Last week, when the U.S. banking system trembled (again), stock markets fell, the Federal Reserve lifted rates to their highest since 2007, and Treasury Secretary Yellen warned of a risk of a U.S. technical default, gold prices climbed to their all-time high of above $2,000 an ounce. Precious metals, including gold, have been rallying since last year on geopolitical pressures, global economic uncertainties, the weakening U.S. dollar, and, of course, inflation.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Many investors believe that when the economy is frail and the financial markets are erratic, investing in gold is the answer to instability. They reason that a great long-term return, protection against inflation, and shelter during stormy times, are gold’s investment advantages. Let’s see if there’s evidence behind those claims, and whether investors should dedicate part of their portfolios to the shiny metal.

Does Gold Protect Your Money in a Recession?

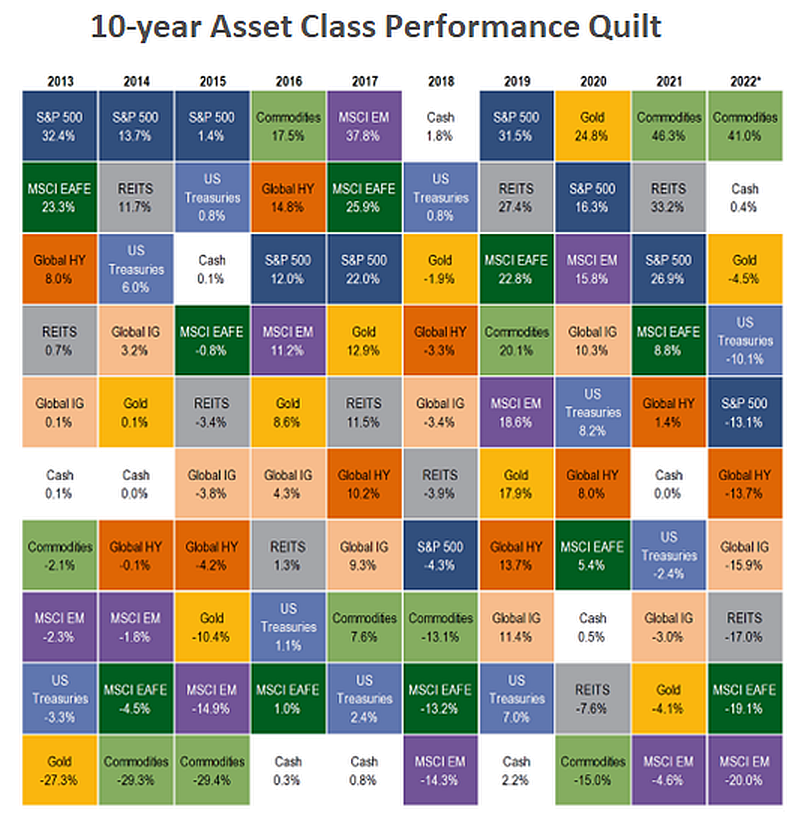

Gold has long been considered a safe-haven asset during difficult times; however, its performance during recessions has been mixed. In some bouts of short-term economic turbulence, gold offered protection, declining less than the stock markets; in other periods, its performance was subpar, not only to stocks but also to Treasuries or even cash.

As can be seen in the chart below, despite the belief that gold is a safe investment, sometimes it can drop in price as much as equities – and much more than Treasuries or investment-grade corporate bonds. When the economy is on the mend, investors flock to stocks, attracted by their growth prospects; gold is not a part of the growth scenario, as it typically shines only when times are hard. Importantly, no one expects growth in the months ahead.

In the short term, many factors, including psychological ones, affect the price of gold, making it hard to predict price trends. However, at least in some recessionary periods, gold can be a worthwhile addition to a portfolio. In most cases, the price of the metal has an inverse relation to the stock market’s short-term trend; therefore, it can be useful in buttressing a portfolio against downward pressures on equities, as well as for diversification. Still, it’s important to keep in mind that, while gold prices benefit from mild to intermediate market volatility, it can nosedive as much as any risk asset on the market in severe circumstances. There’s no need to go far back in history – for example, in March 2020, gold crashed tremendously as investors rushed to sell to cover their losses in other assets. Also, in the stock crash of 2008, in the wake of the Lehman collapse, gold lost a third of its value.

