There are probably as many investing strategies as there are investors – but just because every investor will follow his own path and intuition, doesn’t mean that there can’t be some common themes. Whether it’s seeking out stocks with low share prices or solid growth potential, or following the market’s best dividend payers, some strategies come up over and over again.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

One of these common themes to is to follow the money, that is, to buy into cash-rich stocks. These will bring several advantages to the table, as their deep pockets will help to insulate them against economic shocks and give them the resources to withstand most headwinds. Additionally, many cash-rich stocks are also known for making generous capital returns to shareholders, through combinations of share buybacks and dividend payments.

The stock analysts at Goldman Sachs are following this path, and seeing the US economy as currently in a slowdown phase, during which investors traditionally favor a safety-first approach, they have been pointing out deep-pocketed stocks that are offering total returns of at least 11%. These aren’t necessarily the biggest dividend payers – but their combinations of cash reserves, buybacks, and dividend payments give them total returns that will easily beat inflation and provide investors with a ‘place of safety’ as a possible recession looms on the horizon.

We’ve opened up the TipRanks database, to pull the details on two of these Goldman picks. Let’s see just what these stocks have to offer and check out the comments from Goldman’s analysts.

Tapestry, Inc. (TPR)

The first stock we’re looking at, Tapestry, is based in New York. It’s a multinational holding company, and the owner of three well-known names in luxury fashion: Coach, Kate Spade, and Stuart Weitzman. Tapestry’s brands are operated as independent entities, although they share a common commitment to authenticity, excellence, and innovation. As a luxury retailer, Tapestry has a global reach. The company strives to turn its customer base into an empowered commercial community, and to turn the fashion industry toward sustainability.

In August, Tapestry announced it had entered a definitive agreement to acquire Capri Holdings, a firm that, like Tapestry, is a parent company to three luxury fashion brands. The acquisition will bring Capri’s brands, Versace, Jimmy Choo, and Michael Kors, under the Tapestry umbrella. Tapestry, the acquiring firm, will pay Capri’s shareholders $57 for each share, giving the transaction an approximate value of $8.5 billion.

The Capri acquisition bodes well for Tapestry going forward, but in the recently reported fiscal 4Q23, the company missed quarterly expectations even as it completed a strong overall year. The 4Q revenue of $1.62 billion was flat year-over-year, and some $30 million below the forecasts; at the bottom line, EPS of 95 cents was up 20% y/y but was also 1-cent lower than had been expected.

For 2023 as a whole, however, Tapestry reported some solid metrics. The full-year diluted EPS, based on a net income of $936 million, was $3.88 – up 22% y/y and a company record. And, during the year, Tapestry returned approximately $1 billion to shareholders.

That shareholder return was supported by $791 million free cash flow, compared to $759 million in the prior year. Share repurchases totaled over $700 million in fiscal year 2023, and dividend payments came to more than $283 million. Going into fiscal 2024, the company has raised the quarterly dividend by 17%, to $0.35 quarterly or $1.40 annualized. Tapestry’s total return yield, taking the dividend and buybacks together, comes to ~13%.

For Goldman’s Brooke Roach, despite the recent disappointing results, Tapestry’s combination of market position and solid management add up to a stock worth recommending. She writes of TPR, “We acknowledge the several headwinds in the quarter which were larger than our prior expectations (NA -8% Y/Y) as a result of weaker conversion trends for the value-oriented consumer. That said, we are encouraged by TPR’s actions to improve sales trends here, and management’s commentary regarding a significant QTD acceleration (now trending flat Y/Y). We continue to believe that TPR’s DTC positioning, globally diversified operating model, strong brand momentum at Coach, and execution of strategic initiatives will continue to drive relative outperformance against a choppy macro.”

Looking ahead, Roach gives the shares a Buy rating and a $46 price target that implies a 50% potential gain in the next 12 months. (To watch Roach’s track record, click here.)

