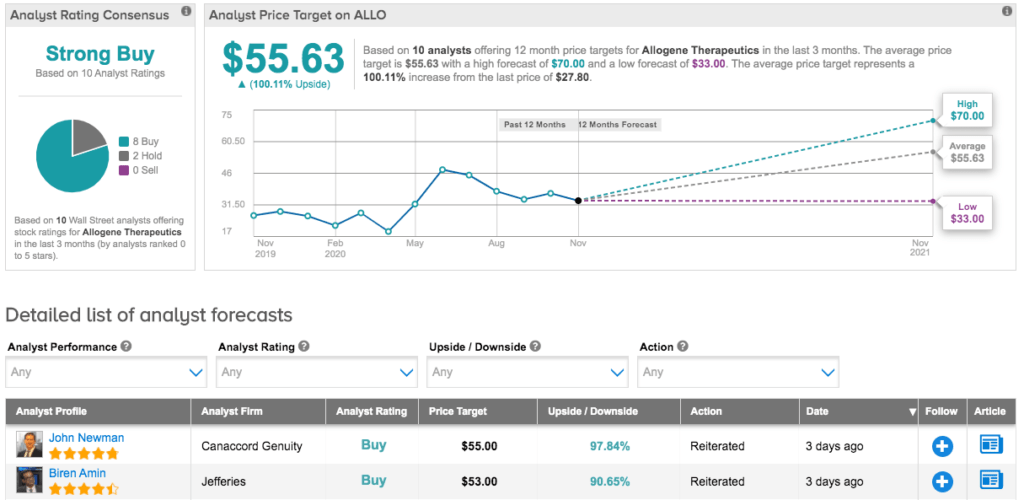

Most other analysts echo Richter’s sentiment. 8 Buys and 2 Holds add up to a Strong Buy consensus rating. With an average price target of $55.63, the upside potential comes in at 100%. (See Allogene Therapeutics stock analysis on TipRanks)

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.