Market indicators have been sending conflicting signals lately, creating uncertainty among investors. While year-to-date gains are certainly better than last year’s bear, and volatility, while a concern, has run lower than last year, plenty of risk factors still remain, both in the broader economy and in the stock market.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Taking a wider view of the markets, Christian Mueller-Glissman, head of asset allocation research for Goldman Sachs, gives investors a nudge toward a more defensive posture.

Explaining that the overall lower volatility we’ve seen this year doesn’t necessarily translate into lower risk, Glissman says, “Equity volatility has been unusually low YTD: first because of relatively supportive macro conditions and, more recently, as the S&P 500 was buffered by lower bond yields. However, we think a shift to a low vol regime remains unlikely considering still elevated macro uncertainty, signs of market stress and mixed macro momentum with slowing growth in Q2…”

“We remain relatively defensive in our asset allocation. While our baseline is a relatively friendly macro backdrop, risks are skewed to the downside and risk premia are relatively low. We see more value in equity protection strategies,” Glissman added.

And this will take us to dividend stocks, a perennially popular defensive play when markets turn sour. Goldman Sachs 5-star analyst Neil Mehta has picked out two dividend payers with impressive yields of up to 10%, surpassing the current rate of inflation and potentially providing a solid source of passive income for investors. Let’s take a closer look.

Coterra Energy (CTRA)

The first high-yield dividend stock that Goldman Sachs is betting on is Coterra, an energy firm headquartered in Texas. From its base in the Lone Star State, Coterra works on hydrocarbon exploration and production in the Permian Basin, Oklahoma’s Anadarko Basin, and Pennsylvania’s Marcellus Shale gas reserves. Coterra’s acreage holdings in these rich production basins total approximately 600,000 net acres, and the company extracts crude oil, natural gas, and natural gas liquids from its holdings.

That production is based on solid proven reserves, totaling more than 2.89 billion barrels of oil equivalent. Coterra has realized strong gains from its assets, generating revenues last year of $9.21 billion, for a 151% year-over-year increase from the $3.66 billion generated in 2021. These raw revenue numbers have translated to a solid y/y increase at the bottom line, and a firm foundation for a generous capital return policy.

At the bottom line, Coterra reported an EPS of $1.16 in 4Q22, the last quarter reported. These earnings beat the forecast by 5 cents and were up 39% year-over-year. The company’s profitable performance was based on strong increases in the realized prices of oil and natural gas from 2021; oil prices were up 8.8%, and gas was up 9.9%. These increases offset Coterra’s lower production numbers in 2022. The 632 thousand barrels of oil equivalent per day were down 7.8% y/y.

On the capital return, Coterra last declared its dividend in February, setting a base payment of 20 cents per share and a variable payment of 37 cents. The combined dividend, of 57 cents per common share, was paid out on March 30. At its annualized rate of $2.28, the base-plus-variable dividend yields an impressive 9%. Coterra supports its dividend policy with its free cash flow, which came in at $892 million in 4Q22. The company will report its 1Q23 results on May 4.

Covering the stock for Goldman Sachs, analyst Neil Mehta writes that he remains bullish on CTRA, including among his reasons: “CTRA has a diversified commodity exposure relative to other gassy produces (14% oil mix), attractive assets in the Delaware that can support management’s plans for ~5% oil production growth over the next three years, and a strong balance sheet that can allow FCF to be allocated towards capital returns, in our view. On valuation, we see CTRA generating 11% FCF yield vs. 10% for gassy peers and 11% large-cap peers over the next three years.”

Quantifying his stance, Mehta gives CTRA shares a Buy rating with a $29 target price to suggest a 14% upside on the one-year time horizon. Based on the current dividend yield and the expected price appreciation, the stock has ~23% potential total return profile. (To watch Mehta’s track record, click here)

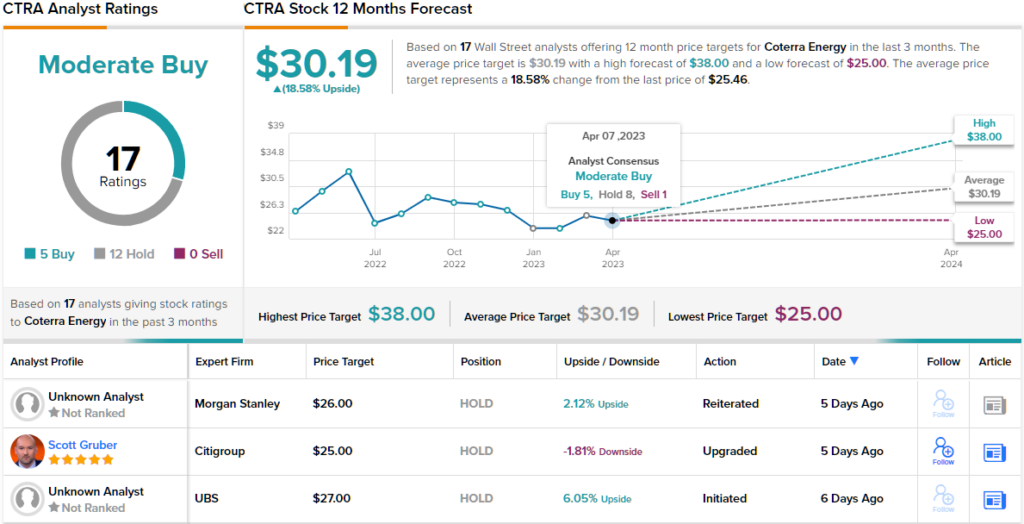

So, that’s Goldman Sachs’ view, let’s turn our attention now to rest of the Street: CTRA’s 5 Buys and 12 Holds coalesce into a Moderate Buy rating. The average price target of $30.19 implies ~19% one-year upside from the current price target of $30.19. (See CTRA stock forecast)

