With just under one month left in Micron’s (NASDAQ:MU) fiscal first quarter (November quarter), the memory giant is flashing some positive signs. On the back of a 25-30% uptick in mainstream NAND (512GB TLC), memory contract prices have been raised across the board.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

For Stifel’s 5-star analyst Brian Chin, this hints at the November quarter tracking ahead of expectations. Chin explained, “We were initially encouraged by our September field checks that suggested Micron had begun to raise pricing to its customers. When Micron gave guidance for F1Q, our impression was that only modest pricing (~mid-single digit) improvement was implied. While this may still be the case in DRAM, we think NAND pricing is tracking well ahead of plan.”

While NAND represents under 30% of Micron revenue, Chin thinks the improvements seen in NAND pricing can mark a turnaround and flip his prior F1Q estimate of negative 3.5% gross margins to positive 3.5%. “While a month in the quarter remains and bit shipments tend to skew toward quarter-end, we view pricing strength entering the final month as a favorable sign,” adds Chin.

As such, the analyst has increased his F1Q revenue/non-GAAP EPS estimates to $4.6 billion/($0.75), better on both ends than the Street’s respective $4.4 billion/($1.02) and Micron’s guide of $4.2-4.6 billion/($1.00)-($1.14).

The increase in memory contract prices, Chin says, makes it “harder to ignore” the turn in the memory cycle. In the wake of Samsung’s recent Q3 report, Chin had noted that it was “perhaps the quietest memory inflection of all time.” Though the comment was made in jest, Chin was still taken aback by the lack of a more positive response, considering the growing signs of memory prices “inflecting.”

“The decibel level should be higher now following the subsequent release of November contract prices,” adds Chin, “which show broad-based increases in memory prices.”

Ultimately, however, the changes are not enough yet for Chin to alter his neutral stance as he does not factor in Micron “returning to profitability” until F4Q (August quarter) of next year. “Should stronger signs of demand recovery materialize, this could pull-in and compel us to revisit our rating,” he sums up.

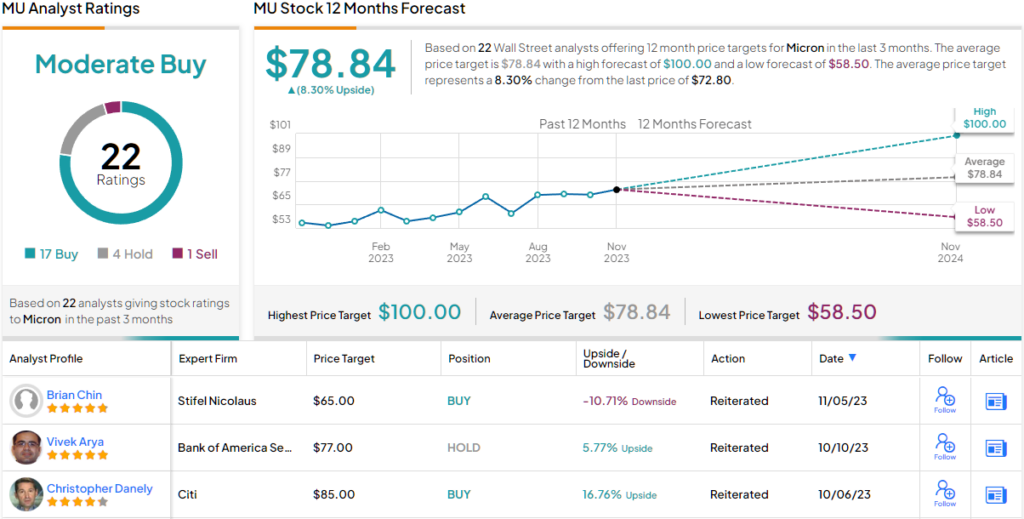

Accordingly, for now, Chin rates Micron shares a Hold, while his $65 price target suggests shares will see downside of 11% over the coming months. (To watch Chin’s track record, click here)

Chin, though, is amongst a minority on Wall Street. 3 other analysts join him on the fence, one remains in the bear camp but with the addition of 17 Buys, the stock claims a Moderate Buy consensus rating. Going by the $78.84 average target, investors will be pocketing returns of 8% a year from now. (See Micron stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.