There’s been no hiding place for most investors seeking shelter from 2022’s stormy market conditions. Most corners of the market have been subjected to a torrid time, pushed under by a combination of soaring inflation, the aggressive interest rate hikes taken in order to tame it, and a global macro environment rocked by Russia’s invasion of Ukraine and China’s zero-Covid policies.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The fear now is that a recession in 2023 is all but inevitable – either of the mild variety or a lengthy and painful one.

So, investors are on shaky ground, and it is hard to know the right stocks to lean into in such an environment. This is where some help from the analysts at leading investment firms such as Goldman Sachs can come in handy.

The firm’s stock analyst have pinpointed two names that they feel are ripe for the picking right now. Even against the weak economic backdrop, the analysts see both delivering returns of over 70% in the coming year. Do other Street analysts agree? This we can find out with help from the TipRanks database, a tool that tracks and measures the performance of Wall Street’s analysts. So, let’s dive into the details and see why the Goldman analysts think these stocks can jump from here.

Braze, Inc. (BRZE)

The first Goldman pick we’re looking at is Braze, an American cloud-based software specialist. This SaaS firm’s customer engagement platform helps its clients automate and analyze their marketing activities, with the goal of improving communication channels between consumers and brands. Its main functionalities include data ingestion, classification, personalization, orchestration, and execution.

The company has operations in the U.S., UK, Germany, Japan and Singapore and boasts over 1,700 customers, with some big names amongst them; Burger King, HBO Max, Skyscanner, PureGym, Grubhub, NASCAR and CleanChoice Energy, are all on its client list.

Software vendors have been impacted by the slowing economy, but Braze still showed some excellent top-line growth in its recently released Q3 report. Revenue increased by 45.6% year-over-year to $93.13 million, beating the Street’s forecast by $2.53 million. For the trailing 12 months, the company attained dollar-based net retention of 126%.

On the bottom-line, adj. EPS of -$0.15 also came in ahead of the analysts’ projections for -$0.22. While the company is still a regular loss-making endeavor, it has beaten bottom-line expectations in every quarter since going public toward the end of last year

The entry into the public markets came at an unfortunate time. The stock has in no way been immune to the market woes of 2022, falling 65% since the turn of the year.

Nevertheless, Goldman Sachs’ Gabriela Borges sees plenty to like about the company. She writes, “Despite the overhang from macro into 2023, we remain positive on Braze’s long-term opportunity to grow sustainably by consolidating spend at existing customers and landing significant new business with organizations looking to upgrade their marketing technology stacks. In our view, Braze’s technology is fundamentally architected in a way that sets the company up for material share gain in the coming years.”

Accordingly, Borges rates Braze shares a Buy, while her $48 price target makes room for 12-month gains of 77%. (To watch Borges’s track record, click here)

The Street is evidently confident this is a stock to own; it has garnered 13 analyst reviews over the past 3 months, and all are positive, making the consensus view here a Strong Buy. At $40.75, the average target suggests the stock is inline for gains of ~50% over the next year. (See BRZE stock forecast on TipRanks)

Splunk Inc. (SPLK)

The next Goldman-endorsed name is Splunk, a big data analytics company. Businesses make use of Splunk’s advanced machine learning technology to mine vast amounts of data for insights. The information can then be used to support company decisions and ensure efficient operations. With a customer base of 20,000+, Splunk is a recognized leader in IT operations and security and known as an innovator in its field.

With a focus on big data, cloud and cybersecurity, Splunk operates at the intersection of some strong secular trends and the company delivered excellent financial results for the third quarter of fiscal 2023. Boosted by strong license revenues climbing 54% year-over-year, revenue reached $930 million, amounting to a 40% increase on the same period last year, and coming in $83.47 million above the consensus estimate. Cloud revenue also grew 54% to $374 million y/y, although that marked a deceleration from the +59% of Q2 and +66% of Q1.

On the bottom-line, adj. EPS turned from -$0.37 in the year-ago period to $0.83, handily beating the $0.25 anticipated by the prognosticators. The company also raised its revenue outlook for the full year from between $3.35 billion and $3.4 billion to between $3.455 billion and $3.485 billion. Consensus had $3.38 billion. Additionally, operating margin is anticipated to be in the 12% to 13% range, up from 8% beforehand.

Among the bulls is Goldman Sachs analyst Kash Rangan, who likes the look of what’s on offer.

“Despite the slowdown in cloud growth, we are encouraged by support to overall revenue growth from the strong license renewal base. This provides a cushion to total revenue growth in the current macro environment, with potential upside in a recovery scenario driven by an ASP uplift as customer cloud conversion trends normalize. We remain positive on Splunk’s underappreciated cloud story, as the company successfully navigates the transition under the direction of the new CEO. Furthermore, the company operating at the Rule of 40+ (revenue growth + free cash flow margin) in FY23 could drive the stock into a higher valuation territory,” Rangan opined.

To this end, Rangan rates SPLK a Buy, backed by a Street-high target of $173. Investors could be pocketing gains of ~105%, should Rangan’s thesis play out as expected. (To watch Rangan’s track record, click here)

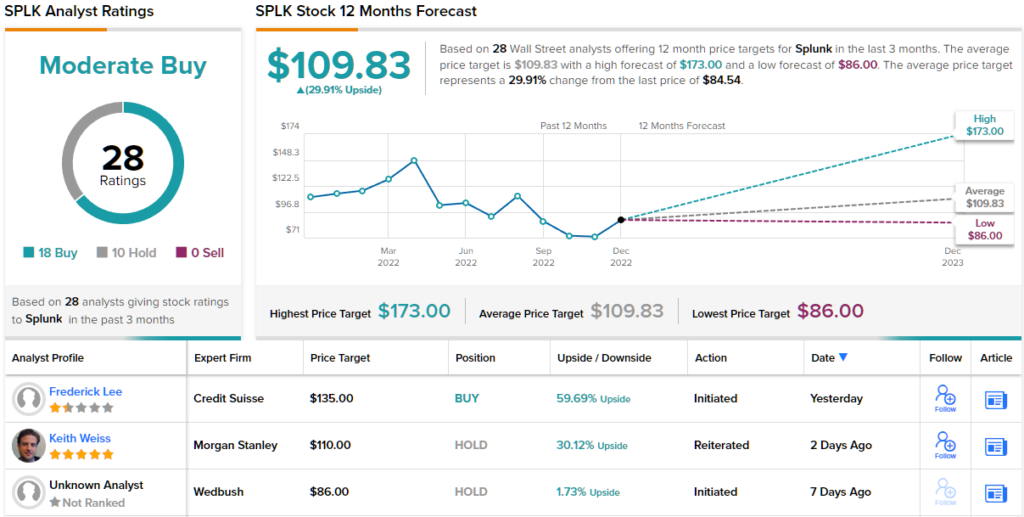

How does Rangan’s bullish bet weigh in against the Street? It appears the Goldman Sachs analyst is not the only one enthusiastic on Splunk’s prospects. With 18 Buy ratings vs. 10 Holds (i.e. Neutrals), the stock claims a Moderate Buy consensus rating. The average price target among these analysts stands at $109.83, implying ~30% rise from current levels. (See Splunk stock forecast on TipRanks)

Don’t miss: Billionaire David Rubenstein Says Recession Is Likely, but Stays Heavily Invested in These 2 Stocks

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.