The price of gold peaked this year in March, when it surged to $2,052 in the wake of Russia’s Ukraine invasion. That marked the first time since August of 2020 that gold traded at that level; since then, however, gold has fallen and is now trading at $1,662. At the same time, gold miners and commodity traders are optimistic about the precious metal, seeing it as a sound investment despite the fall-off in price over the past 6 months.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Gold is usually used as a hedge, a protective investment that will hold its value well no matter how the economy moves. Right now, with inflation high and fear growing of a deep recession in the near future, the supports are in place to keep the price of gold high. At the same time, the Federal Reserve’s moves to fight inflation – by increasing interest rates – have both strengthened the dollar and put downward pressure on gold. The question is, which set of factors will predominate going forward?

In his notes on the recent Americas Gold Forum, a meeting of gold producers and royalty companies, RBC analyst Josh Wolfson notes that the sector’s stocks have underperformed so far this year – but he adds, “…investor and company moods were generally constructive and seeking out upcoming positive inflection points. Interim heightened market volatility and tightening central bank monetary policy was viewed as a prelude to future economic risks and safe haven investment demand.”

Following up on that, especially on the idea of future ‘safe haven’ demand, we can take a closer look at 3 gold stocks which a number of analysts are bullish on. We ran them through the TipRanks database to gauge the rest of the Street’s sentiment. Here are the details.

Sandstorm Gold (SAND)

We’ll start with Sandstorm Gold, a royalty company in the gold business. Sandstorm doesn’t engage in mining activities directly; rather, the company fronts capital to miners, and collects royalties on proceeds of the miners’ operations. Currently, Sandstorm has an investment portfolio featuring 39 production assets, and is collecting more than 250 royalties.

For market investors looking to buy into gold, a company like Sandstorm is a relatively low-risk initial entry. The wide range of Sandstorm’s portfolio provides some protection to investors, in case one or two mining assets don’t play out as planned, while Sandstorm itself, in the process of fronting capital, does the due-diligence research to minimize the risks.

For investors, that makes this stock a quick access to the gold markets. Sandstorm had a company-record revenue of $36 million in the recent 2Q22 report, up 36% year-over-year. This was based on attributable gold equivalent ounces – that is, the production on which Sandstorm draws royalties – of 19,276 ounces in the quarter. Net income came to $39.7 million in the quarter, another company record.

Covering this gold royalty firm for H.C. Wainwright, mining expert Heiko Ihle notes the company’s revised outlook which positions it well for the future. He writes, “Sandstorm has revised its 2022 production guidance to 80,000 – 85,000 GEOs, up from 65,000 – 70,000 GEOs, based on the recent closing of the Nomad acquisition. Additionally, the company has revised its long-term guidance to 155,000 attributable GEOs from 100,000 GEOs by 2025. In our view, Sandstorm has successfully undertaken a number of transformational acquisitions, which should yield favorable results for a long time… We believe Sandstorm continues to position itself for long-term organic growth.”

Stepping forward from this outlook, Ihle rates the stock as a Buy, with a $13.25 price target indicating potential for a robust 156% upside in the next 12 months. (To watch Ihle’s track record, click here.)

Ihle is far from the only bull here, as 6 of the 7 recent analyst reviews are positive on these shares, making for a 6 to 1 ratio of Buy to Hold, and a Strong Buy consensus rating. The stock is selling for $5.17 and its $9.21 average price target implies a 78% one-year upside. (See Sandstorm’s stock forecast at TipRanks.)

AngloGold Ashanti (AU)

From royalties, we’ll shift our focus to miners. AngloGold Ashanti is a major player in the international gold mining scene, a multi-billion dollar mid-cap firm with operations on four continents, including Africa, Australia, and North and South America. The company produced 2.472 million ounces of gold last year, along with important by-products including silver, copper, and sulfuric acid. AngloGold Ashanti’s proven reserves include 123.2 million ounces of gold mineral resources, and a 29.8 million ounce ore reserve.

This past August, AU released its financial results for the first half of 2022. The company showed a 3% y/y increase in production, with a total of 1.233 million ounces for the first six months of the year. Second quarter production was up 10% compared to the first quarter, indicating an acceleration in gold output. The company reported that the production increase was driven by improvements in the Australian and Latin American operations, including a higher grade of ore processed, that offset lower production in some of the African mines. Free cash flow came in at $471 million, a turnaround from the negative $25 million cash flow in the first half of 2021. The company had $2.6 billion in liquid assets, including $1.3 billion in cash, as of June 30.

AngloGold declared a 29-cent dividend per common share, which was paid out last month. At the annualized rate of $1.16 per common share, the dividend yields 8.3%. The company has raised the dividend payment in each of the last two declarations.