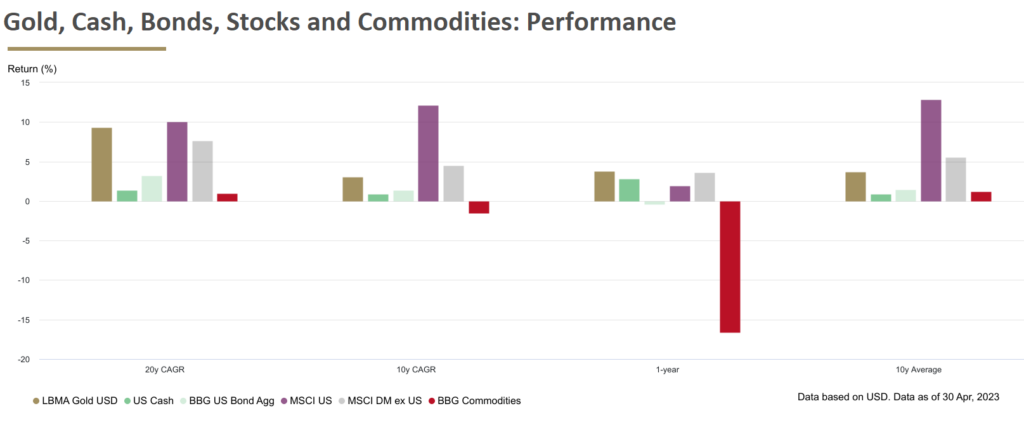

In the long term, the yellow metal doesn’t shine as brightly as it does in some short-term recessionary periods, with the U.S. stock market outperforming gold by a huge margin (which becomes enormous if we also account for reinvested gains and dividends). Gold doesn’t pay interest or dividends, and it cannot generate cash flow or help profit from growth. The only gain from investing in the metal comes from price appreciation – which stems only from the increase in confidence that its price will rise.

Does Gold Protect Your Money from Inflation?

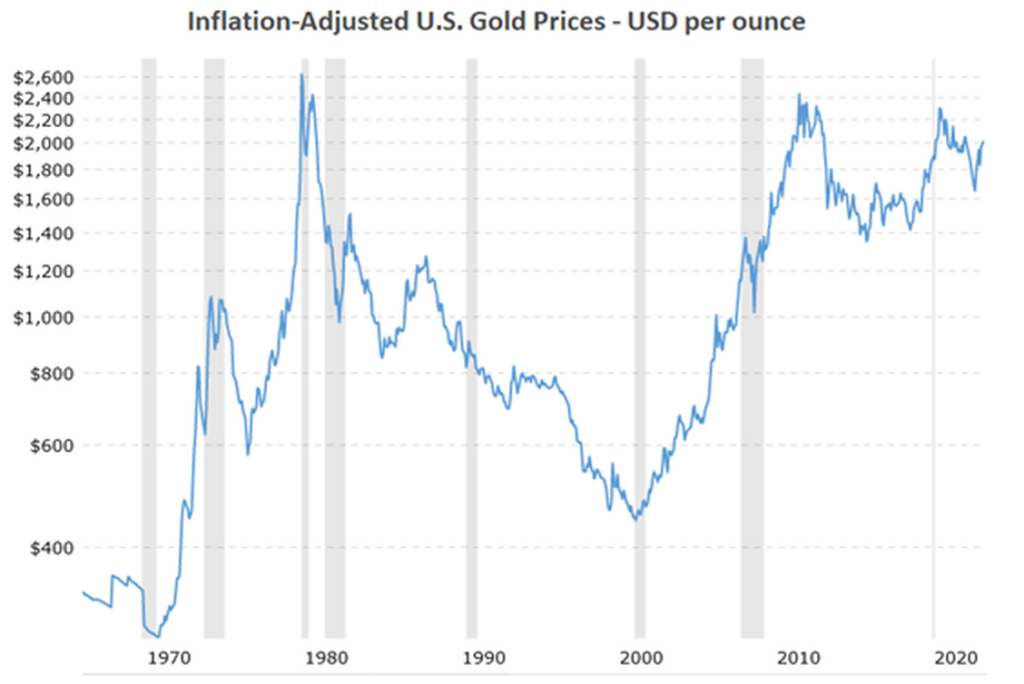

Despite the idea’s wide acceptance as an axiom, gold is not a good hedge against inflation, as the price of the metal is, in fact, uncorrelated with the price trend. Case in point: as recently as last year, inflation accelerated while gold prices declined. In their research paper, “The Golden Dilemma,” NBER economists established that “Gold may be an effective hedge if the investment horizon is measured in centuries,” while proving that for more practical investment terms, gold is an unreliable inflation hedge. As can be seen in the chart above, in real terms the metal was as volatile as in nominal terms, suggesting that investors can see their holdings devalued even when inflation is accounted for.

