Gold bugs, listen up. There’s nothing wrong with owning physical bullion, but there’s also an alternative approach, and it’s quite simple. There’s a small-cap business called Gold Royalty Corp. (NYSEMKT:GROY) that provides exposure to the gold market through an ingenious business model. So, I am bullish on GROY stock and hope that more investors will take a look at it in 2024.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Canada-based Gold Royalty Corp. makes money from a diversified array of gold-focused properties in the Americas. Yet, Gold Royalty doesn’t need to actually own these properties to generate revenue from their gold discoveries. How is this possible? Stick around, as Gold Royalty uses a business concept that you’ll wish you had thought of.

Gold Royalty: A Less Risky Gold Mining Business

As the company’s name implies, Gold Royalty Corp. uses the royalty business model and focuses on gold-yielding properties. “Royalty” basically means that Gold Royalty doesn’t actually own the properties but instead invests money in a variety of gold-mining companies.

In return for the capital infusion, these companies will give Gold Royalty Corp. a percentage of their revenue generated from sales of discovered gold. This means that the various mining companies have the responsibility, risks, and associated costs of exploring properties, testing and drilling, hiring miners, and so on. Gold Royalty Corp. doesn’t have to do any of that.

I wouldn’t say that Gold Royalty Corp. is 100% derisked, but at least the company isn’t exposed to some risks that individual mining companies have to deal with. Plus, there’s the diversification aspect with Gold Royalty that you won’t get if you only invest in a particular mining company.

With a little bit of digging, I found that Gold Royalty Corp. recently invested in gold-focused projects in Quebec, Canada, as well as in Rio Grande do Norte State, Brazil. Furthermore, it’s reassuring that CEO David Garofalo predicted that the company is “poised to break into positive free cash flow in 2024.”

Is GROY Stock a Buy, According to Analysts?

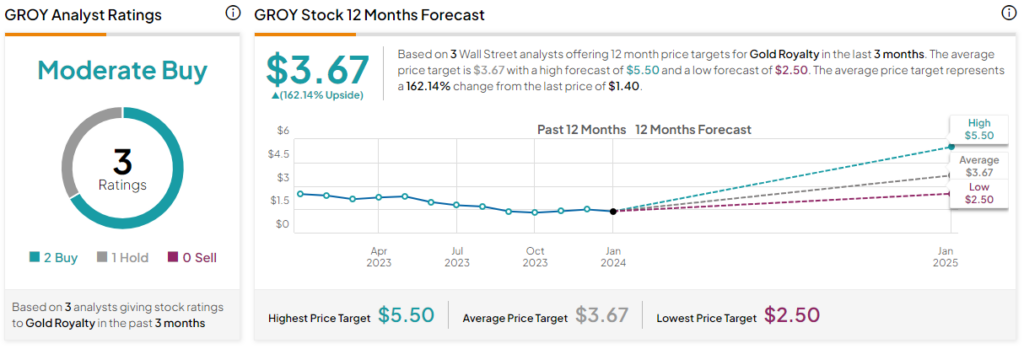

On TipRanks, GROY comes in as a Moderate Buy based on two Buys and one Hold rating assigned by analysts in the past three months. The average Gold Royalty Corp. price target is $3.67, implying 162.1% upside potential.

Conclusion: Should You Consider GROY Stock?

Of course, it’s a prerequisite that you’ll need to be bullish on gold if you plan to invest in Gold Royalty Corp. After all, even if Gold Royalty is somewhat derisked compared to individual mining businesses, it still will fare better if the gold price goes up. Hence, if you expect gold to shine this year and seek easy diversification in one asset, now’s a great time to consider GROY stock.