Slow disinflation and a still-strong jobs market have sparked fears the Fed may be readying to pull the trigger on further aggressive rate hikes in an effort to cool off economic activity and bring inflation down.

Nevertheless, the overall backdrop of continued growth momentum isn’t necessarily bad for stocks, according to Goldman Sachs strategist Kamakshya Trivedi.

“Our overall view is still more consistent with slow disinflation amid some further improvement to global growth. That mix should maintain the upward pressure on yields but ultimately limit the damage to equities,” Trivedi opined.

The banking giant’s stock analysts are taking that line forward, and seeking out the equities that will do more than just ‘limit damages.’ In fact, the analysts see a trio of lesser-known stocks posting gains of at least 60% and going past 100%.

We ran them through the TipRanks database to see what makes them appealing investment choices right now.

Sea, Ltd. (SE)

The first Goldman pick is Sea, a Singaporean firm acting as a tech holding company. Sea operates through its subsidiaries, which have built up a global reach in several online sectors, including e-commerce, online financial services, and gaming. The company’s Shopee brand handles the retail end, the SeaMoney brand, which is one of Southeast Asia’s leading online finance providers, has the financial services, and Garena is the online game development and publishing platform.

All of this boiled down to several years of strong revenue growth – at the expense of profitability. In 3Q22, its quarterly earnings report showed an adjusted net loss of $357.7 million, a loss more than double the $167.7 million 3Q21 figure. That said, revenues for 3Q came in at $3.2 billion, for an 18.5% year-over-year increase, while gross profit was up 21% y/y to $1.2 billion. We’ll see if Sea’s performance has continued to assuage investors, when the company releases 4Q22 and full year numbers on March 7.

Covering Sea for Goldman Sachs, analyst Pang Vittayaamnuaykoon believes the stock will outperform the market, as she sees accelerated path to profitability this year.

“In the mid to longer term, we forecast mid-high teens % ecommerce growth, reflecting our view that Shopee will start reinvesting again post breakeven (while staying profitable) in growth to defend its leadership position and expand in growth areas… On Gaming, we believe that the street has already priced in continual EBITDA decline, which provides downside support; while SeaMoney, largely overlooked, is set to break even in 1Q23E. With this, we now believe SE will generate EBITDA of US$1.1bn/US$4.1bn by FY23/25E,” Vittayaamnuaykoon opined.

With a risk-reward profile that “remains attractive,” Vittayaamnuaykoon added SE to Goldman’s Conviction List. The analyst rates the stock a Buy and her $132 price target suggests an upside of ~101% in the course of the coming year. (To watch Vittayaamnuaykoon’s track record, click here)

Overall, Sea shares have a Strong Buy rating from the analyst consensus, based on 6 recent analyst reviews that include 5 Buys and 1 Hold. The shares are selling for $65.71 and their $88.17 average price target implies room or a 12-month upside of ~34%. (See SE stock forecast)

Krystal Biotech (KRYS)

The second Goldman choice is Krystal Biotech, a clinical-stage biopharma company working on new gene therapies to address serious, rare conditions caused by single-gene mutations or absences. Krystal’s unique twist on gene therapy is a focus on redosable therapeutic agents, to provide best-in-class treatments. Among the disease conditions addressed by the new drug candidates in Krystal’s development pipeline are Dystrophic epidermolysis bullosa (DEB), TGM1-deficient Autosomal Recessive Congenital Ichthyosis (TGM1-deficient ARCI), and cystic fibrosis (CF).

The company’s leading drug candidate, B-VEC (branded as Vyjuvek), was the subject of a recent Phase 3 study in the treatment of DEB. This is a rare, frequently fatal, blistering condition of the skin caused by a lack of a particular collagen protein. The B-VEC drug candidate aims to treat both recessive and dominant forms of this genetic disease. In December of last year, the company published positive results from the Phase 3 clinical trial, and has since received notice from the FDA that the PDUFA date for the Biologics License Application – a key step in regulatory approval of a new drug – is set for May 19, 2023. Labelling discussions between the company and the FDA will begin no later than April 20.

Elsewhere in the clinical pipeline, Krystal expects to soon start dosing patients in the Phase 2 portion in the study of KB105, a treatment for TGM1-deficient ARCI. The trial is enrolling both adult and pediatric patients, and will address the safety and efficacy profiles of the drug candidate.

The third drug candidate in the clinical stage is KB407, a potential treatment for CF. In August of last year, Krystal announced that the FDA had approved the IND application, clearing the way for a clinical trial, and the Phase 1 trial in the US is scheduled to start during 1H23. The company is already conducting patient screening for enrollment in an Australia-based Phase 1 trial of KB407.

On a final note for the clinical program, Krystal is preparing an IND application for KB101 to be submitted this year. This drug candidate is being developed for the treatment of Netherton Syndrome, another dangerous, genetically-defined, skin condition.