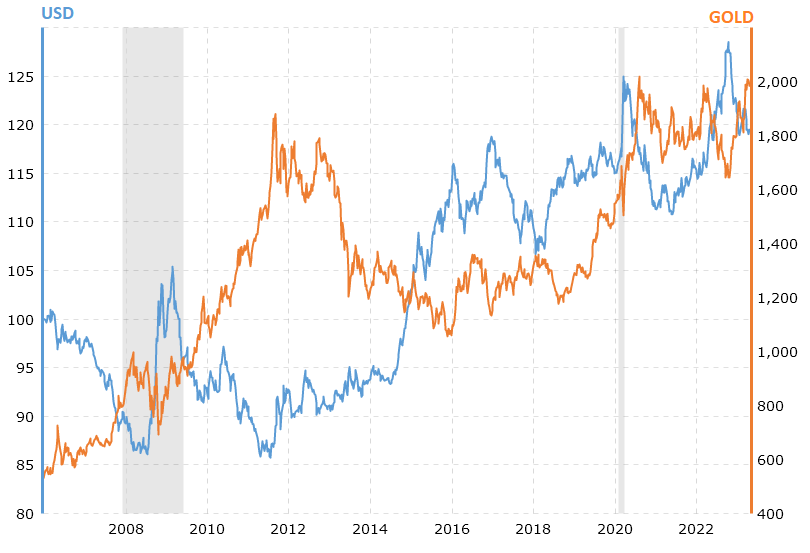

Since inflation is currency debasement, it’s natural that gold, which is traded in U.S. dollars like all commodities, has an inverse relationship with the strength of the buck. That doesn’t make it an inflation hedge, but rather a short-term “antidepressant” for anxious investors. In the longer term, investors trying to derive the future price of gold from inflation expectations will be severely disappointed in most cases. For example, it took gold 31 years to beat its 1980s high in nominal (not adjusted for inflation) terms; however, in real terms – taking into account the increase in prices from 1980 to 2011 – long-term gold investors were left with a loss of about 10%. In 2021 and 2022, while consumer price increases accelerated at their fastest pace in decades, the shiny metal traded sideways or downward.

There are not enough incidents of high and rising inflation in the U.S. in recent decades to comprise meaningful statistics that are relevant for modern times. However, it looks like the contemporary perception of gold as a hedge may have originated from one incidence only, at least in the last 50 years or so. In the ’70s, when the oil shock propelled prices to an average of 9% a year, gold, in fact, performed very well, with returns way above the raging inflation. But when consumer price increases decelerated in the years that followed, while inflation still remained elevated, gold prices declined, producing negative real returns, while underperforming other assets, including the S&P 500 (SPX).

Are Rates Not Real Enough?

If gold prices are uncorrelated with inflation and behave differently in recessions, can we even establish any notable correlations with economic indicators to try and forecast gold prices? Or are they moved by sentiment alone, which makes them completely unpredictable and thus fit only for short-term casino-style speculation, not for investment?

Gold prices are well-known for their low predictability due to the fact that they are affected by many variables. There are some apparent ones, such as supply and demand; but the price is much more susceptible to forces such as political environment, central bank activity, etc., with each factor having a different effect of a different scale at different times. There’s one factor, though, that is less obvious, but until recently seemed to have more predictive power for the prices of the yellow metal: real interest rates, i.e., Treasury yields minus the inflation rate.

