We’re past midway through the first quarter of 2024, and the S&P 500 has been regularly notching new highs. Markets are finding support from several directions, including positive investor sentiment buoyed by the slowing rate of inflation and the prospect of interest rate cuts later this year.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The overall upbeat outlook prevailing in the stock markets has the major investment banks feeling optimistic, too. Recently, Goldman Sachs’s Chief U.S. Equity Strategist, David Kostin, raised his year-end S&P 500 index target to 5200 (from 5100), the driver of the revision being “increased profit estimates.” “Our upgraded 2024 EPS forecast of $241 (8% growth) stands above the median top-down strategist forecast of $235 (6% growth) and reflects our expectation for stronger economic growth and higher profits for the Information Technology and Communication Services sectors, which contain 5 of the ‘Magnificent 7’ stocks,” the strategist explained.

But the ‘Magnificent 7’ stocks are not the only game in town; the Goldman Sachs analysts are also highlighting the potential of lesser-known stocks in their assessment, stocks that show potential to rally as much as 166% in the year ahead. A closer look at two of them may help us see just why these stocks have solid upside. And with help from the TipRanks database, we can also see what the rest of the Street thinks lies in store for these names.

Informatica (INFA)

First up is a Silicon Valley software company, Informatica. This firm has been in the data management business since 1993, and today works with enterprise cloud data management and integration, using CLAIRE, an AI system, to connect, manage, and unify data across multiple cloud or hybrid systems. The company makes possible a data-led digital transformation for its customers, using AI to provide an advanced data picture. The company’s customers include 85 of the Fortune 100 firms, and Informatica is active in more than 100 countries around the world.

Some of Informatica’s recent numbers will give insight into the story of the company’s success and stature in the data management industry. As of this past December 31st, the company claimed 1,988 subscription customers generating more than $100,000 in annual recurring revenue. The firm’s total subscription ARR came to $1.13 billion, which made up the larger part of the $1.63 billion in total ARR. Supporting this revenue generation, Informatica’s business handled approximately 86 trillion cloud transactions per month.

These ARR numbers represented increases over the previous year. The subscription ARR was up 14%, and the total ARR was up 7%. The company’s revenue for the full year 2023 came to $1.6 billion, of which $445 million was generated in Q4. The quarterly top line was up more than 11% year-over-year and came in over $13 million ahead of the forecast. At the bottom line, Informatica generated 32 cents per share in non-GAAP EPS, up from 24 cents in the prior-year period and 2 cents per share better than had been expected.

In a metric that investors should note, this company saw a large increase in its free cash flow from YE22 to YE23. As of December 31, the company reported $116.5 million in quarterly FCF, compared to $61.2 million in 4Q22. For all of 2023, Informatica reported a free cash flow of $303.8 million.

Turning to the Goldman view, we find that this stock has impressed 5-star analyst Kash Rangan. The Goldman tech expert likes this company’s ability to generate cash, and notes that Informatica holds a strong position in its niche. He writes of the company, “INFA presents investors with an opportunity to own a high-quality, FCF generative asset with a strong competitive position, high innovation velocity and solid visibility into double-digit top and bottom-line growth mid-term. Our prior concerns over less durable Cloud ARR growth re: slow migration activity from captive Maintenance have been assuaged as Informatica’s concerted pivot to a cloud-only selling motion (incl. EoS Self-Managed) and highly effective migration tooling (PowerCenter Cloud Edition, Aug. ‘23) provide multiple levers to sustain strong NNARR in Cloud in conjunction with secular tailwinds from DX and Gen-AI. Core to our thesis is appreciable upside to Cloud ARR expectations (GSe +35% CAGR vs. +32% guide, F23-26E) that can deliver accelerating revenue/ARR above Street…”

Rangan goes on to quantify his position here with a Buy rating on the shares, and $44 price target to imply a 34% upside potential for the next 12 months. (To watch Rangan’s track record, click here)

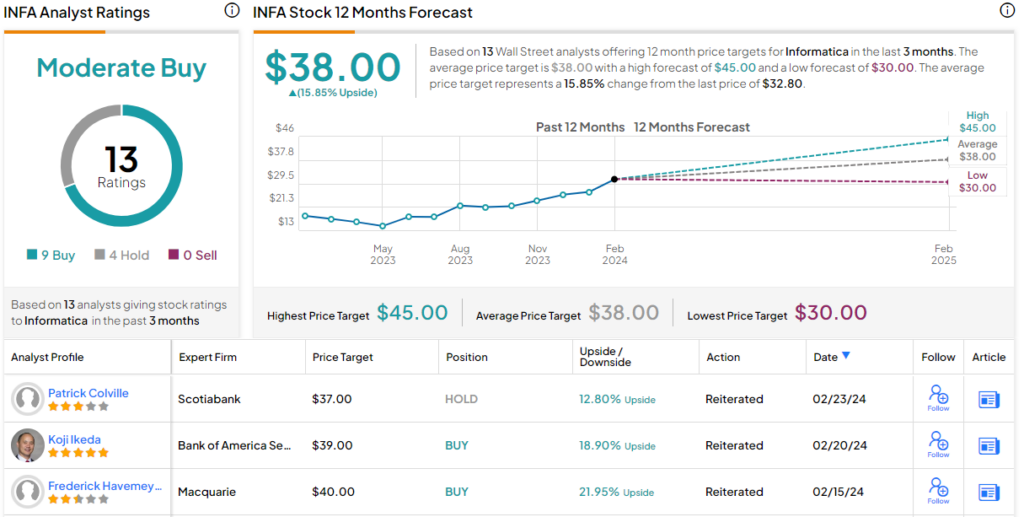

Overall, INFA stock gets a Moderate Buy consensus rating from the Street, based on 13 recent reviews that include 9 to Buy and 4 to Hold. The shares are selling for $32.80 and their average price target of $38 suggests a one-year gain of 16%. (See Informatica stock forecast)

