In some important ways, the Chinese economy has lagged the US in recent years. The country held on to anti-COVID lockdown policies much longer than most others, but after nearly three years of restrictions it has finally been opening up. The result is a strong surge in growth, according to recent Chinese government data.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The country’s GDP grew 4.5% in 1Q23, compared to 2.9% in 4Q22. A particular strength noted in the Chinese data was the 10.6% increase in March’s retail sales. Weaknesses included industrial output, which missed the 4% forecast and came in at 3.9%.

But the overall picture is one of growth, and Hui Shan, chief China economist for Goldman Sachs, said in a recent interview, “[The] data are in line with our full-year bullish view for China growth. That is the kind of the rebound after the reopening [and] is at the core of why we have our above consensus forecast of 6% growth for the full year.”

Taking this forward, the stock analysts at Goldman have been pointing out Chinese stocks that are likely to see gain in the US markets. And just as China’s economy is growing fast coming out of the COVID gate, these Chinese stocks are showing, in Goldman’s view, 50% or better upside potential for next 12 months.

ZTO Express (ZTO)

First under the Goldman Sachs microscope is ZTO Express, a delivery company that has taken advantage of the fast growing digital merchandising sector in China. Since its start in 2002, ZTO has expanded its market share in parcel delivery in China to more than 20%. The company has grown with its home country’s e-commerce sector, and its growth, as a delivery company specializing in online orders, has in turn been an asset for online retailers. ZTO partners with some of China’s major online retail sites, including Alibaba and JD.com.

ZTO has powered its own expansion through its scalable network partner model. The partners typically handle first- and last-mile transport – the pickup and delivery end of the chain, while ZTO works at line-haul transport and sorting operations. The model provides the company with both operational efficiency and economies of scale, while controlling costs. The company is working to expand its network, and has reported strong growth in parcel delivery volume in recent quarters.

As is typical for firms with tight connections to retail, ZTO shows a predictable seasonal pattern in its quarterly earnings and revenues. The high point is typically Q4, the height of many holiday shopping seasons, followed by a drop in Q1. The last quarter reported was Q4 2022, and the company will report its 1Q23 numbers next week, so a quick review of the previous quarter’s performance would be a good way to prepare.

In the final quarter of 2022, ZTO saw revenue of $1.43 billion, up 7.1% year-over-year. This result just missed the forecast, by slightly more than $20.4 million. The quarterly revenue was supported by strong growth in operations, including a 3.9% y/y increase in parcel volume, to 6.593 billion. ZTO boasted more than 31,000 outlets for pickup and delivery; 5,900 network partners; 98 sorting hubs; and some 11,000 self-owned line-haul truck as of December 31, 2022.

At the bottom line, ZTO reported a non-GAAP ‘earnings per American depositary share’ (EPS) of 37 cents, or 1 cent below expectations. The company’s adjusted EBITDA came in at $492.6 million, for a 24% year-over-year gain.

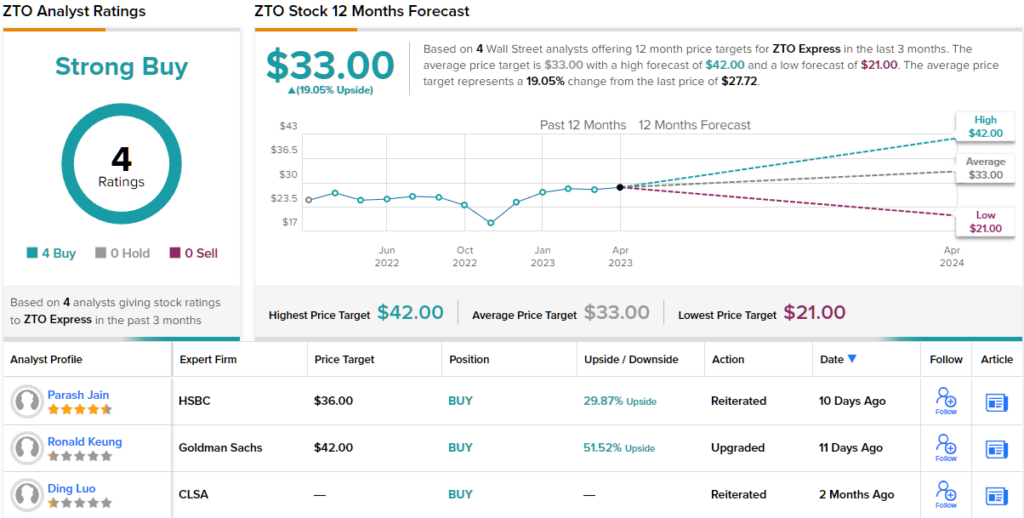

Goldman Sachs analyst Ronald Keung is upbeat about the rebound in China’s online economy, and writes of this stock, “We upgrade ZTO to Buy from Neutral, as (1) we expect its market share gain story to resume this year (we expect +1.5ppt share gain in FY23), (2) valuation looks attractive with 18X 23E ex-cash P/E coupled with 25% earnings growth CAGR, alongside (3) its dual-primary listing that management expects to complete this quarter, paving the way for its subsequent Southbound inclusion.”