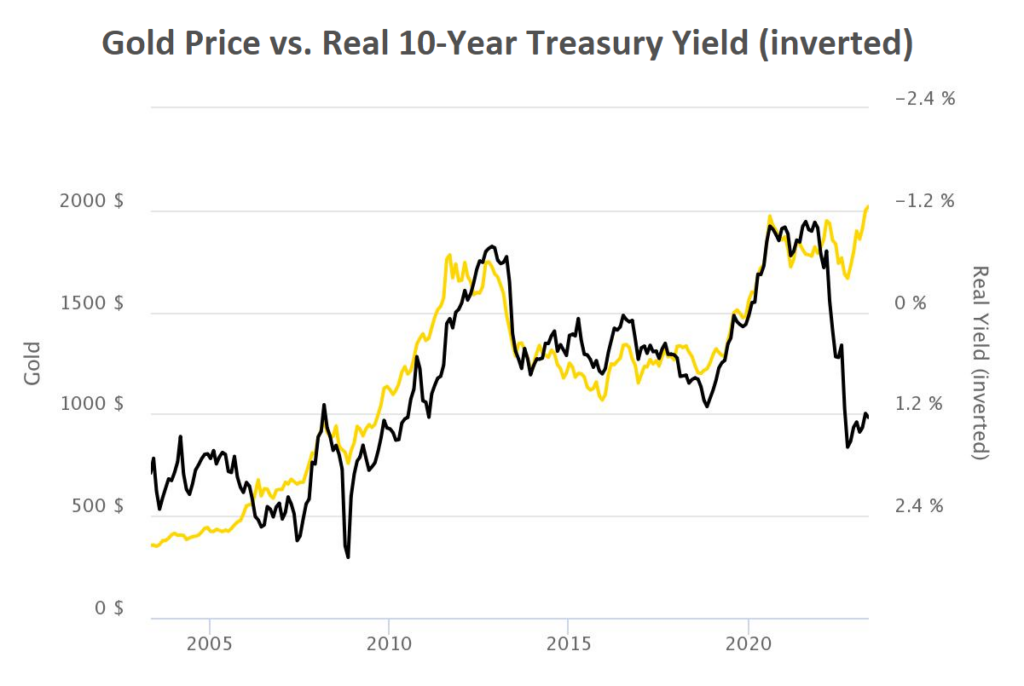

Over the last two decades (gold only became a liquid investment with the launch of gold ETFs in 2004), gold prices have been heavily influenced by the level of 10-year U.S. real yields. That is because when the Federal Reserve raises rates, investors can get more interest on risk-free government securities, making riskier assets like gold less attractive. Vice versa, when investors see lower real income from risk-free assets, the opportunity costs of owning gold decrease, supporting demand and prices.

Real Treasury yields have a significant inverse influence on the price of gold over the long term, as seen in the chart above. Besides setting the direction of gold prices, through the period and up to 2022, real yields have explained most of the magnitude of these changes.

As the Fed began hiking interest rates in March 2022 and offered further tightening guidance, real yields began to rise, depressing gold prices. Then, as inflation expectations began to stabilize, and as the Federal Reserve’s tightening campaign seemingly draws to a close, a moderation in real rates pushed up gold prices. The only discrepancy from the trends of the last 20 years can be noted in the differences in the magnitudes of the changes, as the two parameters are now showing considerable decoupling in the sizes of their moves.

While it’s impossible to predict the magnitude of the effect of rates on gold prices, the trend is quite predictable – if, of course, one can forecast with any kind of certainty where the real rates (i.e., the Fed Funds rate and the inflation rate) will be in any given period.

There are several scenarios going forward. If real rates rise significantly, it would be bearish for all risk assets, including gold. If the yields break to the downside on the back of falling Fed interest rates, it would probably be bullish for gold, as rate cuts in the near future would almost definitely stem from a notably worsening economic situation. On the other hand, if real yields are led down by rising inflation, gold may be supported to some extent, but, as shown above, in this environment equities would offer better protection.

The Shiniest of All, But Still a Commodity

Another important consideration is that gold is a commodity, and, as such, it’s moved by supply and demand factors. Although gold isn’t consumed or burned, and it can’t go bad, gold in the form of jewelry is gold that isn’t trading on the market for years, reducing the amount available for investment. Currently, about 44% of all gold that was ever mined, exists in the form of jewelry. Official holdings, i.e., gold bars stashed in the vaults of central banks and governments as reserves, represent another 17%, which are also taken off the market for a long period of time. 15% is used in industry, dentistry, electronics, and other applications; these usually get recycled into similar usages. Only 22% of all gold in the world – a little more than 44,000 metric tons, is left for private investment.

In the second half of 2022, as it was clear to all that geopolitical issues, inflation, and economic weakening are not “transitory,” demand for gold began to rise, supported by the declining value of the USD. Annual demand for the yellow metal jumped 18%. The main push came from central banks and retail investors. Global central banks bought 150% more gold than in the previous year, the second highest level of annual purchases by monetary institutions since 1950, while investment demand for gold increased by 10%.

In Q1 2023, U.S. and European citizens were shaken by the banking turmoil, still facing rampant inflation despite the aggressive central bank tightening. No wonder, then, that the trend of rising demand for gold continued last quarter. Central banks added another pile of sunshine metal to their reserves in the first quarter. Gold-backed ETFs like GLD or IAU, which registered outflows in the months before March, became attractive for retail investors scared by the banking turmoil; global gold ETFs added 10% to their assets in the quarter. Demand for physical gold, such as bars and coins, also rose. At the same time, global gold supply was almost flat in Q1 2023 from the year ago, adding support to the price increase trend.

Key Takeaway: Should Investors Hold Gold?

Gold isn’t the best choice for long-term investors from the performance point of view: it doesn’t offer significant inflation protection, and it can’t be used as a dependable safe haven in times of turmoil. However, it can offer some upside in the short term, at times of declining real interest rates and a weak economy.

Still, investors wishing to attain a broad portfolio diversification may benefit from adding gold – as well as other assets – to their holdings, as each asset class can help mitigate the different sets of specific risks amid heightened levels of economic, political, and market uncertainty.