BrightSpring Health Services (BTSG)

The healthcare sector has been one of the economic bright spots in recent months – the last jobs report, covering January 2024, showed that the healthcare sector had the highest rate of job creation for the month. BrightSpring, a newly public company in the health care world, provides a range of services designed to promote better health through a combination of home-and community-based provider and pharmacy health solutions. The company’s efforts are targeted at complex patient populations, requiring a mix of both specialized and chronic care.

To meet these needs, BrightSpring employs a staff of skilled and dedicated health professionals, providing high-end pharmacy, primary care, and home health care to the patient base, along with rehabilitation and behavioral health services when needed. The company operates in all 50 states, and boasts that it sees over 400,000 clients, customers, and patients every day.

The pharmacy side makes up a large part of BrightSpring’s business. The company notes that it has agreements with 186 pharmacies, and a presence in every state of the Union. Prescriptions are filled for more than 300,000 patients, and are covered according to more than 5,200 contracts with payors. The company fills more than 30 million prescriptions annually. BrightSpring’s first quarterly release as a public entity is due out on February 29, and we’ll get a better view of the company’s operations at that time.

On January 17 of this year, BrightSpring announced the launch of its initial public offering. The IPO saw more than 53.3 million shares of the company hit the public markets, with the BTSG ticker starting on the NASDAQ exchange on January 26. The stock opened with an initial price of $12 per share, below their $13 offer price (and the $15 to $18 range originally expected). The stock has fallen further since.

Nevertheless, initiating coverage of this stock for Goldman Sachs, analyst Jamie Perse bases his upbeat outlook on the company’s potential for continued growth in its market, supported by its combination of quality services and nationwide exposure. He writes of BrightSpring, “Our investment view of BrightSpring begins with an assessment of growth exposure where we believe the company competes across markets with a WAMGR (weighted average market growth rate) of 6.0-6.5%.Next we assess the company’s positioning in the market and the probability of continued market share gains. On this front, we believe the company is likely to continue growing above their markets due to (1) a strong clinical focus at the patient level and complimentary services lines that enables higher clinical quality with greater efficiency, and (2) a national presence across a variety of service lines that allows for targeted and differentiated investment in capacity expansion where those investments have the highest return.”

All of this justifies, for Perse, opening coverage with a Buy rating – and with a $26 price target that suggests a powerfully robust 166% potential upside on the one-year horizon. (To watch Perse’s track record, click here)

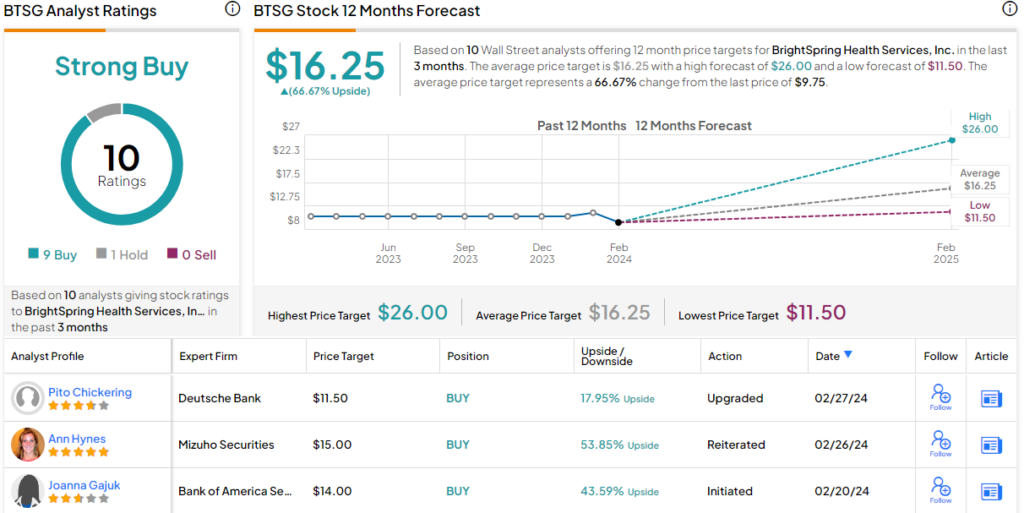

The Street is clearly in alignment with the bulls here, as the 10 recent reviews that this stock has already picked up include 9 to Buy against a single Hold. The shares are priced at $9.75 for now, and the $16.25 average price target implies the stock will appreciate by over 66% in the course of the coming year. (See BrightSpring stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.