Pioneer Natural Resources (PXD)

The next stock we’ll look at is Pioneer Natural Resources, a Texas-based operator in hydrocarbon exploration and production. The company focuses on pure-play operations in the Permian Basin, specifically targeting the Midland formation, which has placed Texas back on the world’s energy production map in the second decade of this century due to its rich oil reserves. The Permian Basin boasts some of the richest recoverable oil and gas reserves in North America, making it a highly significant region for hydrocarbon exploration and production.

Pioneer has followed an interesting route in its extraction ops, eschewing to operate on public lands and focusing solely on drilling and working privately held acreage. While this has been a long-standing policy for the company, it has brought Pioneer a unique advantage given the Biden Administration’s known reluctance to approve hydrocarbon operations on public lands.

Pioneer is scheduled to release its 1Q23 results later this week, and reviewing the most recent quarterly release of 4Q22 should provide us with a clear picture of the company’s current standing.

Even though Pioneer’s revenues and EPS have been sliding downward from the peak levels they reached in 2Q22, the company still reported a bottom-line beat in 4Q22. The company’s non-GAAP EPS of $5.91 was 15 cents better than expected – and it was up 29% from the prior-year quarter. At the top line, revenue came in at $5.1 billion, missing the forecast by $490 million, but still growing 18% year-over-year.

These numbers supported Pioneer’s $1.7 billion quarterly free cash flow, a strong metric that directly supported the firm’s dividend payment. Pioneer has a history of paying dividends based on a combination of base-plus-variable, which may vary from quarter to quarter depending on fluctuations in oil prices. In the last declaration the company set a total payment of $5.58. That payment went out on March 17; the annualized rate of $22.32 gives a powerful yield of 10%.

Goldman Sachs’ Neil Mehta, in his note on this stock, lays out a clear case for buying into PXD based on the company’s proven ability to generate cash. He writes: “We believe the company is favorably positioned to generate attractive FCF, supported by its strong balance sheet and low cost assets in Midland. The stock underperformed peers in 2022, partly due to less favorable productivity trends — the management indicated plans to improve productivity through optimizing operations, extended laterals and high-grading locations.”

In-line with these comments, Mehta gives PXD shares a Buy rating, along with a $240 price target that implies a 7% upside potential. Based on the current dividend yield and the expected price appreciation, the stock has ~17% potential total return profile.

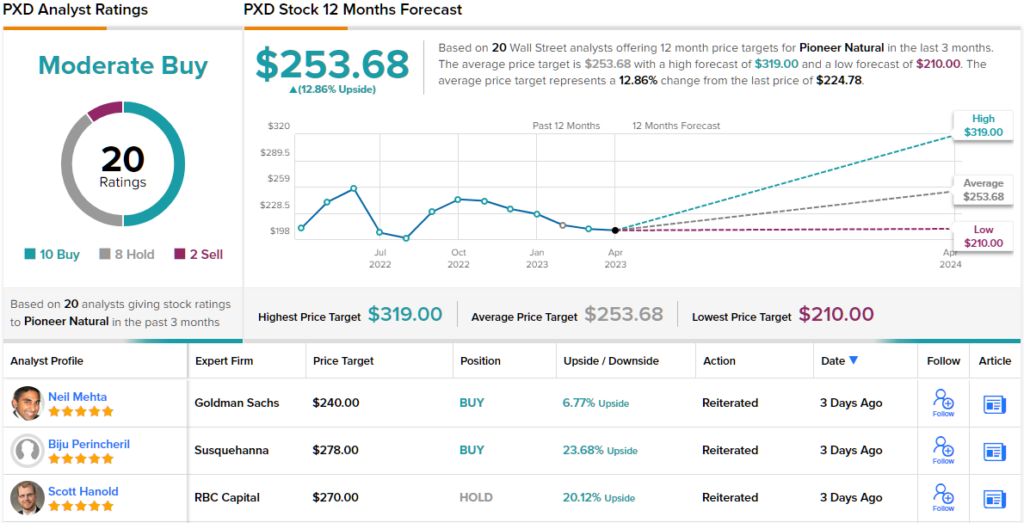

What does the rest of the Street think? Looking at the consensus breakdown, opinions from other analysts are more spread out. 10 Buys, 8 Holds and 2 Sells add up to a Moderate Buy consensus. In addition, the $253.68 average price target indicates ~13% upside potential from current levels. (See PXD stock forecast)

To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.