To this end, Keung gives ZTO stock a price target of $42, implying a gain of 51.5% from current levels, to go along with his Buy rating. (To watch Keung’s track record, click here)

Overall, all four of the recent analyst reviews on ZTO are positive, for a unanimous Strong Buy consensus rating. The shares are selling for $27.72, and the average price target of $33 suggests a potential increase of 19% going out to the one-year time horizon. (See ZTO stock forecast)

iQiyi, Inc. (IQ)

Next up on our list of Goldman’s China picks is iQiyi, the largest online streaming service in China. iQiyi was founded more than a decade ago, by Baidu and now has a leading market share in China’s video-on-demand.

Through its platform, the company provides a wide range of video programming to the Chinese market, including reruns of existing programming and in-house production. iQiyi has more than 50 production studios, and has developed stand-along and serialized original programming. The company follows a subscription for service model, selling access to its library of on-demand video.

Viewers can choose from ad-supported or VIP subscription services, and thematic choices range from drama serials, to old and new movies, to variety shows, to anime. The company offers localized language options, and subtitles, to make viewing, and has a daily subscriber base more than 100 million strong.

On the financial side, iQiyi turned from quarterly net losses to net profits from 2021 to 2022. In the last reported quarter, Q4 2022, iQiyi showed a quarterly profit of 14 cents according to non-GAAP measures. This was a tremendous turnaround from the 32-cent loss in Q4 2021 and beat estimates by 7 cents.

The profits were derived from a top line of $1.1 billion, which was down 8% y/y but $10 million ahead of the forecast. The company’s performance benefited from strong subscriber growth, which expanded from 97 million daily subscribers in 4Q21 to 101.01 million in 3Q22 to 111.6 million in 4Q22. The company will report its 1Q23 results on May 16.

Turning to the Goldman view, we find that analyst Lincoln Kong is upbeat on iQiyi’s prospects. He writes: “We believe 2023 remains the year for IQ to regain market share with accelerating revenue and sustained profitable growth… [We] expect IQ to deliver above-peers revenue growth in an industry with improving competition dynamics, and is set to see accelerating fundamentals off a low base (for both time spent and subscription) starting June-July.”

These comments support Kong’s Buy rating on the stock, and his price target of $10 points toward a 65% upside for the coming year. (To watch Kong’s track record, click here)

Overall, there are 8 recent analyst reviews on record for IQ shares, including 7 Buys against just 1 Hold, and giving the stock a Strong Buy consensus rating. The shares have a $9.41 average price target, indicating ~56% upside potential from the $6.05 selling price. (See IQ stock forecast)

Baidu, Inc. (BIDU)

Baidu has been described as ‘China’s Google,’ as it is the largest online search engine platform in the Chinese language internet. Founded in 2000, Baidu has long since diversified its businesses, and is now also one of China’s leading AI companies. Baidu currently operates through two segments; the smaller is iQiyi, while the larger, Baidu Core, accounts for more than 70% of Baidu’s total revenues.

Baidu Core provides a variety of online marketing services, as well as ‘non-marketing value added’ services. The company’s AI initiatives power a set of growing business segment, including the app platform Mobile Ecosystem; the AI Cloud; and Intelligent Driving.

Annual revenue last year was down slightly from 2021, slipping from $19.3 billion to 18.36 billion, or just under 5%. The firm’s 1Q23 financial release is scheduled for May 16, but we can look back at Q4 to see where it stands.

At the top line, quarterly revenue in 4Q22 came to $4.8 billion, flat y/y but $170 million ahead of expectations. At the bottom line, the company reported $2.21 in earnings per American depositary share, a figure that was up 31.5% from the prior year and which beat the forecast by 16 cents. Baidu demonstrated strong cash generation in the quarter, reporting free cash flow of $859 million, or $736 million with iQiyi’s contribution taken out. At the end of 2022, Baidu had a total of $26.87 billion in cash and liquid assets on hand.

We can check in again with Lincoln Kong for the Goldman view, who sees Baidu continuing to gain going forward. Kong writes of the stock, “Looking into 2023E, we believe Baidu is set for accelerating revenue/profit growth on a better macro backdrop benefiting Ads and cloud business (from 2Q onwards), and clearer visibility on monetization/traffic generation from ERNIE LLM, and hence expect 13% sales and core OP growth for 2023-24E. With the stock trading at 14X 2023E PE, and net cash accounting for more than 30% of market cap, we see continued favorable risk-reward.”

Quantifying his position here, Kong rates BIDU as a Buy, and his $186 price target indicates room for ~51% share appreciation over the next 12 months. (To watch Kong’s track record, click here)

Tech firms get plenty of attention from Wall Street, and Baidu has 13 recent analyst reviews on file. All of them are positive, too, giving the stock its Strong Buy consensus rating. Shares in BIDU are trading for $123.43 and the $193 average price target implies ~56% upside from current levels. (See BIDU stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.