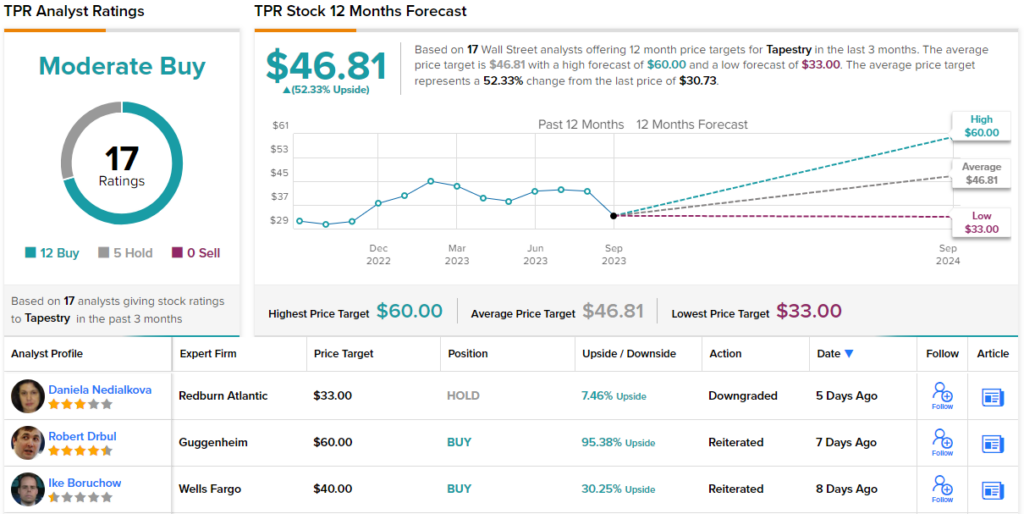

Overall, Tapestry’s Moderate Buy consensus rating is based on 17 recent analyst reviews, including 12 Buys and 5 Holds. The average price target stands at $46.81, suggesting a one-year upside potential of 52%. (See Tapestry’s stock forecast.)

American International Group (AIG)

American International Group, the second Goldman pick we’ll look at, is better known by its initials (and stock ticker), AIG. The company is a leading player in the global insurance industry, offering commercial and retail customers worldwide a full range of insurance products, including property casualty, life, liability, financial, and accident & health policies, along with retirement solutions and other financial services. The business thrust is clear; AIG helps its customers protect their assets through risk management, while providing for future security.

The insurance industry is well-known for generating high income, and AIG brought in an after-tax attributable income (AATI) of $1.3 billion in its last quarter, 2Q23. This compared favorably to the $1.1 billion AATI from the previous-year quarter. The resultant adj. EPS of $1.75, was up almost 26% y/y. The company attributed the increase to higher results in the life insurance and retirement segments of the business; a 9% reduction in the weighted average diluted shares outstanding also contributed to the high EPS, which beat the forecasts by 17 cents per share.

For return-minded investors, the key point here is that AIG returned some $822 million in capital to its shareholders during the second quarter of this year. The company did this through both a share repurchase policy and a common share dividend. On the first, AIG repurchased $554 million worth of common stock during the quarter; on the second, AIG paid out $268 million in dividends to common shareholders. The common stock dividend, at 36 cents per share, reflected a 12.5% increase in the payment, marking the first dividend increase since 2016. Between the dividend and the effects of share repurchases, AIG returns 11% to investors.

The underlying strength of AIG attracted Goldman analyst Alex Scott to this stock. He points out that AIG is likely to continue its solid performance, and writes, “We remain optimistic that AIG will drive ROE expansion through underwriting improvement, greater underwriting leverage, expense reduction, capital management / share repurchases, and net investment income. We increasingly believe that our thesis around the ROE improvement and potential for this company to trade in excess of adjusted BVPS (book value per share) is very real. Ultimately, we think execution on all fronts of the company’s strategy likely yields an ROE more significantly in excess of 10% and with the help of higher interest rates persisting we think the company will get to a 10%+ ROE potentially quicker than we had anticipated.”

Putting his stance into quantifiable terms, Scott rates these shares as a Buy, with an $81 price target to suggest 32% share appreciation over the coming year. (To watch Scott’s track record, click here.)

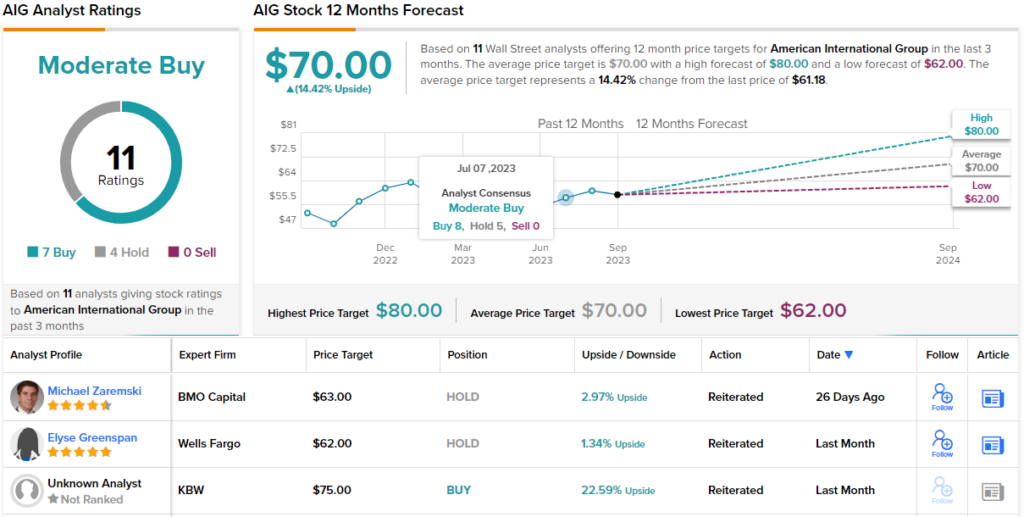

Of the 11 recent analyst reviews on record for AIG, 7 are to Buy against 4 Holds – giving the shares a Moderate Buy consensus rating. With an average price target of $70, and a trading price of $61.18, AIG can claim a one-year upside potential of 14%. (See AIG’s stock forecast.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.