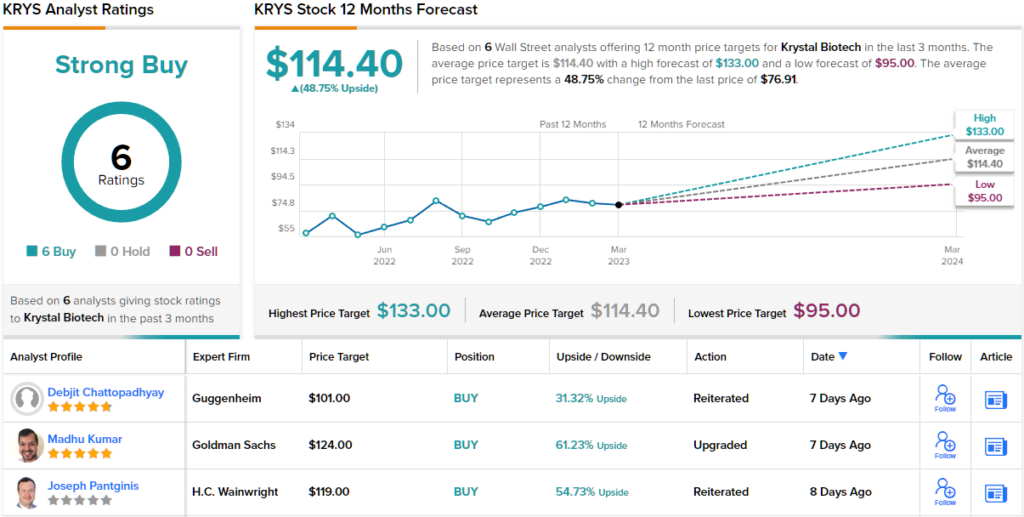

While Krystal has plenty of promising research tracks in its development pipeline, the main news revolves around the leading program, B-VEC/Vyjuvek. Goldman’s 5-star analyst Madhu Kumar writes of this program: “The 5/19 PDUFA for Vyjuvek for dystrophic epidermolysis bullosa (DEB) remains the key NT event for KRYS shareholders. Our 90% POS and investor conversations indicate potential approval and debates around Vyjuvek are now primarily focused on the launch… We have revised our market model to better reflect Vyjuvek’s opportunity in DEB (peak global unadjusted sales increase from $1.2B to $1.5B with an accelerated ramp in early years of the launch with 25% and 48% of peak penetration being reached in 2024 and 2025), which we believe could drive further upside for KRYS shares.”

In Kumar’s view, this supports a Buy rating on KRYS shares and a $124 price target that implies a 61% upside for the next 12 months. (To watch Kumar’s track record, click here)

Overall, this biotech stock has picked up a unanimous Strong Buy consensus rating from the Street’s analysts, based on 6 recent positive reviews. The shares have a $76.91 trading price, and the average price target, standing at $114.40, suggests a gain of ~49% on the one-year time frame. (See KRYS stock forecast)

Inter & Company (INTR)

The last Goldman pick we’re looking at is Inter, a Brazilian-based financial firm providing a wide range of banking services, including asset management, insurance brokerage, and securities to individual, retail, and commercial clients. The company’s banking segment includes checking and deposit accounts, credit and debit cards, and various loan services. The Securities segment aids in the purchase, sale, and custody of various security assets, as well as portfolio management, while the Insurance segment offers all of the common insurance products, including life, property, auto, financial, and health/dental policies, as well as travel and credit protection.

Inter has quickly become a leader in Brazil’s digital banking sector, and has seen its customer base expand from just 1.5 million in 2018 to 24.7 million at the end of 2022. Even better, 66% of the company’s clients use 3 or more of Inter’s financial products. As of the end of last September, Inter boasted over 28 billion Brazilian reals (US$5.39 billion) in customer deposits, and a loan portfolio totaling over 22 billion reals (US$4.23 billion) – up 47% year-over-year.

While Inter got its start in Brazil, the company is not confining its operations to that country. Inter boasted 501,000 global accounts at the end of September 2022, and reported opening 5,500 new global account per day in the first 9 months of last year.

The Goldman view on this stock, set out by analyst Tito Labarta, is based on solid prospects for further growth. Labarta notes three key points driving the company’s success: “1) an increased focused on profitability with a more prudent approach to growth and pricing, as well as efforts to improve efficiency… 2) sound digital platform/super app — Inter has built one of the most complete digital platforms in Brazil, combining banking, investments, and e-commerce, among others; 3) credit as a growth lever — credit is the largest profit pool for Brazil banks and Inter still has modest market share in most of its operations, between 1-2%. Delivering on growth and keeping asset quality under manageable levels can close most of the gap to incumbents’ profitability…”

For Labarta, this comes out to a $4.20 price target, indicating room for robust share growth of 113% in the coming year, along with a Buy rating on the stock. (To watch Labarta’s track record, click here)

Is the rest of the Street in agreement? The majority of other analysts are. 4 Buys, 1 Hold and 1 Sell have been issued in the last three months, so the word on the Street is that INTR is a Moderate Buy. The shares are priced at $1.97 and have an average target of $3.54, implying a one-year upside of ~80%. (See INTR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.