In the ever-evolving world of stocks, the year has seen its share of ups and downs. Currently, the stock market grapples with the headwinds of rising interest rates and the resulting surge in bond yields. At the same time, there is reason for optimism.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Based on historical patterns, Q4 is typically the year’s strongest for US stocks, and investment bank Goldman Sachs is sticking resolutely with its earlier year-end price target of 4,500 on the S&P 500.

“Our baseline view remains that the index will rise to 4500 by year-end,” said the firm’s head of investment strategy David Kostin, “as a result of modest EPS growth and a roughly flat multiple.” Based on current levels, a rise to 4,500 will translate to an increase of ~5% for the S&P.

The bank’s stock analysts are following this thesis, picking out the stocks that they see as ready to gain, and to gain big. Their picks include stocks with potential, in some cases, to double investors’ money. That’s a serious gain by any standard, and the Goldman analysts have explained just why some of their picks may show such a substantial jump. Let’s take a closer look.

Moderna, Inc. (MRNA)

We’ll start with Moderna, a biotech firm working on mRNA vaccine technology. You’ll likely remember mRNA vaccines from the recent pandemic; it was the technology used to create the viable COVID vaccines, and Moderna was one of the first companies to bring such a vaccine to the market. Moderna, however, is much more than just that – the company has a broad portfolio of vaccines under development or in commercialization stages. The company’s 48 pipeline projects include vaccines for flu and RSV, Lyme disease, and even some cancers.

For investors, the most relevant parts of Moderna’s pipeline are those concerned with the next iterations of the COVID vaccines. These are being developed to cope with new strains of the virus, which is showing signs of becoming an endemic seasonal virus in human populations, not unlike the various strains of influenza. In fact, Moderna’s newest COVID vaccine research is designed to combine the vaccines with flu vaccines, allowing patients to receive a single shot each season.

In addition, the company has commenced working in partnership with Merck on an advanced immune-oncology project for the treatment of melanoma. This project includes a Phase 3 clinical trial, a randomized, double-blind, placebo- and active-comparator-controlled study, designed to study the efficacy of the new drug candidate mRNA-4157 as a combination therapy with the existing anti-cancer drug Keytruda when compared to Keytruda alone. The trial is a global study, set to take place at more than 165 locations in 25 countries and enroll well over approximately 1,089 patients.

The potential of these programs helped to outweigh recent drop-offs in revenue and earnings, and boosted Moderna’s attractiveness for Goldman analyst Salveen Richter.

“In 4Q23, we anticipate updated Ph2 efficacy data in adjuvant melanoma from the MRK-partnered individualized neotantigen therapy (INT) where we believe a path to accelerated approval is possible in addition to next-generation COVID+flu combination vaccine data. MRNA guided to up to 15 product launches over the next five years across these four verticals, with $10bn-$15bn in annual sales in oncology, and rare and latent diseases by 2028 in addition to $8bn-$15bn from the respiratory franchise in 2027. The updates signal an expectation for a meaningful transition beyond a solely COVID-driven story as potential revenue drivers emerge,” Richter explained.

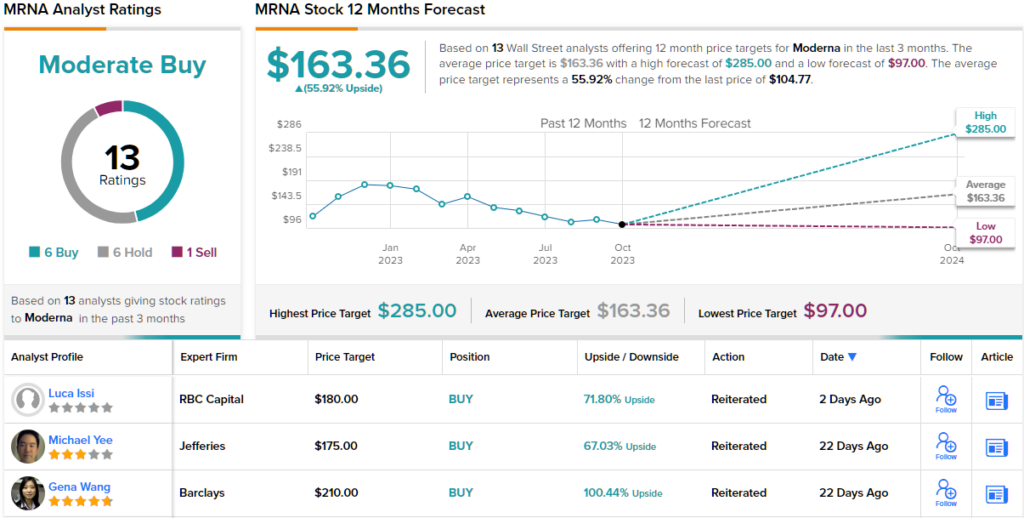

For Richter, these comments lead into a Buy rating, and her price target, set at $285, implies a robust one-year upside potential of 172%. (To watch Richter’s track record, click here)