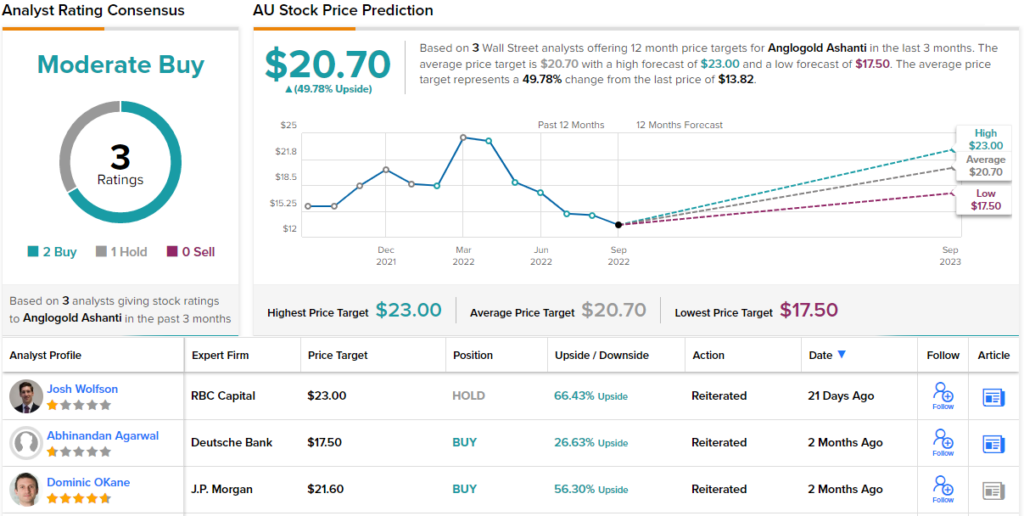

JPM analyst Dominic O’Kane, in his recent note on AU, says of the stock, “AngloGold is one of the world’s largest gold companies. It is geo-graphically diversified: ~100% of production is now derived from lower-cost assets in Australia, Africa and South America. AngloGold ranks globally as one of the cheapest listed gold companies on EV/EBITDA metrics, which we believe unjustly reflects a discount relating to its South African listing and domicile. It is trading at a discount to its average historical traded multiple of ~5x (+1 year), as well as to global peers.”

To this end, O’Kane rates the shares as Overweight, and his price target, of $21.60, suggests an upside of 56% in the year ahead. (To watch O’Kane’s track record, click here.)

Of the three recent analyst reviews here, 2 are to Buy against 1 to Hold, for a Moderate Buy consensus rating on the shares. The stock is trading for $13.82 and its $20.70 average price target implies a gain of 49% in the next year. (See AngloGold Ashanti’s stock forecast at TipRanks.)

SSR Mining, Inc. (SSRM)

Last on our list is SSR Mining, another mid-cap miner in the gold business. The company has operations in Asia and the Americas, in Turkey, Saskatchewan, Nevada, and Argentina, with development projects in Mexico and Peru.

Last year, SSR saw total production hit more than 794,000 gold-equivalent ounces, a total that translated into more than $1.33 billion in total revenues. In the most recent financial report, for 2Q22, SSR reported quarterly production of 159,262 ounces, from which the company derived $319.58 million in total revenues. While revenue was down 15% from the year-ago quarter, the figure beat Wall Street estimates by $27 million. Likewise on the bottom-line, adj. EPS of $0.30 beat the Street’s call for $0.21.

For the first half of 2022, as a whole, SSR reported an operating cash flow $95 million, with a free cash flow of $18.7 million. After making scheduled debt payments, the company had a cash balance at the end of Q2 of $938.6 million. Among its obligations, SSR paid out a dividend of 7 cents per common share, up from 6 cents in the prior quarter. The dividend has been raised twice in the last year; the 28-cent annualized rate gives a yield of 1.9%, about average when compared to dividend payers in the broader markets.

One factor in the company’s lower performance recently, when compared to the year-ago quarter, was the shut-down of the Turkish Çöpler mine, pending a Turkish government regulatory review. The company restarted this mine, with regulatory approval, on September 22, and expects to quickly regain normal operations. SSR used the mine’s downtime to bring all maintenance up to date.

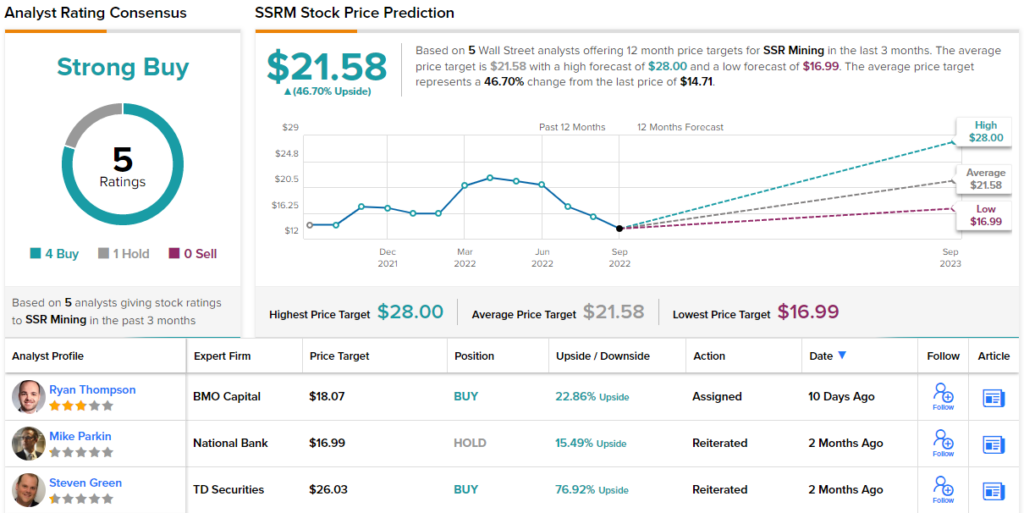

Writing up the bullish case for SSRM is Ryan Thompson of BMO Capital, the analyst writes, “Q2 earnings beat expectations, mostly as a result of gold sales exceeding production by 11koz… The company was active on its share buyback program in Q2 and share repurchases have ramped up after quarter-end… SSR has a best-in-class balance sheet and a track record of solid execution. FCF is supporting the company’s dividend and share repurchase programs.”

The analyst gives SSRM stock an Outperform (or Buy) rating, and a price target of C$25 ($18.07), implying an upside potential of 23% for the next year. (To watch Thompson’s track record, click here.)

There are 5 recent analyst reviews on this mining stock, with a 4 to 1 split favoring Buy over Hold for a Strong Buy consensus rating. The shares are priced at $14.71 and their $21.58 average target suggests a 47% one-year gain. (See SSR Mining’s stock forecast at TipRanks.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.