Overall, Moderna has picked up 13 recent analyst reviews, which include an even 6-6 split between Buys and Holds, plus one Sell, for a Moderate Buy consensus view. The shares are trading for $104.77, and their average target price of $163.36 suggests they’ll gain 56% in the year ahead. (See Moderna stock forecast)

Organon & Co. (OGN)

The second Goldman Sachs pick we’re looking at, Organon, is based in Jersey City, New Jersey, and puts its focus on women’s health and reproductive medicine. The company offers a varied portfolio of therapies and other products, including medications to treat reproductive conditions and heart disease, as well as issues in oncology, immunology, and dermatology. The product portfolio, dedicated to women’s health, is heavy on biosimilars and established medicines.

In a move that is typical of Organon’s operations, the company recently entered into a license agreement with Daré Bioscience (DARE) for marketing and commercialization of the recently approved drug Xaciato. This is a medicated cream for the treatment of bacterial vaginosis in women ages 12 and up. Daré holds the global license, and Organon, with its reputation and network in the field of women’s medicine, handles marketing and commercial expertise.

Other leading products in Organon’s lineup include the fertility drug and injection system Follistim, and the contraceptive drug Nexplanon. In addition, Organon reported this month successful results from the first real-world observational study of its JADA System, a medical device designed to quickly and effectively control post-partum bleeding.

All of this supported Organon’s revenue and earnings beats in the 2Q23 report. The company reported a top line of $1.61 billion, which beat the forecast by $51.34 million, and it showed a bottom line, in non-GAAP measures, of $1.31 per share, 32 cents per share better than had been expected. Organon also declared a quarterly dividend of 28 cents per common share, which yields 6.8% based on the annualized payment of $1.12.

Chris Shibutani, a 5-star analyst with JPMorgan, is impressed with Organon’s overall position, and lays out why investors should pick up this stock now.

“Amidst cross currents including relative strength from core CV/Resp products, with potentially offsetting uncertainties from dynamics in China (VBP), emerges evidence that the business is making progress towards achieving relative stability. We are further encouraged by performance in the US from Nexplanon (+1% ahead of our expectations but more materially, ~10% above consensus), as well as Follistim – franchise products in Women’s Health. While revenue expectations for Biosimilars remains modest, tactical progress with Hadlima (biosimilar Humira), with ordering levels, formulary access thus far, and positive results from their interchangeability (IC) study, indicate solid execution and a potential IC indication in 2024,” Shibutani explained.

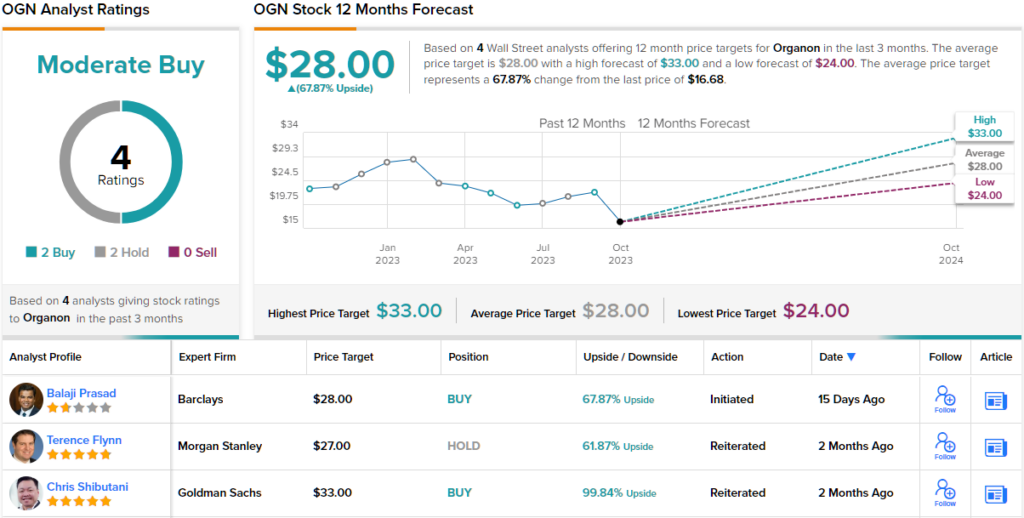

Shibutani’s stance here backs up his Buy rating, and his $33 price target points toward a high one-year potential upside of nearly 100%. (To watch Shibutani’s track record, click here)

All in all, Organon holds a Moderate Buy consensus rating from the Street, based on an even split in the 4 recent analyst reviews: 2 Buys and 2 Holds. The stock’s $28 average target price indicates room for ~68% upside growth from current levels. (See Organon stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.